Even I can't write about Brexit everyday - the newspapers seem less reticent. Surely Brexit insomnia will set in soon?

However, on a wider note, I have been considering recently how much longer China's debt bubble can last. As with all markets, accurate prediction is the key, without that there is no chance of making money. With China, being a communist controlled state, they have a lot more levers to pull when it comes to juicing their finances than most countries. Plus as the largest economy in the world they can also rely on everyone else to play the extend and pretend game in order to keep the party going.

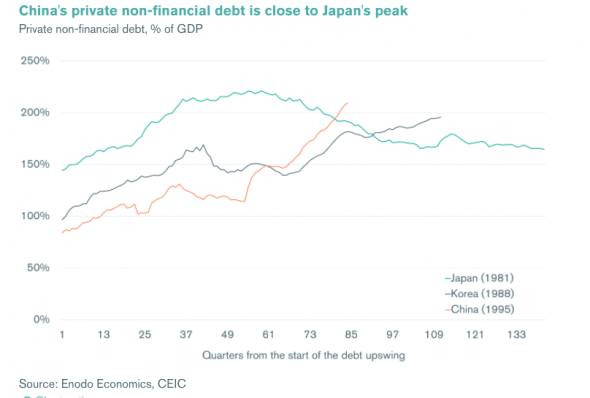

The chart above shows the path that Japan and Korea both pursued during their own debt fuelled booms. As can be seen, China is on a huge tear currently that will out-shoot even Japan.

Japan has never really recovered from its debt-binge in terms of economic growth and development, sure they have nice stuff there and a high standard of living, but real growth is near impossible due to the debt burden and demographics. China will be in that boat too in short order.

The chart though is quite long-term, so I can see China having another 5 years or so of debt fuelled 5%+ growth before the big crunch. Perhaps this will then coincide with Brexit and the collapse of the Euro - who knows the domino effect.

One thing we can be sure of, this will happen as sure as eggs are eggs. In our own way in the UK, we know all too well the consequences of a debt binge - the China scale is around double the problem in relative terms that we had in 2008;

14 comments:

How can we trust any data when it relates to China?

Unless that graph relates to foreign lending into China then can it even be trusted?

It's not just about 'state' levers. When Korea had their financial crisis, concerned citizens lined up to donate their gold wedding rings to the government.

I'd imagine the Chinese would demonstrate a similar patriotism should the need for haircuts ever arise.

Can it be sustained in the longer term? No idea, but their starting point is rather different than Korea, Japan or the UK. An awful lot of China's population still are poor, so there is probably a long way to go before growth slows to Western levels. If China can go up the value chain at the same time it may be able to grow quite strongly for quite a long time.

But then again there are also huge demographic headwinds, Japan on stilts. So a one-off crash could well stymie China's development long-term as it has in the land of the rising sun.

Not much to be learned from the chart, but more interesting than Perma-Brexit.

Meanwhile Britain Soldiers On.

If there are any Chinese watching.....

They have a huge hoard of dollars which they can sell. In fact, they are getting so much of this "hard" currency they will have to do something soon.

Or perhaps they are just waiting.

Doesn't Japan prove that all this is pretty academic from the population's point of view?

I've spent quite a lot of time in Japan over the last five years. Their standard of living is higher than ours in the UK.

Who cares about GDP growth when tiny increases rely on important an army of cheap labour, with all the consequential effects on standard of leaving for those on low and middle incomes?

*importing

Given China's aim is to perpetuate China, looking at this through capitalist eyes is probably the wrong filter.

I used to think a crash would be both inevitable and disastrous to China, but whilst I still think the former, I'm more inclined to think any crash would be disastrous to everyone bar China.

China undoubtedly has problems heading its way, but demographics isn't really one of them.

The "One Child" Policy only applied in cities, not the countryside, (and not for certain ethnic groups), the "fines" for having more than one child are actually a source of tax revenue, and on top of that there are millions of undocumented Chinese (whose births were not registered) in order to avoid the fines. This population is now being allowed to admit its existence, and of course the One Child policy has already been relaxed to a "Two Child" policy.

China's demographics are actually much better than admitted and much better than either Japan, or especially (South) Korea.

In any event, a flattening of the demographic bulge will actually help support wages as automation starts to kick in.

China's problem is that the people in charge need to manage their population's expectations in order to prevent unrest that could threaten their control.

China isn't a country, it is a civilisation. There is no "Chinese" language any more than there is a "European" language. It is tied together by history and a common written language Hanzi that enables communication between otherwise widely dissimilar people.

If its rulers lose control it could easily split up as those in power attempted to carve out personal fiefdoms. That's the real danger. Do we really want a brief re-run of the Warring States period where some of those states have access to nukes?

They have a huge hoard of dollars which they can sell.

Sell them for what? Euros? Yen??? Because whatever they sell them for, the new IOU's will have to match the local currency claims of Chinese savers. The flip side to all those Chinese private debts are Chinese local currency bank deposits. And with no welfare state, the Chinese save hard. They have not consumed 100% of their trade surplus, they have saved a fair whack of it. The plebs own Yuan and the government (who owe the plebs) own dollars.

Who cares about GDP growth when tiny increases rely on important an army of cheap labour

People who have made huge leveraged bets of 5 or more times their annual gross income that UK house prices will increase?

So which is it? China flushed with cash or China in debt to its eyeball? Can we make our minds up?

They are flush with cash, and will continue to be unless they pay back their eye-watering debts.

Charlie, we did indeed discuss the Japan 'problem' a few weeks ago with that very angle.

Japan is a homogenous society which has undergone some very strange social developments (boys preferring computer games to girls etc).

China is MUCH poorer far MORE corrupt - then end of growth now or in a few years will not be met with a shrug and emoji as in Japan.

Who cares about GDP growth when tiny increases rely on importing an army of cheap labour

People who have made huge leveraged bets of 5 or more times their annual gross income that UK house prices will increase?

Well, quite. Unfortunately, I see nothing on the horizon to suggest that their bets are misplaced.

Post a Comment