One of the oft quoted pieces when we discuss where companies may move to in Europe after Brexit, is that the incoming Financial Transaction Tax (FTT) will impose future costs. These costs should therefore be set against the benefits of re-locating away from the UK. Overall, the FTT will act a counter-weight to the loss of financial passporting.

So far, so good. The one interesting fly in the ointment is that FTT shows every sign of having been quietly forgotten by the EU.

The last activity on the EU website is from, er, 2014. Whilst in 2015the EU won a court case that meant the UK could not opt-out of any future FTT , nothing more has been seen or heard of it since.

All the initial proposals seem to have been passed, but then countries started withdrawing. Last year, they were down to the nine which would be the minimum required.

Nothing has happened since last year, strongly suggesting with event moving so quickly in Europe that this is now a dead duck. Certainly for the foreseeable future.

Which from a Capitalist perspective is great, as this is a very expensive tax on finance. From a UK perspective a shame, as this would indeed make plenty of firms think twice about the costs of taking on EU domicile only.

Monday, 27 February 2017

Friday, 24 February 2017

Endgame for Drax?

Drax is a great name for a villain: and for anyone who gives a toss about the way 'green' subsidies are thrown about, Drax plc can certainly be cast as one of the villains of the piece. Drax and its fellow industrial-scale wood-chip burners receive nearly £1 billion a year in subsidies for generating electricity that way, and are not required to proffer CO2 emission permits or pay the carbon tax - on the pretext that wood-burning reduces CO2 emissions.

Except, it doesn't - it increases them, even by reference to coal (which is the obvious comparator, since it is coal-fired power generating capacity that is essentially being replaced by biomass-burning). It's basic physics, plus a little logic. A perfect example of crass policy-making at its most perverse - whatever view you take on (C)(A)GW. The way they get away with it, BTW, is under the utterly demented 'carbon accounting rules' which allow them to account only for the CO2 emitted in the manufacture and transportation of the wood-chips - and to ignore the CO2 emitted during actual combustion, which is nowhere recorded. To repeat, wood-chip burning generates more CO2 than coal burning: and in answer to the riposte that eventually, if you replant the forests, it all balances out, the answer is that 'eventually' is several decades at best, but maybe 100 years or more. Meantime, all this is happening by the many millions of tonnes of mostly North American forest per annum.

There have been a number of people saying this patiently for quite some time, mostly from the green side; although of course the hatchet-faced subsidy-farmers and their 'green' lobby the REA are all in favour. Well, after all, a billion is a billion ...

Yesterday, the fairly universally-respected Chatham House has published what everyone knows to be the truth (here and here). Even the Beeb has picked up on it (though silence from the Grauniad at the time of writing). The REA's response is risible.

Why does the government (which, by the way, knows all this too) continue to load up our electricity bills with these subsidies? Easy. (a) the UK depends on biomass to meet its 'binding' EU renewables targets; (b) in a world of windfarms and ever decreasing coal, it depends on the reliability of biomass (inter alia) to keep the lights on in winter; (c) Drax and its smaller confreres are up shit creek without the subsidies, which greatly exceed their profits. I don't know whether Drax - a FTSE 250 company - would go under without the subsidy (and remember, if that is withdrawn then by the same logic Drax should also be paying the carbon tax which would compound their woes). But withdrawal of the subsidy would certainly impact massively on its fortunes.

I can't see the status quo continuing indefinitely.

ND

Except, it doesn't - it increases them, even by reference to coal (which is the obvious comparator, since it is coal-fired power generating capacity that is essentially being replaced by biomass-burning). It's basic physics, plus a little logic. A perfect example of crass policy-making at its most perverse - whatever view you take on (C)(A)GW. The way they get away with it, BTW, is under the utterly demented 'carbon accounting rules' which allow them to account only for the CO2 emitted in the manufacture and transportation of the wood-chips - and to ignore the CO2 emitted during actual combustion, which is nowhere recorded. To repeat, wood-chip burning generates more CO2 than coal burning: and in answer to the riposte that eventually, if you replant the forests, it all balances out, the answer is that 'eventually' is several decades at best, but maybe 100 years or more. Meantime, all this is happening by the many millions of tonnes of mostly North American forest per annum.

There have been a number of people saying this patiently for quite some time, mostly from the green side; although of course the hatchet-faced subsidy-farmers and their 'green' lobby the REA are all in favour. Well, after all, a billion is a billion ...

Yesterday, the fairly universally-respected Chatham House has published what everyone knows to be the truth (here and here). Even the Beeb has picked up on it (though silence from the Grauniad at the time of writing). The REA's response is risible.

Why does the government (which, by the way, knows all this too) continue to load up our electricity bills with these subsidies? Easy. (a) the UK depends on biomass to meet its 'binding' EU renewables targets; (b) in a world of windfarms and ever decreasing coal, it depends on the reliability of biomass (inter alia) to keep the lights on in winter; (c) Drax and its smaller confreres are up shit creek without the subsidies, which greatly exceed their profits. I don't know whether Drax - a FTSE 250 company - would go under without the subsidy (and remember, if that is withdrawn then by the same logic Drax should also be paying the carbon tax which would compound their woes). But withdrawal of the subsidy would certainly impact massively on its fortunes.

I can't see the status quo continuing indefinitely.

ND

Thursday, 23 February 2017

Where should you flee Brexit too if you are a Capitalist Corporation?

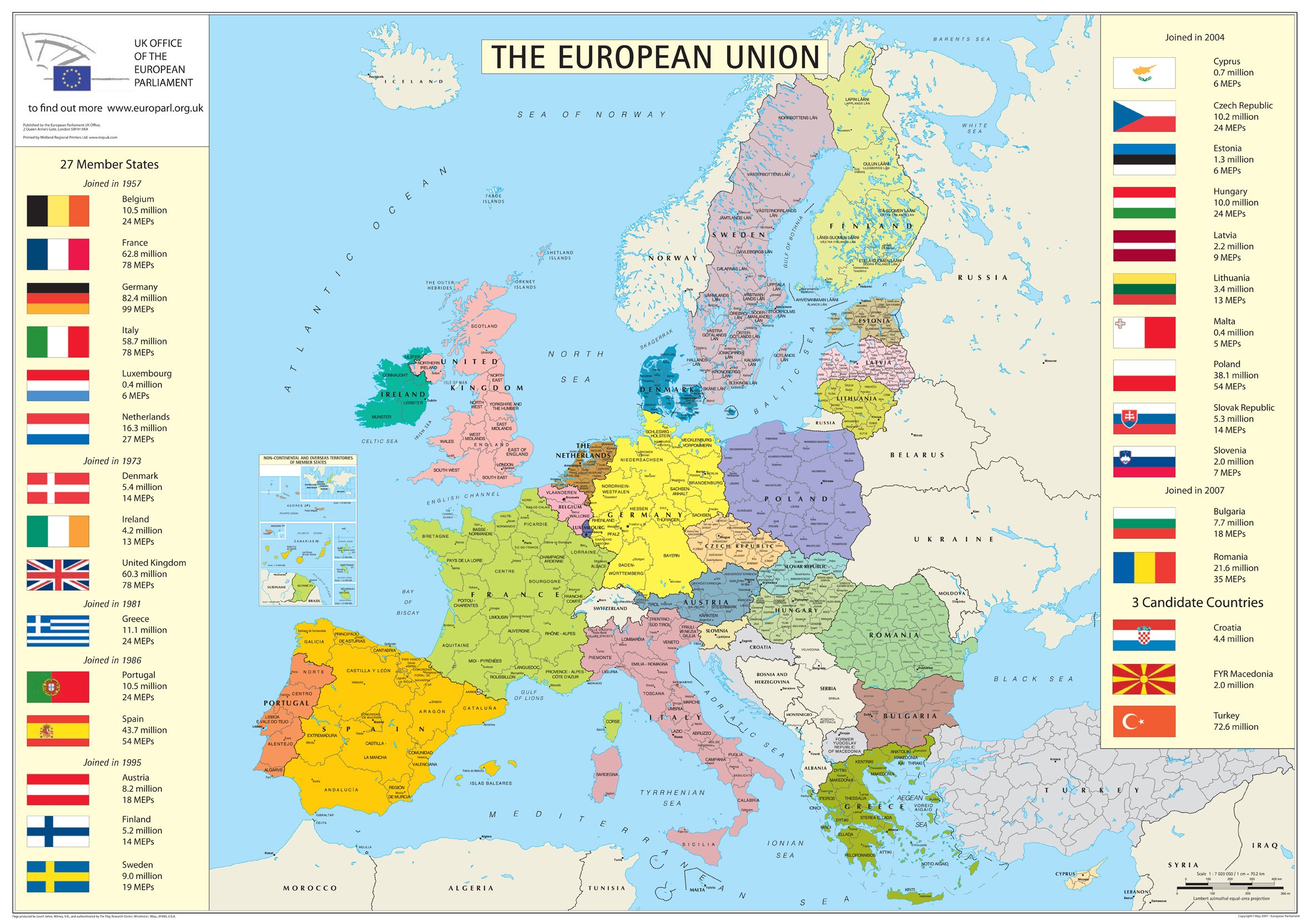

So this is easier than you may think to decide. There are five major considerations that any company has to take account of:

Regulatory Environment, Tax, Employment, Language, EU exit potential

For the first, this is how seriously a country takes enforcement or regulatory rules and therefore how much time and effort you will have to put into pretending your company is operating there.

This is quite a hurdle, Ireland for example are saying you have to have significant operations in-country to count. This is not surprising, given how close to death Ireland came in the 2008 Financial crash.

What this means is that very few countries are able to offer the light regulation (this means a brass plate address a la the Cayman Islands). The EU Countries that do are Malta and Luxembourg. Neither of these places really wants large movements of people to them.

Of the other major Countries, Germany, Ireland, France, Holland, Iceland and Lithuania offer a more challenging regulatory regime, but at least you could actually move people there. Here though both Employment and Language come into play. Ireland apart language is a real issue and notably in France employment issues too - not point being a capitalist company if you can't sack the staff or only hire contractors. The employment element rules out most countries.

Then of course, France and Holland may exit the EU themselves, so why move there for only a temporary escape.

So when it comes down to it, there is only really Luxembourg, Malta and Ireland as serious places to go. Luxembourg ins hands down as many financial services funds are already domiciled in Luxembourg to pay no tax. of course, if you have actual people and business to move then there is Ireland but there regulations mean that is a long process that you really should have started already.

For how long though will the EU put up with Luxembourg offering its companies and UK companies a no-tax jurisdiction within the heart of the continent? Also, when the Financial Transaction tax hits, how much will that hurt the EU trading companies - why bother moving now only to come back later?

As a final thought, due to the above I fully expect to see Luxembourg and Malta veto any moves towards allowing UK passporting or other deals with the EU. They will push for hard Brexit all the way as for them it is a one-way bet.

Wednesday, 22 February 2017

That Exodus from the City to Europe

As we tremble in our boots at the prospect of all those City firms upping and offing, the runners and riders for the Wannabe European 'Capital' City stakes are bimbling around somewhere near the starting line, bumping into each other, in the mud. It looks like heavy going.

And here is what the tip-sheet says:

Already on the map, really - for a nice bit of tourism. Good luck with the global finance.

ND

PS, to be fair, that Grauniad article also gives a list of good reasons why it ain't gonna happen. And they didn't even mention Civil Code and FTT.

PPS, the other day I watched Luxembourg's promotional video clip. You know the way that in TV ads for BUPA private hospitals, the word CLEAN swims in and out of the picture, subliminal-message-wise? Well for Luxembourg, the subliminal onscreen message-word was SAFE ...

And here is what the tip-sheet says:

From Paris to Vilnius, Milan to Madrid and Frankfurt to Valletta, regulators, local authorities and sometimes national governments are clearing a path for the exodus many feel is coming ... or even Amsterdam ... Dublin is a serious contender ... Appealingly low-tax Luxembourg ... Milan is also making a pitch, particularly for technology and financial firms, with ambitious if probably unrealistic plans to turn the Expo 2015 space into a global tech hub. Small, user-friendly Valletta, in Malta, fancies some insurance business, while Lithuania’s Vilnius and Riga in Latvia, want a share of fintech and support activities. “We have the talent and we have the infrastructure,” said Latvia’s finance minister, Dana Reizniece-Ozola. “Everyone wants to put themselves on the map.”Jolly good stuff, chaps. Nice to see a united front. And we all certainly fancy a bit of business. By the way, I've been to Latvia, and Riga is very nice. If you like little old Hanseatic League towns. A bit like Lübeck. Or King's Lynn.

Already on the map, really - for a nice bit of tourism. Good luck with the global finance.

ND

PS, to be fair, that Grauniad article also gives a list of good reasons why it ain't gonna happen. And they didn't even mention Civil Code and FTT.

PPS, the other day I watched Luxembourg's promotional video clip. You know the way that in TV ads for BUPA private hospitals, the word CLEAN swims in and out of the picture, subliminal-message-wise? Well for Luxembourg, the subliminal onscreen message-word was SAFE ...

Tuesday, 21 February 2017

By-Elections - the end of the populist surge?

There are 2 by-elections this week. One in Copeland and one in Stoke.

The Copeland one is about as uninteresting as it gets. A safe Labour seat, Labour are running their traditional 30-seconds-to-save-the-NHS campaign. It is a slam dunk hold for Labour. I doubt many of the people there even know what a Tory is, some kind of baby-eating animal their parents used to scare them with when they were angry. For reasons of needing to fill newspaper columns there seems to be a move to suggest the Tories might win...I mean really. Even when the Tories were led by William Hague and IDS they were not losing seats in Surrey.

As for Stoke, it could have been a bit more exciting if UKIP had a decent candidate, instead the new leader seems as error-prone as previous UKIP candidates and thus is not making much headway. Plus the Labour candidate is also poor meaning the net result will be a very low turnout and thus a likely Labour hold too.

You can get 3-1 for both seats to be holds. At least it means we get to keep Mr Corbyn as our commie-entertainer in chief for a few more months at least. But the likely press angle will be that this is the end of the Populist surge - hhmmmm...that we will have to wait and see about.

Monday, 20 February 2017

"Rationing Police Services" - A Shot Across The Bows

Sir Bernard Hogan-Howe has delivered himself of the opinion that the Police will need to start "rationing" their services if budget contraints continue. "Cuts meant police would have to pick and choose more often what they prioritise, and, more controversially, what they will not", in the Grauniad's paraphrase.

One's responses to this range from "statement of the bleed'n obvious", through to "could be pretty sinister".

ND

One's responses to this range from "statement of the bleed'n obvious", through to "could be pretty sinister".

- All resources are finite and anyone who imagines there isn't some kind of prioritisation going on, in respect of any service provision, is deliberately kidding themselves. The NHS gets fairly close to undiscriminating non-prioritisation in the way GPs and A&E are fairly much forced to deal with whatever fetches up in their system. But after forced entry through the unguarded gate, the patient rapidly gets triaged and filtered and rationed, even if only in ways that are never articulated

- As BH-H notes, the military and more recently the NHS have forced a bit of recognition of this into the public debate: and maybe the Police should be making matters more explicit in their own manor. More openness in strategic decision-making has advantages over unaccountable private policy-making, which we all know is what happens

- I could draw his attention to the situation at a cafe of my acquaintance which, every weekday morning, is home to three and sometimes four patrol-cars' worth of coppers enjoying an exceptionally leisurely morning coffee-break ...

- How much openness is wise? It's one thing for the military to state: we can no longer patrol in the Pacific Ocean; or for the NHS to say we can't afford this new cancer drug. But what happens when the Police say: we can't patrol after midnight? (Our local force has already unilaterally declared it will not enforce the new 20 mph speed limits the council has imposed.)

- What happens when 'rationing' get really political? When (say) a mayor with strong community affiliations tells the local police chief that laws he reckons aren't congenial to his community mustn't be enforced?

ND

Saturday, 18 February 2017

Robotic Cars - The driver-less future.

America is So ready for robotic cars.

There are already adverts on the television along the lines of "Your insurance local, friendly, family run insurance provider .. securing you yesterday, today.. and with the autodrive cars of the future."

I've been driving in the US recently. I was pleased that the rental car options are two grades above our UK ones. Order a midsize and get a Jeep Cherokee. Fuel is still half UK prices. Despite everything else now costing European amounts of money with our currently worthless overseas currency.

Its about ten years since I've been to the USA. And the 99c hamburger is now $3.99

Its a much calmer driving experience than in the UK. Much calmer and easier. The cars may be bigger but the roads are wider.The speeds are much lower. Motorway 65. Country 40-50mph.

That doesn't look on paper much different. But many more roads are dual carriageway. Many , many roads, even through the centre of cities, towns and villages are three lanes wide.

Three lanes wide and often with an emergency lane on both sides. The median guardrail that is within touching distance of a passenger in the fast lane in the UK is a lane and a grass strip or run-off sandstrip away in the US.

The roads tend to be straighter. The traffic lights wait for longer and the signals are above each lane. Three lanes of traffic tend to move at the same speed. A speeding car is quite easily spotted. I saw plenty of highway patrols. A few accidents. And despite what seemed to be every single road in every state I traveled being worked on by orange clad construction crews with orange and white barrels reducing lanes, traffic flowed exceptionally well.

The USA is ready for the driver-less automobile.

I thought maybe ten years away before we start to see them. But that was with my narrow roads, roundabouts, single lane, farm track, heavily congested, impatient, high speed Euro-UK driver eyes.

It will be much easier in the Americas..

People in the know say on the technology required front, we can have driver-less cars right now. The systems are all ready. The testing has been done. It all works. Its all ready. Millions of accident free miles already put in.

Its the legal issues that are holding the whole thing up.

What do we think about this new invention?

Its going to change our lives and our commerce as radically as the internet did. A change to the existing order and the existing structures and systems. With huge cost savings and huge job losses. Winners and losers. With the law and the governments panicking and obstructing and lagging a fair way behind the technology rush.

Are we happy about the driver-less vehicles?

Will you be getting one?

Friday, 17 February 2017

Thursday, 16 February 2017

Turnbull: Not-so-much Wizard of Oz

Reports coming from the other side of the world are not so bright these days. For whatever it is worth, Turnbull didn't seem to hit it off with Trump - even if that's now being spun as a Good Thing. More concretely, Australia looks set to be the first major nation to screw up energy policy so badly that blackouts are increasingly the result (most people had Germany down for that honour). Its mining policy looks to be a mess, as well - and highly dependent on Chinese demand.

Reports coming from the other side of the world are not so bright these days. For whatever it is worth, Turnbull didn't seem to hit it off with Trump - even if that's now being spun as a Good Thing. More concretely, Australia looks set to be the first major nation to screw up energy policy so badly that blackouts are increasingly the result (most people had Germany down for that honour). Its mining policy looks to be a mess, as well - and highly dependent on Chinese demand.I've been surprised that Malcom Turnbull hasn't been a more immediately successful Prime Minister. Our paths crossed briefly when he was at Oxford but not so much as I could form a proper assessment of him. But a friend who knows him well and whose judgement on people and politicians tends to be excellent, reckons him the most dynamic, ambitious and purposeful getter-of-things-done he's ever met. Turnbull's CV rather bears this out; and reaching the top of the greasy antipodean pole seemed a natural career progression.

So what's up down under? Turnbull's Oz should be one of our best and most useful friends in the post-Brexit world - and perhaps even more importantly during the extended phase of pre-Brexit diplomacy. Perhaps it will still be so.

Any C@W readers who can offer some good perspectives?

ND

Tuesday, 14 February 2017

We Have Heard Enough from Justin Welby

As a conservative I am apt to giving the benefit of the doubt to figures of authority. At the same time I expect them to merit respect: and if they prove otherwise ...

Which brings us to Justin Welby. Who started in the oil industry like, errr, me - so he already had a couple of credits in the bank. And I've long had a benign tolerance towards the naive leftism of the many clerics I know.

I see Welby now considers Brexit et al to be "in a nationalist, populist or even fascist tradition of politics"; oh, and from other recent news items, that taxes should be increased.

And we have also seen Welby featuring in other headlines recently: his (tangential?) historical connection to the boy-thrashers of the Church of England, and his leadership of the same organisation over the past four years when it has been not exactly eager to see this scandal properly dealt with.

Here he is, blustering (check the second clip embedded in the story). Nothing to do with me. I was only young at the time. Hardly know the chap, apart from the odd Christmas card. Petulant stuff - no sign of leadership, responsibility or authority.

So - benefit of the doubt withdrawn.

Which brings us to Shami Chakrabarti...

ND

Which brings us to Justin Welby. Who started in the oil industry like, errr, me - so he already had a couple of credits in the bank. And I've long had a benign tolerance towards the naive leftism of the many clerics I know.

I see Welby now considers Brexit et al to be "in a nationalist, populist or even fascist tradition of politics"; oh, and from other recent news items, that taxes should be increased.

And we have also seen Welby featuring in other headlines recently: his (tangential?) historical connection to the boy-thrashers of the Church of England, and his leadership of the same organisation over the past four years when it has been not exactly eager to see this scandal properly dealt with.

Here he is, blustering (check the second clip embedded in the story). Nothing to do with me. I was only young at the time. Hardly know the chap, apart from the odd Christmas card. Petulant stuff - no sign of leadership, responsibility or authority.

So - benefit of the doubt withdrawn.

Which brings us to Shami Chakrabarti...

ND

Monday, 13 February 2017

Eight years of banking pain and still no end in sight

Co-Op bank has put itself up for sale today. Ouch, even after a big bailout from new shareholders, there seems to be no way for it to actually turn a profit on its customer base. Frankly with low interest rates and non-banks piling into the market, there is not much to be said for retail banking. They never did get there way on charging for current accounts...

Add this to RBS, being denounced in the press for being about to launch another mass redundancy round to try and cope with its 9th annual multi-billion loss. Again, similar to Co-Op, it can't make money from its business - certainly only a couple of billion from what it has left after shutting down investment and international banking. This two billion is dwarfed every year by payouts for the sins of the past misdemeanours.

2007/8 feels like a long time ago, but many of the problems in the banking system are still working through. The medicine of Quantitative Easing, which was hard to argue against at the time, has persisted long past its use by date. The Bank of England has always found a reason to keep the taps on to help the economy.

However, the underlying system is now very screwed by this approach. With no interest rate differential in the markets, banks struggle to make money. The regulatory burden, necessarily increased after the great crash, is expensive. Instead of the Banks making good, new entrants, with lower costs have come to the market and started to feast. This is good capitalism and as it should be, but will make for a big taxpayer write-off on the RBS investment.

Perhaps we should just do it and move on, rather like Co-Op group did with Co-Op bank.

Friday, 10 February 2017

OPEC's Oil Price Fix - Is That All You've Got?

So - OPEC finally came up with its production-cutting deal last November, and sure enough, up went the price of crude. Members' discipline has been OK (Iraq and Venezuela excepted) but, needless to say, it's been heavy going for the Saudis, who have needed to hold back rather more than agreed to achieve even this ...

Pretty feeble for a price-hike, huh? And US oil stocks are high right now: and the hedge funds are holding record long positions in oil (nearly 900 million barrels) - whatever you think that means. But $55 is quite enough to get the great shale-oil venture back on the road, and the US 'rig count' has been climbing since its low of May last year. A bit of a cyclical upswing, to be followed by a cyclical production response ...

In case anyone doesn't know, as this new(ish) development in fracking technology really gets into its stride the Middle East is living on borrowed time because (a) the USA now knows it has all the oil it will probably ever need; and (b) should there be the slightest error in that calculation, it now transpires that the world's largest reserves belong to ... Venezuela. As for gas, if Russia can ever get to grips with the fracking technology (shouldn't be beyond them), they have so much more gas than everyone used to think, it's quite off the scale. Enough of all these hydrocarbons to make a Green weep.

Venezuela, eh? The politics of the western hemisphere may get quite interesting down the road. A good job for them President Trump doesn't need to go looking abroad for US supplies.

What price that slice of Aramco then? The 'risks' section of the prospectus should make interesting reading. Remember, anyone caught lying in a prospectus for a Wall Street flotation goes straight to gaol, do not pass Go. It's taken very seriously there.

ND

Pretty feeble for a price-hike, huh? And US oil stocks are high right now: and the hedge funds are holding record long positions in oil (nearly 900 million barrels) - whatever you think that means. But $55 is quite enough to get the great shale-oil venture back on the road, and the US 'rig count' has been climbing since its low of May last year. A bit of a cyclical upswing, to be followed by a cyclical production response ...

In case anyone doesn't know, as this new(ish) development in fracking technology really gets into its stride the Middle East is living on borrowed time because (a) the USA now knows it has all the oil it will probably ever need; and (b) should there be the slightest error in that calculation, it now transpires that the world's largest reserves belong to ... Venezuela. As for gas, if Russia can ever get to grips with the fracking technology (shouldn't be beyond them), they have so much more gas than everyone used to think, it's quite off the scale. Enough of all these hydrocarbons to make a Green weep.

Venezuela, eh? The politics of the western hemisphere may get quite interesting down the road. A good job for them President Trump doesn't need to go looking abroad for US supplies.

What price that slice of Aramco then? The 'risks' section of the prospectus should make interesting reading. Remember, anyone caught lying in a prospectus for a Wall Street flotation goes straight to gaol, do not pass Go. It's taken very seriously there.

ND

Thursday, 9 February 2017

Will Brexit Kill off the House of Lords?

As a Republican, as ever an unpopular position, I was musing that the paradigm shift which Brexit has cause may find new victims this week.

The House of Lords has long been an anachronism in the UK system. There has of course been some attempt to reform it with Tony Blair getting rid of the hereditary Lords.

Hilariously, this reform has probably made the Lords even worse than it was. The hereditary's were at least independent, whereas their replacements have been retiring and failed politicians. The Liberal Democrats, long-since abandoned by the voting public, happily have 109 of our 807 Lords positions.

Today they are going to try to amend the Brexit bill which was handily passed by Parliament, they may have more success and be more blinded than is the common thinking. Remainers are nothing if not strident and the Lords is full of Remainers who owe nothing to the public and who face no prospect of election or losing their remuneration or position, thanks to the unwieldy constitutional convention that we have inherited.

Lords reform will be fully on the agenda for the Tories and UKIP together if there is too much resistance. At a push I can see the SNP and Plaid Cymru also spying a chance to make mischief with the constitutional set-up.

In reality, this will all take time as if there is not enough for the Government to do with Brexit over the next few years. However, planting the seed if the first step to growing a new garden.

Tuesday, 7 February 2017

UK in Housing Crisis according to the Government

Really, Sajid Javid has a reputation as a high flying City Banker, lowering himself in service of his country by taking a Government job.

Allegedly, his ego remains that of a City High-Flier.

However, coming out today to say there is housing crisis, young people can't buy or rent and the Government should do something about it is pretty thin. Rarely these days do the labour opposition make any good points, but to say the Government is complicit in not doing anything serious about housing for 7 years is spot on. Allegedly there were some ideas about planning reform floated last month, but these do not seem to have seen the light of day.

Actually, now is a good time to get building. The higher end property market has gone for a burton, freeing up labour and companies to look again at more mid-range projects where prices are more inelastic (as are the profits though..).

A good old house building boom is long-overdue. Indeed if this comes alongside falling immigration and falling household formation then more is the better - we could see a real improvement in the situation.

Of course a real improvement also means house price falls (or, no nominal increases) for the foreseeable which will be very unpopular with our Banks and Lenders. But suffer they must, jus don't buy any shares in them.

The real issue though is the Government has not really committed to anything as per usual, so not doubt I will be re-writing this post again every year for the next decade. I somehow doubt prices can go beyond 8x income ration which is where they have reached, but then again I thought that at 6x Income and 7x income!

Allegedly, his ego remains that of a City High-Flier.

However, coming out today to say there is housing crisis, young people can't buy or rent and the Government should do something about it is pretty thin. Rarely these days do the labour opposition make any good points, but to say the Government is complicit in not doing anything serious about housing for 7 years is spot on. Allegedly there were some ideas about planning reform floated last month, but these do not seem to have seen the light of day.

Actually, now is a good time to get building. The higher end property market has gone for a burton, freeing up labour and companies to look again at more mid-range projects where prices are more inelastic (as are the profits though..).

A good old house building boom is long-overdue. Indeed if this comes alongside falling immigration and falling household formation then more is the better - we could see a real improvement in the situation.

Of course a real improvement also means house price falls (or, no nominal increases) for the foreseeable which will be very unpopular with our Banks and Lenders. But suffer they must, jus don't buy any shares in them.

The real issue though is the Government has not really committed to anything as per usual, so not doubt I will be re-writing this post again every year for the next decade. I somehow doubt prices can go beyond 8x income ration which is where they have reached, but then again I thought that at 6x Income and 7x income!

Monday, 6 February 2017

Money For Old Rope

Little-noticed by the MSM, last week saw an event that neatly demonstrates two interesting British governmental phenomena: one of tremendous strategic incompetence, the other of impressive tactical prowess.

Little-noticed by the MSM, last week saw an event that neatly demonstrates two interesting British governmental phenomena: one of tremendous strategic incompetence, the other of impressive tactical prowess. Recognising that the 'capacity margin' (of reliable electricity supply over peak demand) has become perilously low - probably negative, in fact - the PTB (technically the National Grid, but it is of course government + regulators + grid in cahoots) ran an unscheduled, one might well say panicky, capacity auction for next winter's cover. More on capacity auctions below.

The first thing this demonstrates is the astonishing failure of policy that results in an 'advanced' nation getting itself into the position where there could be blackouts arising from lack of generating capacity - a situation that could well arise even this winter if February turns out to be as cold as some forecasts suggest**; and next winter will be worse. (Note: any blackouts would be for industry - governments will do absolutely anything to keep lights on in homes and hospitals.) This state of affairs has been evolving in slow motion, in plain sight, for 10 years with no shortage of warnings from many sources (e.g. this blog, for the whole of that decade).

On the flipside, it demonstrates just how technically capable the civil service (incl. regulators and grid) still are in this country. The Capacity Mechanism was designed to provide an incentive for firms to build new power plants with a 4-year lead time: so the first auction more than 3 years ago was for the period starting winter 2018-19, and there have been two more of these annual 4-year-ahead auctions. For various reasons to do with the stupidity of ministers and economists, the 'wrong kind' of power plants have been winning these auctions. They were hoping for new ultra-efficient gas-fired plants: they got old coal plants on life-support, creaking old gas plants coming out of mothballs, cheap-and-cheerful inefficient gas plants, and banks of diesel generators instead. Anyone could have told them this would happen (specifically, I did).

However, as a purely technical exercise in running a complex auction - and 'discovering' the cheapest way of solving the problem - they have been a great success: a credit to the team that devised the Mechanism. To be fair, they had several pre-existing examples of auction designs to consider frm around the world, including some that have been a fiasco. Nonetheless, to get it right first time is creditworthy. Several continental countries whose energy policy is just as bad if not worse than ours - oh yes, it is possible - gaze in awe at how well we do these technocratic things, and wish they could emulate us. (I was at a 3-day technical seminar in the Netherlands in December - the only Brit there. On four separate occasions, concerning different aspects of energy policy, someone said "they've done this already in the UK" or "they do it so much better in Britain".)

So - when in 2016 ministers contemplated the dire prognostications for winter 2017-18, and the dreadfully inefficient way the Grid struggled through 2015-16 and this winter, they readily concluded the answer was to run an emergency 'early' auction. As a piece of sticking-plaster, it's probably worked. The clearing price that we all shall pay in our electricity bills was way, way lower than the commentariat forecast (enabling the government to crow); and of course 97% of the winning capacity is ... already-existing power plants. Less old coal-on-life-support has succeeded; more gas-coming-out-of-mothballs. Oh, and of course, the 3% that will be new-build plant will all be little diesels: what else can you put in place inside 6 months??

This being the case, for 97% of the winners they are being paid just for being there - which they already are. I can report that in the industry, these payments are routinely referred to as 'money for nothing'. Dire Straits indeed.

ND

UPDATE - bit of a PR campaign going on here: and there have been other self-congratulatory pieces over the past few weeks. You might argue some of my text above justifies their preening. But there's a political agenda here too - don't worry about renewables, everything's fine. Trouble is, National Grid are not a neutral judge on this: they get a guaranteed rate of return on investments they make that are required to accommodate, e.g., windfarms in the north of Scotland. Nice work if you can get it - or moral hazard, as professors of ethics say.

-----------------

** because we may run out of gas, owing to an unforseen problem with storage: and gas-fired power generation is now absolutely critical with so much coal plant having shut down.

Friday, 3 February 2017

Iconic UK rock and popsters. Bowie and friends.

Royal Mail are continuing with their sometime series of pop icons on stamps with a David Bowie set.

The previous UK popular beat combo that RM chose was Pink Floyd. Before them, the Rolling Stones and The Beatles.

Despite the Uk's view of itself as a world leader in popular music. Rivaling the USA for talent and sales, it is quite difficult to point to Tier 1, superstar, internationally renown musicians.

In the girl band pop group category The Spice Girls are undeniably the world's best selling all girl band. A UK hit who would easily claim a set of stamps on all measures except longevity, which was mercifully short.

But the next most successful ever all British, all female line up, is Bananarama. Who are still going after their formation 37 years ago. But have under half the sales the Spice girls managed, even though they existed during the easier to rack up volumes, peak vinyl sales era.

So, Dave B aside, and allowing that Posh and co are a definite, which British music artist is successful enough to warrant their very own fame sticker?

Who is known throughout the globe? Has had their music played in taxi cabs from Mogadishu to Montpelier. Has sold tens of millions of records and played packed out stadiums? Who is so well known, so iconic, that they can carry the UK flag around the globe on our new Post-Eurovision age?

Its harder than it seems. We have, and have had, many, many good musicians. Many well known. Many successful. far more than our island population should warrant.

{That WORLD language we own, helping us out yet again.}

But Headliners?

Madonna - Sprinsteen - Beyonce - Michael Jackson - level front rankers.

We do have them. But trying to get another ten, has proved quite hard for the BQi offices.

So - Given Bowie, Floyd, Stones, Beatles are already taken, can we agree another batch?

I have pitched in with Spice Girls {I'm no fan..its just that they fit the criteria!} and Elton John.

70s superstar. 80's star and multi-million selling artist, Still performing, still selling out stadiums, still with his original albums on sale in shops and digitally.

Anyone else worth a lick ?

Wednesday, 1 February 2017

5 reaons the Markets will turn in February

1. After a US election, the historically most common trend is for a rise in anticipation and also as loose monetary policy is a given prior to any election. This has tended to cause a hangover the following year.

2. The US markets have touch all time highs recently - despite not particularly stellar corporate returns or signs of massive growth potential. The Price/Earnings ratios are well above the long-run average of 12.

3. Trump, is, err, mad. Whilst some of his policies are going to be good for growth in the US, like investing in infrastructure and trading off environmental protection for economic expansion, they are also going to be implemented badly - after all, few of his advisory picks are getting put in place quickly.

4. The over-blown reaction to his immigration executive order has made some large US corporates very jumpy - confidence is a key thing in the markets and this already has taken a knock. Yes, some of them are lefty-hand wringing types, but still, they run some very important companies for the US economy. Look at Brexit, all the big companies against and the FTSE regularly takes a kicking when they come out with the woe-is-me-shtick.

5. Protectionism - this is a two way street, good for US jobs potentially, but at the expense of international companies also probably inflation and slower GDP growth. These latter issues will be priced in before the former. Reducing trade won't be good for US markets.

All in all, the Trump bounce does not feel that sustainable in 2017, even if over 4 years things do work out for the best.

And finally, the old phrase is worth a mention., when the US sneezes the UK catches a cold...

2. The US markets have touch all time highs recently - despite not particularly stellar corporate returns or signs of massive growth potential. The Price/Earnings ratios are well above the long-run average of 12.

3. Trump, is, err, mad. Whilst some of his policies are going to be good for growth in the US, like investing in infrastructure and trading off environmental protection for economic expansion, they are also going to be implemented badly - after all, few of his advisory picks are getting put in place quickly.

4. The over-blown reaction to his immigration executive order has made some large US corporates very jumpy - confidence is a key thing in the markets and this already has taken a knock. Yes, some of them are lefty-hand wringing types, but still, they run some very important companies for the US economy. Look at Brexit, all the big companies against and the FTSE regularly takes a kicking when they come out with the woe-is-me-shtick.

5. Protectionism - this is a two way street, good for US jobs potentially, but at the expense of international companies also probably inflation and slower GDP growth. These latter issues will be priced in before the former. Reducing trade won't be good for US markets.

All in all, the Trump bounce does not feel that sustainable in 2017, even if over 4 years things do work out for the best.

And finally, the old phrase is worth a mention., when the US sneezes the UK catches a cold...

Subscribe to:

Comments (Atom)

.jpg/220px-The_Co-operative_Bank_-_Ealing_(9415463884).jpg)