An interesting development that demonstrates in some of the poor decision making by the coalition and the challenge of financing all in one.

Trapoil, a real tiddler of a North Sea explorer, has made a big fanfare about starting to do off-shore fracking in the North Sea. Regular readers will know how immensely keen we are here on fracking for gas and oil as it has the potential to solve our long-term energy needs in a way that wind farms simply won't.

And so to do it off-shore, all the better. However, since 2011 the North Sea has been a complete disaster zone for finance. George Osborne's tax raid inflicted massive damage on tall the smaller AIM listed oil companies that had moved in to replace the majors. Even the majors cut back on investment and since then falls in oil production have held down UK GDP and caused a double dip recession.

Now there are some hints at changes to the rules and regulations which will allow a better shot at exploration. But there is another problem that has reared its head and that is as the big deposits are all discovered, the smaller companies are not having such a good strike rate with their prospective drilling.

This means that the banks who used to lend to the companies are quite sceptical about lending more money, plus of course they are in financial difficulties themselves and much more risk averse to high risk lending than they were. Prior to 2008/10 Lloyds was the largest lender to the companies in the region and of course now this is one of the banks in the worst condition.

So whilst it is great that the Coalition Government are now looking to change the DECC rules to try and encourage the sector, it is only after two very deep self-inflicted wounds have been taken. It's a long way back from here and I doubt North Sea production is going to recover in time to boost the economy before the election.

Friday, 29 March 2013

Wednesday, 27 March 2013

Question Time - some news

Austerity budget cuts lead to a more creative use of resources. I've noticed this quite a bit. Its something private companies do all the time. Shuffle resources. Look for ways of reducing costs. Doubling up workloads. Its so common place it goes unremarked.

Yet in the public sector, its only when the budget hits the buffers that suddenly there is a necessary scramble for savings. departments are closed and managers oversee recycling and waste instead of individual ones for wheelie bins or bio-bags. Suddenly, now that all the public toilets in the land have been closed, its occurred to someone that they don't need to manage them at all. That they could have given the buildings away to a contractor. Or paid existing private business, pubs, restaurants, coffee shops, to allow non users access to their facilities. Seeing as that already happens those businesses might have been willing to take a small payment to put up a sign ?

Some are so obvious and so sensible it seems incredible that no one has though of them before.

Police stations in London are to shut. Not the holding cells and processing but the counter where someone sits waiting for a member of the public to rush in.

Closing these outposts is seen as an end to policing. Angry campaigners are condemning Mayor Boris for cuts during a recession. Yet these buildings aren't really used. If someone sees a car crash they don't go to the police station. They phone 999. Because they have a phone. And that's the obvious way to report a crime. Same if they see a dodgy individual climbing on a roof with a bag marked swag.

I think the last time I went to police station was in the late 80s. Some sort of driving documents producing requirement. Since those days the police now come to you. Call them up and days or weeks later someone comes round. Or gives you a crime number because they can't really do anything about your stolen bicycle/phone/wallet.

There is no real need to have a dedicated access point.

Fire stations closing. Many, many of them. There is now, belatedly, and without enthusiasm from the various unions, a move to integrate ambulance/fire/police in one purpose built emergency centre. One emergency response call operator. One set of buildings insurance, power, light, heat etc. Makes sense. And maybe the tow trucks and gritters can rent a portion of the space?

Doctor's surgery to have a social centre. Or a DWP point for information and guidance.

District councils looking at sharing services across the arbitrary county boundary.Cleaning contracts for say "The west" rather than Devon East.

Libraries that are also {again- is there really this much crime?} police posts and local information centres and possibly the MPs surgeries. Or libraries on school premises ? A different access door, but utilising the land? Or, the dissapearence of citizens advice. get into the libraries?

The DWP benefits office could be attached to the council offices.The army could share UK bases with the RAF. Joint kitchens and shared land, vehicles, stores and..ok ..ok, lets not get carried away.

But in future?

Its even dawning on the super bureaucracies that maybe some cross platforming is going to be required.

BBC One's Question Time is also to be broadcast

on BBC Radio 5 live.

The weekly discussion programme, chaired by David Dimbleby,

will be preceded by extra discussion of the issues making news, starting

at 22:00.The network is putting an "increased emphasis on its news and political output".

Or, a cheap way to fill a time slot with a program that you've already paid to make.

PS. There is no QT this week.

The Evil That Is Censorship

Here's a story I can empathise with. Iain Inglis - from Wales - stormed to the semi-finals of China's Got Talent (sic) with his renditions of traditional Chinese Communist revolutionary songs.

But then - disaster: his path to the finals was blocked, seemingly by po-faced Party officials. They can't imagine he's taking the piss, can they ?

I feel his pain. I myself was making great progress through the initial rounds of the next series of The X-Factor with my own distinctive brand of dialectical ditty when a shadowy figure, believed to be the Head of Political Correctness at Common Purpose, had a word in Simon Cowell's ear - and I was axed.

What is the world coming to ?

ND

'It was a bit of fun to start off with but the more performances I did, the more I was hooked. For some reason the Chinese people seem to find it quite hilarious'Since his biggest hit is a number called I Love Reading Chairman Mao's Books, we can see why this might be.

But then - disaster: his path to the finals was blocked, seemingly by po-faced Party officials. They can't imagine he's taking the piss, can they ?

I feel his pain. I myself was making great progress through the initial rounds of the next series of The X-Factor with my own distinctive brand of dialectical ditty when a shadowy figure, believed to be the Head of Political Correctness at Common Purpose, had a word in Simon Cowell's ear - and I was axed.

What is the world coming to ?

ND

Tuesday, 26 March 2013

Larry Summers: Wrong about UK and US fiscal policy

Larry Summers, a former senior US economic advisor made some pretty stinging comments yesterday about UK economic policy. He said it was a mish mash of austerity and loose monetary policy which has clearly failed, comparing it disapprovingly with the US policies.

So what has happened to the 2 nations since the great crash of 2008 and who has come out better. Financial crises take a long-time to recover from and we can't be sure we are there yet, plus of course the US has not had to deal with the Euro collapse, which has probably benefited the US, but more of this later.

First up, let's compare GDP:

We can see from the above that firstly the US crash was worse and also that GDP growth in in the US has been stronger. In total, the US economy is now .12% bigger than 2008 but that the UK economy is still 3.5% smaller.

So on the strength of this the US debt fuelled recovery has done better than the US attempts at austerity.

But how about the Debt to GDP ratio?

So what has happened to the 2 nations since the great crash of 2008 and who has come out better. Financial crises take a long-time to recover from and we can't be sure we are there yet, plus of course the US has not had to deal with the Euro collapse, which has probably benefited the US, but more of this later.

First up, let's compare GDP:

|

| Stats: Cityunslicker.com |

We can see from the above that firstly the US crash was worse and also that GDP growth in in the US has been stronger. In total, the US economy is now .12% bigger than 2008 but that the UK economy is still 3.5% smaller.

So on the strength of this the US debt fuelled recovery has done better than the US attempts at austerity.

But how about the Debt to GDP ratio?

The US debt ratio has gone for 66% of GDP to 101% - an increase of 35% of GDP - in real terms this is from just under $11 trillion to nearer $17 trillion

For the UK, debt has gone from 38% of GDP to 70% of GDP - an increase of 32% an a real increase of £300 billion or so. So much for austerity in the UK then, it has been pretty fictional and the same amount of debt has been added as in the US, give or take 3% - but the US has delivered an economy 3.6% bigger.

This is equivalent to about half a trillion dollars, so relative for the UK would be about £200 billion bigger than it is today if we had kept pace with the US, given 50% of GDP goes in tax that would equate to a huge part of the annual deficit of £120 billion odd.

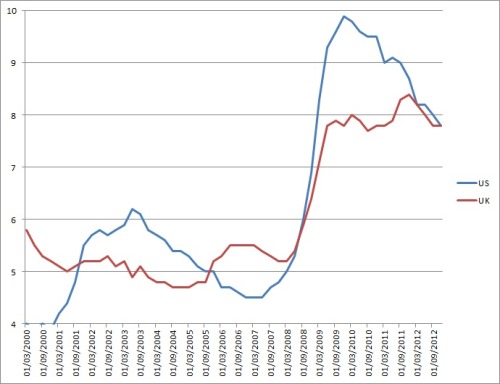

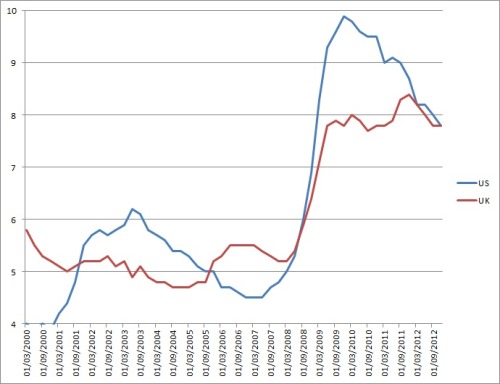

How about Unemployment?

In many respects, there is not much to see here. US employment rose to a higher level than in the UK, but has then come down faster as growth has kicked in - but only to reach the same level as the UK's rate now anyway - with both economies on 7.7%.

Verdict

This is a difficult one, firstly, there has not been much fiscal austerity in the UK and the US is about to embark upon some - so Summers' proposition about our fiscal approach is simply wrong. He does not know what he is talking about. Having said that, the US has outperformed the UK in GDP and seems on a better path than the UK for growth - all for the same relative costs in national debt. So the US has done better.

The reasons for this could be varied, but I would posit better de-leveraging of debts caused a bigger fall in the beginning but has enabled a firmer recovery.

However, the US now has a debt/GDP ratio of 101%. Once the economy normalises and interest rates rise, there will be a massive cost to the US economy in terms of public debt servicing. In the current ultra-low environment, which the US benefits from and the Eurozone crisis helps them with due to flight to safety reasoning, this matters not. In the long term, the UK debt levels should top out at under 80% of GDP -we have a lower debt burden.

Also, should another crisis hit, the US is now just one step away from Greece and Japan, whereas the UK's better fiscal health means we are maybe 2 steps away.

Monday, 25 March 2013

British Island Outposts (2) - Cyprus and the Bear

History Corner again: Cyprus this time. A few days ago in comments to her post on the adolescent troika and their jejune conduct, the estimable Hatfield Girl wrote:

Draw up a sandbag, swing the lamp ... it all takes me back to 1974, when it was the Turks that had Cyprus in their sights. Yours truly was a young subaltern in an austere barracks in Germany when the signal came. The details of Operation Platypus don't seem to be in the public domain yet so my lips are sealed (even if some chaps don't seem quite so reticent). Suffice to say, a number of measures were taken, sending a message that a martial nation like Turkey wouldn't fail to understand.

Whatever the juvenile idiocies of the troika and the Eurozone, I have a feeling the Russians will know where they stand vis-à-vis ourselves on this one. It will be interesting to see how the bear makes its displeasure felt towards countries who are simply twisting its tail. Remember the Gazprom song ... cut the gas for everybody !

ND

"One of the unacknowledged problems of England being so remote from the EU and in particular the Eurozone, is that imperial experience and knowledge is untapped. No English civil servant's political antennae would not have twitched at the very word Cyprus, never mind Cyprus and Russian bank deposits. They'd have been in with the Treasury and the Foreign Office, and Defence, before you could say Makarios. I wonder that these troikerenes didn't notice not one but two British sovereign bases on the island. Why here, they might have said to themselves (but didn't)."An awful lot of non-civil-service Brits would have those antennae, too. They would recall how, when the famous Iraqi WMDs were being touted by Campbell, it was the British bases on Cyprus that were "under threat":

25 September 2002 - The Sun newspaper has the headline: "Brits 45 mins from doom" about the threat to troops in Cyprus.Now what might they be doing there ? What's the connection with Russia ? Readers are invited to google their way to the answers - or to take a look at the atlas. No surprises when we read - Cyprus crisis: UK experts fly out to advise on bailout. Ah yes, the bailout. And an RAF plane was needed - to ship over sackloads of Euros. Well of course. Just as Gazprom was arriving at the other end of the island - what Great Games !

|

| Don't Twist My Tail |

Draw up a sandbag, swing the lamp ... it all takes me back to 1974, when it was the Turks that had Cyprus in their sights. Yours truly was a young subaltern in an austere barracks in Germany when the signal came. The details of Operation Platypus don't seem to be in the public domain yet so my lips are sealed (even if some chaps don't seem quite so reticent). Suffice to say, a number of measures were taken, sending a message that a martial nation like Turkey wouldn't fail to understand.

Whatever the juvenile idiocies of the troika and the Eurozone, I have a feeling the Russians will know where they stand vis-à-vis ourselves on this one. It will be interesting to see how the bear makes its displeasure felt towards countries who are simply twisting its tail. Remember the Gazprom song ... cut the gas for everybody !

ND

Sunday, 24 March 2013

Cyrpus - will be it AIM high or low?

Zak Mir gave Spreadbet Magazine readers some interesting insights

into a few AIM stocks this week, in particular Gulf Keystone Petroluem

which looks to me as if it might well drop below the key 172p support

level rather than start a new breakout - with a court case over the

ownership rights to the fields hanging over it then it is not surprising

there is nervousness around the stock.

But what of the AIM market as a whole with Chancellor announcing the abolition of stamp duty on trading in AIM shares and so making them even more attractive to retail investors? We would have expected this to give a big boost to the market yet instead we lie the index largely flatlined throughout the week and ended with a dip below the 750 level that it nosed through to the upside during February and March. Indeed, it is heading towards a critical point in the next week - just a couple more percent to the downside and it will have given up the gains for this year in contrast to the FTSE 100 and FTSE 250 which are still ahead materially as shown in the chart below.

The AIM index is of course heavily weighted to the likes of GKP and other oiliess, and this sector has continued to underperform for the second year in a row with continued disastrous drill results by many stocks such as Chariot Oil. Even the likes of Rockhopper with proven reserves and a path to market have struggled to show positive returns. AIM looks very likely to be in for yet another rocky ride this year…

Cityunslicker’s own favourite EMED Mining has suffered another delay too in its quest for permitting of the comapny’s copper mine in Spain and has dropped nearly 10% in a week.

So, overall, we are left with another “interesting” week ahead with the desperate situation in Cyprus likely to affect near term directionality.

A fudge and stability looks to be the most likely outcome and if you look back at the history of the Eurozone from 2009 to now, fudge after fudge seems to be the common theme. Mhy guess is that a deal will be done over the weekend to try and calm the markets for a Monday. If Cyprus gets even more messy then we can expect a sharp drop in the index – yet another downhill rollercoaster as happened during the last 2 summers… A most unwelcome environment for AIM investors given their incremental volatility. Volatility that for a number of years now, investors have not been compensated for relative to their larger cap brethren.

This post is brought to you by site sponsor spreadbetmagazine.com

But what of the AIM market as a whole with Chancellor announcing the abolition of stamp duty on trading in AIM shares and so making them even more attractive to retail investors? We would have expected this to give a big boost to the market yet instead we lie the index largely flatlined throughout the week and ended with a dip below the 750 level that it nosed through to the upside during February and March. Indeed, it is heading towards a critical point in the next week - just a couple more percent to the downside and it will have given up the gains for this year in contrast to the FTSE 100 and FTSE 250 which are still ahead materially as shown in the chart below.

The AIM index is of course heavily weighted to the likes of GKP and other oiliess, and this sector has continued to underperform for the second year in a row with continued disastrous drill results by many stocks such as Chariot Oil. Even the likes of Rockhopper with proven reserves and a path to market have struggled to show positive returns. AIM looks very likely to be in for yet another rocky ride this year…

Cityunslicker’s own favourite EMED Mining has suffered another delay too in its quest for permitting of the comapny’s copper mine in Spain and has dropped nearly 10% in a week.

So, overall, we are left with another “interesting” week ahead with the desperate situation in Cyprus likely to affect near term directionality.

A fudge and stability looks to be the most likely outcome and if you look back at the history of the Eurozone from 2009 to now, fudge after fudge seems to be the common theme. Mhy guess is that a deal will be done over the weekend to try and calm the markets for a Monday. If Cyprus gets even more messy then we can expect a sharp drop in the index – yet another downhill rollercoaster as happened during the last 2 summers… A most unwelcome environment for AIM investors given their incremental volatility. Volatility that for a number of years now, investors have not been compensated for relative to their larger cap brethren.

This post is brought to you by site sponsor spreadbetmagazine.com

Saturday, 23 March 2013

History Corner: British Island Outposts (1)

Today's Grauniad contains a curious little editorial that makes the case for Mrs Thatcher not needing the Falklands victory for her own political triumph a year later.

The invasion took place in the first week of campaigning for local elections, in one of which I was a candidate. The initial impact on us was striking - real vitriol on the doorstep towards the treacherous Tories who had left the islands undefended; and we feared for our prospects.

Four weeks later, with hostilities in full swing, Thatcher's fighting resolve in clear evidence, and the patriotic jingo-juices roused, we swept the board: 65 council seats out of 70 in my borough. The Labour Party, which sometimes holds this council in its turn, and in 1982 definitely had its hopes up, was reduced to a dazed rump. No-one was in any doubt why this had come about and, no, it was not due to Drew's peerless political rhetoric on the stump.

So: my personal recollection is that as a direct consequence of the conflict, the electorate came to the clear understanding we had a genuine and resolute big-hitter in Downing Street. In circumstances where (as the Guardian reminds us) the Tories' poll position in 1983 was 2 points adrift of its 1979 level, how could that not have been a positive, and perhaps even a decisive factor ?

ND

"The myth is that the Falklands won the Tories the general election. In fact, ... "Well, everyone must speak as they find, and history is an ongoing debate: the more views, the merrier, and the piece makes some sound points. But I can't help feeling there's a perspective they have missed, that tends to tilt the balance towards the other point of view.

The invasion took place in the first week of campaigning for local elections, in one of which I was a candidate. The initial impact on us was striking - real vitriol on the doorstep towards the treacherous Tories who had left the islands undefended; and we feared for our prospects.

Four weeks later, with hostilities in full swing, Thatcher's fighting resolve in clear evidence, and the patriotic jingo-juices roused, we swept the board: 65 council seats out of 70 in my borough. The Labour Party, which sometimes holds this council in its turn, and in 1982 definitely had its hopes up, was reduced to a dazed rump. No-one was in any doubt why this had come about and, no, it was not due to Drew's peerless political rhetoric on the stump.

So: my personal recollection is that as a direct consequence of the conflict, the electorate came to the clear understanding we had a genuine and resolute big-hitter in Downing Street. In circumstances where (as the Guardian reminds us) the Tories' poll position in 1983 was 2 points adrift of its 1979 level, how could that not have been a positive, and perhaps even a decisive factor ?

ND

Friday, 22 March 2013

Move along, nothing to see here

So in recap:

We are closing down coal and nuclear plants;

Reducing subsidy to Green energy;

Subsidising fracking which is a few years off;

Not building any new nuclear plants on any kind of non fanciful timescale;

Not really building many new gas power plants

and then we small mishaps like this. A mere 50% price jump in a day over a run of the mill incident...

At least the lights will stay on, for now....

We are closing down coal and nuclear plants;

Reducing subsidy to Green energy;

Subsidising fracking which is a few years off;

Not building any new nuclear plants on any kind of non fanciful timescale;

Not really building many new gas power plants

and then we small mishaps like this. A mere 50% price jump in a day over a run of the mill incident...

At least the lights will stay on, for now....

Where art thou, Eurofudge?

Has it really comet his this? Ever since 2009 the favourite nibble across Euroland has been delicious eurofudge. Everywhere from Italy, to Spain, Ireland, Greece and Portugal there has been plenty of fudge; enough to sate even global appetites and keep the euro bandwagon well fed and on the road.

But now tiny Cyprus could see and end to fudge distribution and dark day for the euro-fudge industry - another tale of woe for European industry.

Of course, Euro-Fudge is resilient and production runs over the weekend have been known to many times unblock seemingly difficult conditions.

This time though, perhaps it is different? Cypriot politicians face the prospect of voting to nick all the money from their pension funds AND from some rather unsavoury Russian types - normally the sort of people who you would try very hard never to meet, let alone cross.

Or they can go for just stealing money out of everyones bank account at the Eurogroup's behest.

Or they can abandon the euro, print new Cypriot pounds and see what happens as their banks collapse.

If you had to vote on any of the above what would it be? All maybe of direct personal consequence to your financial and physical well being too. maybe they will panic and do the wrong thing.

Maybe Euro-fudge will come to the rescue, I think a Country leaving the Euro would be a bad precedent for the europhiles to accept as it would surely lead to more over time...

But now tiny Cyprus could see and end to fudge distribution and dark day for the euro-fudge industry - another tale of woe for European industry.

Of course, Euro-Fudge is resilient and production runs over the weekend have been known to many times unblock seemingly difficult conditions.

This time though, perhaps it is different? Cypriot politicians face the prospect of voting to nick all the money from their pension funds AND from some rather unsavoury Russian types - normally the sort of people who you would try very hard never to meet, let alone cross.

Or they can go for just stealing money out of everyones bank account at the Eurogroup's behest.

Or they can abandon the euro, print new Cypriot pounds and see what happens as their banks collapse.

If you had to vote on any of the above what would it be? All maybe of direct personal consequence to your financial and physical well being too. maybe they will panic and do the wrong thing.

Maybe Euro-fudge will come to the rescue, I think a Country leaving the Euro would be a bad precedent for the europhiles to accept as it would surely lead to more over time...

Thursday, 21 March 2013

Question Time : Downgraded Chancellor edition.

Joining David Dimbleby on the panel of BBC Question Time in York:

Michael Gove MP, Education Secretary; Emily Thornberry MP, Shadow

Attorney General for Labour; Natalie Bennett, Leader of the Green Party;

Mark Littlewood, Director General of the Institute of Economic Affairs;

and bestselling author Anthony Horowitz.

A mix of meanies and greenies,

rough scoring guide and player's guide

Bang on,as the script, right answer - 3 points

Close enough for government work, right answer -2 points

in the right ballpark - 1point

witty comments - 1 point

sole entrant to guess a question asked - 3 points

guessing a 'catchphrase/bandwagon/party message' spoken , accurately - 1point

Only choosing 4 questions out of a possible 5, and only 4 are asked - 1 point.

Posting first - 1 point

Predicting correct colour of Dimbleby's tie - 5 point {must guess before 9pm.}

Bang on,as the script, right answer - 3 points

Close enough for government work, right answer -2 points

in the right ballpark - 1point

witty comments - 1 point

sole entrant to guess a question asked - 3 points

guessing a 'catchphrase/bandwagon/party message' spoken , accurately - 1point

Only choosing 4 questions out of a possible 5, and only 4 are asked - 1 point.

Posting first - 1 point

Predicting correct colour of Dimbleby's tie - 5 point {must guess before 9pm.}

This tournament is sponsored by Timbo 614

Week 10

DtP 76

GSD 67

BQ(MP) 66

Botogol 65

Hopper 64

Timbo614 64

ND 64

Measured 64

kynon 56

Malcolm Tucker 54

Malcolm Tucker 54

Budgie 53

Blue Eyes 35

Idle 28

Taff -27

CU 17

James Higham - 7

James Higham - 7

New build scheme

Is this a good idea?

Loan to value subsidy mortgage?

Considering where we are and how we got here, it looks like NO!

The government will lend 20% of the purchase price, on an interest-free basis for five years, to buyers able to find a 5% deposit.

Isn't this where we came in? With all the debt, and the over lending over valuations and the inability to repay and the big bubble and the 4.5 x the made up salary, 125% mortgages ?

But..in the situation we are in, isn't this just a practical idea?

Doesn't this allow those close to being able to buy, but unable to pay the current above market rentals and save for a deposit at the same time, a good chance for home ownership?

The difference in the rental/mortgage payments will add significantly to a first time buyers disposable income. As will the end of the requirement to save every spare £1 for a deposit.

And those first time buyers are the ultimate spenders. Think of all the soft furnishings, white goods, household, kitchen utensils, seating, cooking, lighting, bathroom, ladders,entertainment and music, tv, tools, paint and decorating equipment and gardening stuff that suddenly needs to accompany the first permanent home.

Isn't this policy just the fastest possible way to get the system moving again. If Interest rates are going to be low for 5 - 10 years {citation and crystal ball needed} then does it matter that people are borrowing to afford a high priced house, rather than the hope that house prices will fall the 10-20% that would be needed to self correct the market?

We are where we are. There aren't enough houses and there isn't enough money. Making people pay save more than they need to, pay more for rental than they need to, and not build up any equity as they do so, is stopping our economy from moving. Osborne has accepted that and tried to do something about it. He's moving into the sub-prime market, knowing there's a risk, but expecting the short term boost to be worth the long term problems. And the very difficult longer term slowing of the economy without causing a crash will be a problem for someone else and he/we need growth now.

This is a really good scheme ?

Isn't it?

Loan to value subsidy mortgage?

Considering where we are and how we got here, it looks like NO!

The government will lend 20% of the purchase price, on an interest-free basis for five years, to buyers able to find a 5% deposit.

Isn't this where we came in? With all the debt, and the over lending over valuations and the inability to repay and the big bubble and the 4.5 x the made up salary, 125% mortgages ?

But..in the situation we are in, isn't this just a practical idea?

Doesn't this allow those close to being able to buy, but unable to pay the current above market rentals and save for a deposit at the same time, a good chance for home ownership?

The difference in the rental/mortgage payments will add significantly to a first time buyers disposable income. As will the end of the requirement to save every spare £1 for a deposit.

And those first time buyers are the ultimate spenders. Think of all the soft furnishings, white goods, household, kitchen utensils, seating, cooking, lighting, bathroom, ladders,entertainment and music, tv, tools, paint and decorating equipment and gardening stuff that suddenly needs to accompany the first permanent home.

Isn't this policy just the fastest possible way to get the system moving again. If Interest rates are going to be low for 5 - 10 years {citation and crystal ball needed} then does it matter that people are borrowing to afford a high priced house, rather than the hope that house prices will fall the 10-20% that would be needed to self correct the market?

We are where we are. There aren't enough houses and there isn't enough money. Making people pay save more than they need to, pay more for rental than they need to, and not build up any equity as they do so, is stopping our economy from moving. Osborne has accepted that and tried to do something about it. He's moving into the sub-prime market, knowing there's a risk, but expecting the short term boost to be worth the long term problems. And the very difficult longer term slowing of the economy without causing a crash will be a problem for someone else and he/we need growth now.

This is a really good scheme ?

Isn't it?

Wednesday, 20 March 2013

(a) They'll Do Anything; (b) Bullion as Hedge

A couple of really interesting articles that illustrate powerfully some recent C@W themes.

(a) They'll Do Anything. This superb piece from Hinde Capital on the Cyprus debacle, strongly reinforces the point that politicians will do anything to keep the bicycle upright in the short term - and not just the usual slow-burning devaluations and inflationary tricks. In the comments here we'd discussed more precipitate measures such as seizing private gold and forcibly converting savings into Consols. Hinde stresses what a fundamental outrage is being planned for Cyprus in the expropriation of deposits, and lists a few more ghastly examples from recent years:

(b) Bullion as Hedge: the other day I suggested that bullion might work as a currency hedge (not an original thought, I know) and this is another theme developed in the Hinde piece - with graphs to make the point that gold has worked well for Sterling and Yen investors. Strongly recommend you take a look: if we are all being forced to take that heightened sense of responsibility for ourselves, the more perspectives the better.

ND

|

| Bargaining session |

... the reality that the state is not in fact here for your protection as it once was and that we all need to take on self-reliance and a heightened sense of responsibility for ourselves. Some notable rule changes of late are subtle but growing in number:

- The ECB, holders of Athens-law and foreign law Greek debt all received different treatment

- The Dutch didn’t restructure SNS Reaal paper, they confiscated it

- The Irish banned lawsuits against the ultimate wind-down of Anglo Irish

- Portuguese private pensions were confiscated

The list is long but you get the idea. Rule-changes are getting ‘regressively’ more creative and sinister ... as if the football referee has gone from being a quasi-neutral arbiter, to pulling off his black shirt to reveal a Manchester United one underneath and awarding himself a series of penalties.Then, in comments under yesterday's post, Anon directed us to this story - our old friends Gazprom offering to bail out Cyprus ! Such a neat solution, eh ? I have long suggested that, when the chips are finally down, we'll find ourselves delivered to the Chinese, and it looks as though we might be in for a small-scale rehearsal of this approach. [Though in this instance, presumably the Cypriots will simply use it to get more out of the Troika - one Russian-sounding rescue package vs another ...]

(b) Bullion as Hedge: the other day I suggested that bullion might work as a currency hedge (not an original thought, I know) and this is another theme developed in the Hinde piece - with graphs to make the point that gold has worked well for Sterling and Yen investors. Strongly recommend you take a look: if we are all being forced to take that heightened sense of responsibility for ourselves, the more perspectives the better.

ND

Tuesday, 19 March 2013

Cypriots decide against a haircut

Cyprus bailout

MPs on the island have rejected the harsh bailout.

36 against - 19 don't knows and none in favour.

This seems unlikely to have happened if the government didn't have a plan B.

Or possibly a plan P?

British bases on Cyprus are Sovereign base areas. They are treated as part of the UK and British rules and laws apply.And then there's the small problem of the Turkish neighbours on the other side.

The Budget I don't want to see but probably will

All the articles I read are about various ideas that George Osborne could use in his budget tomorrow. I have read some really nutty ones, Richard Murphy seems to think all our woes can be solved simply by taxing everyone and anything that moves - its an interesting concept!

All the articles I read are about various ideas that George Osborne could use in his budget tomorrow. I have read some really nutty ones, Richard Murphy seems to think all our woes can be solved simply by taxing everyone and anything that moves - its an interesting concept!

So here is my reverse prescription - things I am dreading come to pass, but probably will....

1. No more cuts - yes indeed, we need more cuts, more cuts to quango's more cuts to crazy subsidies of green energy, more cuts to overseas aid, more cuts to Vince Cable's empire, more cuts to Trident, more cuts to rail subsidies, more cuts to NHS bureaucracy and its budget, more cuts to public sector pensions.

2. Personal Tax Rises - Tax take in the UK stands at one of the very highest levels in the Western world, very nearly 50% of GDP. It is not sustainable to demand more from anyone, rich or poor. Tax rises alone are responsible for dragging GDP down as they reduce personal income and reduce consumer spending.

3. Tinkering Gimmicks - Tolley's tax guide is 11,000 pages, hwo is this possible. yet every budget since Brown became Chancellor has resulted in ridiculous gimmicks. Of course, when there 11,000 pages of tax law, there are a lot of loopholes and contradictions - so these need fixing by the clever bods in HM Treasury and so they fiddle. The fiddling makes things worse and worse and the Press pick up on it - disastrously last year for George Osborne. So this year I want to see streamlining, but that is not the way of a Government bureaucracy.

4. Massive Nuclear Subsidy - We have all been waiting, especially my esteemed colleague Mr Drew, to see how far over the Government will bend to accommodate new Nuclear power stations with massive subsidies. What better time to announce it than in the budget, a nice large lump of money to support a French state owned enterprise perhaps......

5. North Sea tax raid to fund Retail petrol 'tax cut' - This is one of the worst decision made by the Chancellor in 2010. Destabilising the North Sea cash cow has cost the country nearly 3% of GDP and tens of billions in tax revenues - all for 3p 'off' retail petrol prices. Sadly, i can see the ruse happening again as the Government seeks to hurt businesses over voters.

What other potential horrors have I missed?

Monday, 18 March 2013

Cyprus; the penny drops

Just in case the citizens of Europe were in any doubt about who is in charge and what their fate maybe, the EU decision to try and impose a 9.9% levy on Cypriots - via closing down their banking system, will perhaps wake a few more people up to the ugly reality.

In a fatally flawed move the EU is trying to get Cyrpus to pay for 50% of its own bailout directly from its tax payers. No doubt this will be very popular in Germany and the Nordic states, who want to see less of their own money wasted in pointless bailouts and more 'input' from the locals.

But this weekend's decision shows up some many of the difficult and complex realities of a single Euro system. Firstly, the foreigners who have invested in Cyprus are hit hard, even the British armed forces are. Plus if you have not voted for the current Government or the past ones you are having your money expropriated without much in the way of personal legitimacy.

Perhaps the EU thinks people should leave badly run states to avoid the consequences? This could have interesting consequences for Portugal and Spain in the near future. The few people who have survived with money are now fully incentivised to take it off shore or indeed leave the Country themselves.

As much as the EU says this is a special one-off measure, it sets a precedent - something in the UK we take very seriously as it is the basis of our legal system.

Even more deeply, it may tip the Euro-scepticism debate in further away from being pro-Euro. If the Northern states don't want to underwrite transfers, then they should not allow the Southern states in. If the Southern states want to run inflationary basket case economies, then they too should not join a single monetary system.

But overall, way to go EU, just as you had calmed the crisis, back it comes for the sake of a few couple of billion euro's! I thought they were meant to be all-powerfully intellectual supreme beings.....

In a fatally flawed move the EU is trying to get Cyrpus to pay for 50% of its own bailout directly from its tax payers. No doubt this will be very popular in Germany and the Nordic states, who want to see less of their own money wasted in pointless bailouts and more 'input' from the locals.

But this weekend's decision shows up some many of the difficult and complex realities of a single Euro system. Firstly, the foreigners who have invested in Cyprus are hit hard, even the British armed forces are. Plus if you have not voted for the current Government or the past ones you are having your money expropriated without much in the way of personal legitimacy.

Perhaps the EU thinks people should leave badly run states to avoid the consequences? This could have interesting consequences for Portugal and Spain in the near future. The few people who have survived with money are now fully incentivised to take it off shore or indeed leave the Country themselves.

As much as the EU says this is a special one-off measure, it sets a precedent - something in the UK we take very seriously as it is the basis of our legal system.

Even more deeply, it may tip the Euro-scepticism debate in further away from being pro-Euro. If the Northern states don't want to underwrite transfers, then they should not allow the Southern states in. If the Southern states want to run inflationary basket case economies, then they too should not join a single monetary system.

But overall, way to go EU, just as you had calmed the crisis, back it comes for the sake of a few couple of billion euro's! I thought they were meant to be all-powerfully intellectual supreme beings.....

Friday, 15 March 2013

Cameron's Coup: The Serious Politics Begins

Yesterday was, I think, a very significant day in UK politics. Cameron walked out of the tripartite leaders' talks on Leveson, made straight for a Press Conference, and drew a very clear line in the sand. He left Clegg and Miliband in front of the cameras visibly gasping for air as they surfaced from the cold waters of the Thames into which they had just been dumped. They also gave the distinct appearance of being already in coalition which, when he thinks about it later, will not please Clegg one little bit, and he'll want to guard against it becoming a pattern.

This is excellent stuff.

Furthermore, it is self-evidently the work of a genuine strategist (Crosby), making earlier efforts by Osborne look the amateurish stunts they were. It is earnestly to be hoped that the precise parliamentary tactics for the complex proceedings next week have been equally well thought through.

I see it as being all of a piece with Cameron's 'Europe speech'. He sticks his neck out (and draws a dividing line); the commentariat goes, oooh, you can't say things like that ... and then they notice that overall, reactions are comfortably favourable.

If (as I've hoped here before) this represents the start of the 'no more Mr Nice Guy' phase, then (a) he's reached that point a good deal earlier in his regime than did Blair; and (b) Thatcher was very much deeper in trouble at the 2-years-9-months point than is Cameron now, albeit that he too has some massive battles ahead.

My new-found optimism is undimmed.

ND

This is excellent stuff.

Furthermore, it is self-evidently the work of a genuine strategist (Crosby), making earlier efforts by Osborne look the amateurish stunts they were. It is earnestly to be hoped that the precise parliamentary tactics for the complex proceedings next week have been equally well thought through.

I see it as being all of a piece with Cameron's 'Europe speech'. He sticks his neck out (and draws a dividing line); the commentariat goes, oooh, you can't say things like that ... and then they notice that overall, reactions are comfortably favourable.

If (as I've hoped here before) this represents the start of the 'no more Mr Nice Guy' phase, then (a) he's reached that point a good deal earlier in his regime than did Blair; and (b) Thatcher was very much deeper in trouble at the 2-years-9-months point than is Cameron now, albeit that he too has some massive battles ahead.

My new-found optimism is undimmed.

ND

Thursday, 14 March 2013

Question Time :Pope Frankie edition

*Someone post the actual dimbytie colour please.

David Dimbleby presents from Cardiff. On the panel are Francis Maude MP, Minister for the Cabinet Office; Chuka Umunna MP, Shadow Business Secretary for Labour; Kirsty Williams AM, Leader of Welsh Liberal Democrats; Leanne Wood AM, Leader of Plaid Cymru; and shopkeeper and investor Theo Paphitis.

rough scoring guide

Bang on,as the script, right answer - 3 points

Close enough for government work, right answer -2 points

in the right ballpark - 1point

witty comments - 1 point

sole entrant to guess a question asked - 3 points

guessing a 'catchphrase/bandwagon/party message' spoken , accurately - 1point

Only choosing 4 questions out of a possible 5, and only 4 are asked - 1 point.

Posting first - 1 point

Predicting correct colour of Dimbleby's tie - 5 point {must guess before 9pm.}

UPDATE

This tournament is sponsored by Timbo 614

Week 9

DtP 70

Botogol 65

GSD 60

BQ(MP) 61

Hopper 58

Timbo614 58

kynon 56

ND 55

Measured 54

Malcolm Tucker 45

Budgie 45

Blue Eyes 35

Idle 22

Taff -17

CU 8

James Higham - 7

James Higham - 7

Shale will take time...maybe too much

This is less encouraging news today. Caudrilla, already a hated company thanks to much Green campaigning, has taken a sensible corporate decision to go for a full environmental impact assessment. After its PR disaster of 2011, this is no doubt demanded by the board and shareholders.

The downside though is that Caudrilla is the only company even close to drilling for shale gas and now this will be 2014 at the earliest, maybe a year later given how long the timescales can be.

No doubt the Greenies will be happy that they can now insist on new, subsidised wind farms to help Britian through its energy crunch.

There is a Bill going through parliament that should make the shale gas exploration a little easier, but in reality we are looking at 5 years minimum before it starts to trickle through to any meaningful production. At the same time the North Sea fields keep suffering from major outages, so much so that they have had a significant effect on GDP measurements these last two years.

So all in all, not a great story, Nuclear powerstations are a decade away, old coal and nuclear stations are being phased out and the North Sea and Shale are not going to produce enough energy.

Meanwhile in the USA, they have started to export gas such is the growth in capacity.

I wonder if we really will have 'dark days' ahead.

The downside though is that Caudrilla is the only company even close to drilling for shale gas and now this will be 2014 at the earliest, maybe a year later given how long the timescales can be.

No doubt the Greenies will be happy that they can now insist on new, subsidised wind farms to help Britian through its energy crunch.

There is a Bill going through parliament that should make the shale gas exploration a little easier, but in reality we are looking at 5 years minimum before it starts to trickle through to any meaningful production. At the same time the North Sea fields keep suffering from major outages, so much so that they have had a significant effect on GDP measurements these last two years.

So all in all, not a great story, Nuclear powerstations are a decade away, old coal and nuclear stations are being phased out and the North Sea and Shale are not going to produce enough energy.

Meanwhile in the USA, they have started to export gas such is the growth in capacity.

I wonder if we really will have 'dark days' ahead.

Wednesday, 13 March 2013

I'm Not Making This Up (and it isn't even April 1st)

So - HMG is keen to be abreast of developments in shale gas etc etc, and has quite properly put someone in charge.

And what's his department to be called ? We turn to the experts at Utility Week, who have the press release ...

Wait for it ...

They tell us it's the Office of Unconventional Gas & Oil - OffUGO!

Actually ... some spoilsport at DECC obviously realised and so, disappointingly, it's OffUOG. Geddouddahere, you clowns.

ND

And what's his department to be called ? We turn to the experts at Utility Week, who have the press release ...

Wait for it ...

They tell us it's the Office of Unconventional Gas & Oil - OffUGO!

Actually ... some spoilsport at DECC obviously realised and so, disappointingly, it's OffUOG. Geddouddahere, you clowns.

ND

Tuesday, 12 March 2013

The Limits of Localism - and how to define them

The good Raedwald and I have a long-running disagreement over 'localism'. To caricature our positions for the sake of brevity: he is a strong supporter of decisions being made at at the ultra-local level, with control over resources being correspondingly devolved. I am deeply skeptical, having (in a long career in local government) seen things happen that range from inspirational, through undesirable, all the way to dreadful when control, de facto or de jure, is exercised at this level. At the worst extreme there is outright warlord-ism; and don't let anyone tell you this doesn't happen, or that it is easy to put right.

I wonder where on the spectrum Raedwald assesses this rather fraught situation ?

Summarising: in a particular London district, a specific community wants to take charge of planning decisions - using the government's 'localism' policy for devolving powers - with (as we read) the intent of allowing a considerable quantity of house-extensions to be built, in order to facilitate the doubling of their numbers they anticipate in the next several years. One of their leading lights,

But perhaps others see it as just part of life's rich tapestry. Where are the lines to be drawn ?

How would readers legislate ?

ND

I wonder where on the spectrum Raedwald assesses this rather fraught situation ?

Summarising: in a particular London district, a specific community wants to take charge of planning decisions - using the government's 'localism' policy for devolving powers - with (as we read) the intent of allowing a considerable quantity of house-extensions to be built, in order to facilitate the doubling of their numbers they anticipate in the next several years. One of their leading lights,

"a father of nine and secretary of the bid for a planning forum who was jailed for ballot fraud in 2001, estimated the average family size in his community was eight children and said he sees "constant conflict" over extensions. He believes the opposition to extensions is part of a more sinister threat aimed at encouraging the fast-growing community to find other places to live."All very interesting and, to me, a very good illustration of how things can get well out of kilter when you push decisions down to 'community' level. If this attempt at taking formal planning control succeeds, I am sure we can all extrapolate to other potential developments that might follow. (If you were to give planning decisions over to my local residents' association, for example, you'd get a rather different outcome as regards house extensions.)

But perhaps others see it as just part of life's rich tapestry. Where are the lines to be drawn ?

How would readers legislate ?

ND

BIll Quango - Man of the year

So the result of our quick poll is in, BQ wins as best writer here, with a super-majority of the votes, Nick drew trailed in with 4 and CU only one (and I voted for myself!).

BQ's great victory has won him the price of having to write 5 posts a week for the next 6 months?

Trust that's OK with you BQ?

BQ's great victory has won him the price of having to write 5 posts a week for the next 6 months?

Trust that's OK with you BQ?

Monday, 11 March 2013

The Virgin Killler - APD

I am a great admirer of Richard Branson, he has always done things differently and had many, many successes with this approach. For all his detractors the story of someone who starts with nothing and works hard and cleverly to build that into a massive global empire is inspiring.

Some of his tactics, using PR to make unbelievable claims about his opponents and potential of his own business, are close to the mark, but fun.

Recently though some of his large businesses are starting to either struggle or lose their uniqueness. Virgin Media has become a brand only, with just a sliver of Branson capital in the business and certainly no Virgin management. Virgin trains lost their bid - well may have done, depends on the outcome of the UK Government dispute. There are though still many successes across his sprawling empire, particularly in the mobile phone sector.

Also, Virgin Atlantic, one of the original success stories has now had two terrible years. An annual loss of £135 million needs to be put in context of a business where in the good years it managed a once a record profits of £46.5 million, but in the past decade a good year was a £10m-20m profit. Since 1984 the airline has done well though to chart a path through many storms.

These record losses are going to be hard to sustain for the medium term, despite the new 49% ownership by Delta airlines, it is a tough job for the new CEO to try to turn around.

After all, Virgin is a holiday flight company to long-haul destination in a time when Air Passenger tax has put this out of the reach of many people who used to be able to afford it. With a UK hub this is an unfortunate turn of events for Virgin as few other countries have gone in for such punitive taxes as this.

With a small fleet and small set of destinations, the main Atlantic hub routes are also under pressure as BA and AA get closer and closer and BA also streamlines Iberia to make it less competitive across the Atlantic.

As ever, something will be done to preserve the brand and the face of the airline if not the infrastructure, but it is in a very tough spot - and another great example of how Government over-taxing and tax interference can have such a terrible effect on even large and stable businesses.

Some of his tactics, using PR to make unbelievable claims about his opponents and potential of his own business, are close to the mark, but fun.

Recently though some of his large businesses are starting to either struggle or lose their uniqueness. Virgin Media has become a brand only, with just a sliver of Branson capital in the business and certainly no Virgin management. Virgin trains lost their bid - well may have done, depends on the outcome of the UK Government dispute. There are though still many successes across his sprawling empire, particularly in the mobile phone sector.

Also, Virgin Atlantic, one of the original success stories has now had two terrible years. An annual loss of £135 million needs to be put in context of a business where in the good years it managed a once a record profits of £46.5 million, but in the past decade a good year was a £10m-20m profit. Since 1984 the airline has done well though to chart a path through many storms.

These record losses are going to be hard to sustain for the medium term, despite the new 49% ownership by Delta airlines, it is a tough job for the new CEO to try to turn around.

After all, Virgin is a holiday flight company to long-haul destination in a time when Air Passenger tax has put this out of the reach of many people who used to be able to afford it. With a UK hub this is an unfortunate turn of events for Virgin as few other countries have gone in for such punitive taxes as this.

With a small fleet and small set of destinations, the main Atlantic hub routes are also under pressure as BA and AA get closer and closer and BA also streamlines Iberia to make it less competitive across the Atlantic.

As ever, something will be done to preserve the brand and the face of the airline if not the infrastructure, but it is in a very tough spot - and another great example of how Government over-taxing and tax interference can have such a terrible effect on even large and stable businesses.

Saturday, 9 March 2013

Feeding Frenzy at the Subsidy Trough

The EDF nuclear subsidy game rumbles on with another batch of orchestrated leaks. The stakes could hardly be higher.

And haven't the lobbyists and briefers been busy ! How convenient that the Telegraph can always be persuaded to publish their radioactive releases. From the EDF camp, we learn that unless HMG comes up with the readies (well, forces electricity bill-payers to come up with the readies), not only will there be no EDF nukes for the UK, the Japs will pull out too - along with every potential developer of UK infrastructure ! “'No big infrastructure investor will ever trust the Government again' if that happens, is the bleak verdict of one industry insider" - quoth the ever-helpful Telegraph. The whippers-in have indeed been out in force. Every b*****d wants a monster subsidy: who'd have guessed ?

So stick that in your pipe, David Cameron. And not just lots of readies are required, mind - it must be a 40-year deal, and government under-writing for the capital costs, and indemnity for EDF on cost over-runs. And to think all they wanted just a couple of short years ago was a carbon-price floor (already long-since delivered and banked, of course).

The government side wants it to be known that, err, they are prepared to walk away if they can't get a 'good deal' - such tough negotiators, eh ? - and will certainly keep the nameplate price lower than £100/MWh. But we all know this is fairly arbitrary when 40-year indexed-linked games are being played, and so much is on offer by way of guarantees.

"The truth is likely to become much clearer in the next few weeks", opines the Telegraph. How very trusting.

Whatever we get to know about the dirty deal, it will go straight into the long grass of an EC State Aid review, and there will be no binding commitment from EDF for, oooh, 18 months minimum. So - no start-up until 2022 earliest ? Which means in turn that all the practical problems of keeping the lights on post the LCPD shut-downs will have to be solved without new nukes. Which means ...

It was not always thus. A mere decade ago there was a parallel issue in UK natural gas: North Sea gas production was forecast to decline to the extent that new import sources would be needed from around 2005. The UK government had played a clever strategic hand several years earlier, but otherwise stood back and let the market work. Sure enough, the companies that make up the UK gas industry invested in sufficient new import pipelines and LNG import facilities to replace the declining North Sea production entirely, if needed (which it won't be for several years yet). Invested. Their own money, with no subsidies !

They did so because (a) there was a clear business case, and (b) there was no hint that subsidies might be forthcoming if they just held back a bit. Happy days.

ND

And haven't the lobbyists and briefers been busy ! How convenient that the Telegraph can always be persuaded to publish their radioactive releases. From the EDF camp, we learn that unless HMG comes up with the readies (well, forces electricity bill-payers to come up with the readies), not only will there be no EDF nukes for the UK, the Japs will pull out too - along with every potential developer of UK infrastructure ! “'No big infrastructure investor will ever trust the Government again' if that happens, is the bleak verdict of one industry insider" - quoth the ever-helpful Telegraph. The whippers-in have indeed been out in force. Every b*****d wants a monster subsidy: who'd have guessed ?

So stick that in your pipe, David Cameron. And not just lots of readies are required, mind - it must be a 40-year deal, and government under-writing for the capital costs, and indemnity for EDF on cost over-runs. And to think all they wanted just a couple of short years ago was a carbon-price floor (already long-since delivered and banked, of course).

The government side wants it to be known that, err, they are prepared to walk away if they can't get a 'good deal' - such tough negotiators, eh ? - and will certainly keep the nameplate price lower than £100/MWh. But we all know this is fairly arbitrary when 40-year indexed-linked games are being played, and so much is on offer by way of guarantees.

"The truth is likely to become much clearer in the next few weeks", opines the Telegraph. How very trusting.

Whatever we get to know about the dirty deal, it will go straight into the long grass of an EC State Aid review, and there will be no binding commitment from EDF for, oooh, 18 months minimum. So - no start-up until 2022 earliest ? Which means in turn that all the practical problems of keeping the lights on post the LCPD shut-downs will have to be solved without new nukes. Which means ...

It was not always thus. A mere decade ago there was a parallel issue in UK natural gas: North Sea gas production was forecast to decline to the extent that new import sources would be needed from around 2005. The UK government had played a clever strategic hand several years earlier, but otherwise stood back and let the market work. Sure enough, the companies that make up the UK gas industry invested in sufficient new import pipelines and LNG import facilities to replace the declining North Sea production entirely, if needed (which it won't be for several years yet). Invested. Their own money, with no subsidies !

They did so because (a) there was a clear business case, and (b) there was no hint that subsidies might be forthcoming if they just held back a bit. Happy days.

ND

Friday, 8 March 2013

Another sick bonus culture exposed?

It's amazing how fickle the newspapers and media can be. John Lewis has reported a good set of results this year and as a result is able to pay a 17% bonus to all staff.

And this is celebrated by the Guardian.

Of course, if you read the guardian perhaps you are more likely to be a client of one of the John Lewis brands and this may have an impact on their reporting.

In fact it must do because in the normal order of the leftie-world view, bonus's are of course evil and always unearned. The money should really have been used to reduce prices and stop the sheer rip off to the consumer that is a can of baked beans from Waitrose, a can that is overly expensive to a single mum struggling on benefits and a brand which also leads to much envy and promotes the hideous consumerism that is rampant within our society to the detriment of all.

At least now the growth in the John Lewis business is fuelled massively by its growing online presence we can be assured that there will be less need for those expensive high street shops with their business rates and employees.

Even better the final salary pension scheme is to be reviewed too as that is becoming too costly. So staff have a bright future to look forward too.

Of course regular readers will hopefully be amused to see me writing the above, but it just goes to demonstrate how partisan the media is today.

Of course, partnerships are a good business format, with some good benefits. Indeed, years ago now the City investment banks, now so hated, were all partnerships - I wonder if this becomes true again one day whether the Guardian will be celebrating the success of a potential Good Bank Capital LLP?

And this is celebrated by the Guardian.

Of course, if you read the guardian perhaps you are more likely to be a client of one of the John Lewis brands and this may have an impact on their reporting.

In fact it must do because in the normal order of the leftie-world view, bonus's are of course evil and always unearned. The money should really have been used to reduce prices and stop the sheer rip off to the consumer that is a can of baked beans from Waitrose, a can that is overly expensive to a single mum struggling on benefits and a brand which also leads to much envy and promotes the hideous consumerism that is rampant within our society to the detriment of all.

At least now the growth in the John Lewis business is fuelled massively by its growing online presence we can be assured that there will be less need for those expensive high street shops with their business rates and employees.

Even better the final salary pension scheme is to be reviewed too as that is becoming too costly. So staff have a bright future to look forward too.

Of course regular readers will hopefully be amused to see me writing the above, but it just goes to demonstrate how partisan the media is today.

Of course, partnerships are a good business format, with some good benefits. Indeed, years ago now the City investment banks, now so hated, were all partnerships - I wonder if this becomes true again one day whether the Guardian will be celebrating the success of a potential Good Bank Capital LLP?

Thursday, 7 March 2013

Question Time - 'Sorry about all that immigration' edition.

David Dimble-tie chairs Question Time from Dover. On the panel are

Conservative cabinet minister, Ken 'minister without a job' Clarke MP; Labour's shadow education

secretary, Stephen 'he'll never' Twigg MP; Diane 'I'm not Farage. I'm the other one' James, UKIP candidate in the

Eastleigh by-election; Bob '3 strikes' Crow, general secretary of the RMT union; and

Daily Mail columnist 'Mad' Melanie Phillips.

Melanie and Diane on the panel? Take Two UKIPers into the studio? Dimby musty have missed an editorial. Looks like a right punch up panel.

*Remember - in the Question Time universe, Eastleigh was only yesterday.

rough scoring guide

Bang on,as the script, right answer - 3 points

Close enough for government work, right answer -2 points

in the right ballpark - 1point

witty comments - 1 point

sole entrant to guess a question asked - 3 points

guessing a 'catchphrase/bandwagon/party message' spoken , accurately - 1point

Only choosing 4 questions out of a possible 5, and only 4 are asked - 1 point.

Posting first - 1 point

Predicting correct colour of Dimbleby's tie - 5 point {must guess before 9pm.}

DtP 61

Botogol 61

GSD 56

BQ(MP) 56

kynon 55

Hopper 55

Timbo614 54

Measured 51

Malcolm Tucker 45

Budgie 39

Blue Eyes 29

Idle 22

Taff -14

Melanie and Diane on the panel? Take Two UKIPers into the studio? Dimby musty have missed an editorial. Looks like a right punch up panel.

*Remember - in the Question Time universe, Eastleigh was only yesterday.

rough scoring guide

Bang on,as the script, right answer - 3 points

Close enough for government work, right answer -2 points

in the right ballpark - 1point

witty comments - 1 point

sole entrant to guess a question asked - 3 points

guessing a 'catchphrase/bandwagon/party message' spoken , accurately - 1point

Only choosing 4 questions out of a possible 5, and only 4 are asked - 1 point.

Posting first - 1 point

Predicting correct colour of Dimbleby's tie - 5 point {must guess before 9pm.}

This tournament is sponsored by Timbo 614

Week 8

DtP 61

Botogol 61

GSD 56

BQ(MP) 56

kynon 55

Hopper 55

Timbo614 54

Measured 51

ND 51

Malcolm Tucker 45

Budgie 39

Blue Eyes 29

Idle 22

Taff -14

CU 8

James Higham - 7

James Higham - 7

Wednesday, 6 March 2013

How much leisure do we need ?

I've been to a dozen local planning meetings recently. Pity the poor, overworked, MP. Sitting in a draughty hall of an evening, listening to residents all saying "I'm not against development...I'm not a NIMBY!..But we don't need anymore houses..and think of the traffic going past my house..!" etc.

Something strikes me that should be changed about our planning regulations.

Firstly, the 106 money. This is money that local councils insists that any housing development over a certain size needs to give to the council, to secure planning permission. Some of which is then passed onto the local area where the development takes place. These sums can be very large. A 25 house development might have contributed up to £100,000 to the local parish.

The problem is, by the rules of my district and county council, this money can only be used for leisure.

Leisure means leisure. Playing fields. BMX Tracks. Swimming pools. Toddler running laness and such.

There is no provision to use the cash for roads, toilets, transport, schools, parking or anything of a non sporting activity.

This issue has annoyed me for years, and now the big building surge is coming. {Due to changes made by this much maligned 'government of inactivity.' Its takes years to get anything moving from minister's announcement to the first change in the legal documents.}

In one village of 1,000 homes two developments totaling 100 houses have been built. This village has had a brand new recreation ground. Brand new multi-use all weather soccer pitch. Brand new changing rooms for its below non league, under 11's, soccer team. A cycling track. Tennis courts. Bowling green. Cricket pitch. Electronic scoreboard. And even more.

There are currently development plans for 2 more builds, making another 100 houses and another £150k of ...Leisure money!

At the same meeting the parish council voted to close the local toilets as the council won't fund them anymore and they cost 8-15k a year to run. And on the agenda the doctors surgery and hospital, {another brand new, just completed, £80 million NHS development, pushed through under the dying days of the Brown splurge,} is having the local bus service changed from hourly to a two-three service gap due to funding cuts.

The library, one of the smallest in the land, is on closure watch.

A scheme for a minibus to be used for the elderly to go to the new supermarkets, serve the surgery, could not be approved because of costs. {This is in the country for you metro types. Instead of one supermarket every 2000yds, its one medium sized supermarket every 10 miles.}

The two schools are both at capacity, by virtue of the previous developments. Once the new houses go up 4+5 beds mostly, the parents may need to bus the kids to another school in another town, as is already the case for ALL the secondary school kids.

Interestingly the figures used to calculate numbers for children/ household is 1.3 children per home. That seems ridiculously low for 3/4 bed homes. That might be the national average figure, taking in all those grandparents still living in their 4 bed family homes once the chicks have fled, but for new builds it must be higher ? Who is buying a New Build, 4 or 5 bed for themselves ?

It seems absurd that a village/small town about to be denuded of amenities is seriously considering an all weather, floodlit, hockey pitch, that they don't want, need and probably will never see much use and that will increase the current costs in upkeep and maintenance of the already extensive leisure facilities.

Barmy!

Ofgem: A Feeble Showing

A short while ago our esteemed correspondent Mr Wendland (comments, here) remarked on an alarmist presentation by Ofgem's outgoing Alistair Buchanan, which has certainly made some waves. You can find it here.

And what a bizarre offering it is - you'd guess it was an A-level student's course-work, all wonky screen-grabs, childlike graphics and spelling mistakes. (Is he deliberately cultivating an air of 'EnergyUnslicker' ? Does he imagine it make him seem more authentic ?) And so self-serving: OK Alistair, we'll remember you always warned us about the lights going out. Question is, why haven't you done anything about it ?

Anyhow, to business. Of his 72 amateurish slides, we can only really hit some headlines, and first up is his bizarre floating of the idea that maybe the Large Combustion Plant Directive (the EC regulation that will see the closure of gas and oil plants in short order, the proximate cause of our steeply-decline electricity capacity margin) can be flouted or thrown into reverse (slide 15). He tentatively offers 5 reasons why this might not be so easy as red-faced Telegraph readers always assume, but he's missed the main point. The LCPD, the original version of which dates to 1988 and the present version 2001, has been in effect,and therefore built into everyone's plans, for a very long time. Plants that will shortly be shut under the Directive were always earmarked to be sweated (as indeed they have been) and for years now, as well as being hammered, have not been given the kind of ongoing maintenance required to keep them going any longer. When they finally remove the ignition key, they will need to sprint to the gate as the plant collapses in dust around their ears.

Turning to Mr W's notes: Buchanan observes that 'GB has no Public Service Obligation' of the kind that automatically over-rides cross-border free-trade principles in gas and electricity. At the time I commented that GB certainly puts several public-service obligations on UK suppliers - this is particularly true as regards residential customers - but I accept that they are not the blanket export-banning guillotines that most EU countries have up their sleeves. (In this regard I have written about French and Dutch behaviour here, and the Italians are just as 'bad'. But of course some of our other C@W regulars - especially Budgie - reckon this is just fine and to be accepted.) So Buchanan's point stands, as far as it goes, and his one-liner is a fair and sobering one for all of us (slide 68): "relying on markets being flexible is hard".

Mr W also picked up on Buchanan's Gazprom quote (slide 32) of June 2009: "We [Gazprom] have always invested inproduction and transportation as much as needed to meet already signed contracts and not focusing on demand forecasts…As a result Gazprom has enough production capacity but does not suffer from surplus". However, June 2009 was exactly when Gazprom's exports were cratering due to the recession, and they were whistling loudly in the dark - we've covered the saga periodically since, and suffice to say the statement rings very hollow today. Their current public stance is that the surplus - oh yes, they have one all right - is purely a transient phenomenon. Meanwhile they are busily paying out big cash rebates to European utilities to keep them sweet....

Overall, Buchanan's piece was most commented upon in the media for its warnings over (a) the lights going out - no news there - and (b) availability of gas for importing to the UK. His 'analysis' of the LNG market is not very sophisticated: but no-one can deny the concerns over the security of Qatari production with Iran sharing its largest gas field.

But the UK will be dependent on gas imports under every feasible scenario for decades to come: the only question is over the precise quantities. Yes, perhaps new nukes, and new coal (in a different policy environment) may some day reduce the absolute gas requirement, but not any time soon. There is no point wishing it were not so: the only thing that matters is making it work.

Where Buchanan can truly be lambasted is the over the feebleness of his comments on international gas trade and the need for very purposeful development of market mechanisms (as I wrote here 5 years ago ...). He hints at question-marks over European gas-market integrity (e.g. slide 67) and lamely states: 'Need Answers' - well yes, but on whose watch has this happened ? Why hasn't Ofgem been a dynamic and proactive force in these vital matters ? Where's your report on the gas index-fixing allegations ?

We are not impressed. If, as is rumoured, the great maverick Ian Marchant is indeed being lined up to replace Buchanan, you will hear a great cheer from around these parts.

ND

And what a bizarre offering it is - you'd guess it was an A-level student's course-work, all wonky screen-grabs, childlike graphics and spelling mistakes. (Is he deliberately cultivating an air of 'EnergyUnslicker' ? Does he imagine it make him seem more authentic ?) And so self-serving: OK Alistair, we'll remember you always warned us about the lights going out. Question is, why haven't you done anything about it ?

Anyhow, to business. Of his 72 amateurish slides, we can only really hit some headlines, and first up is his bizarre floating of the idea that maybe the Large Combustion Plant Directive (the EC regulation that will see the closure of gas and oil plants in short order, the proximate cause of our steeply-decline electricity capacity margin) can be flouted or thrown into reverse (slide 15). He tentatively offers 5 reasons why this might not be so easy as red-faced Telegraph readers always assume, but he's missed the main point. The LCPD, the original version of which dates to 1988 and the present version 2001, has been in effect,and therefore built into everyone's plans, for a very long time. Plants that will shortly be shut under the Directive were always earmarked to be sweated (as indeed they have been) and for years now, as well as being hammered, have not been given the kind of ongoing maintenance required to keep them going any longer. When they finally remove the ignition key, they will need to sprint to the gate as the plant collapses in dust around their ears.

Turning to Mr W's notes: Buchanan observes that 'GB has no Public Service Obligation' of the kind that automatically over-rides cross-border free-trade principles in gas and electricity. At the time I commented that GB certainly puts several public-service obligations on UK suppliers - this is particularly true as regards residential customers - but I accept that they are not the blanket export-banning guillotines that most EU countries have up their sleeves. (In this regard I have written about French and Dutch behaviour here, and the Italians are just as 'bad'. But of course some of our other C@W regulars - especially Budgie - reckon this is just fine and to be accepted.) So Buchanan's point stands, as far as it goes, and his one-liner is a fair and sobering one for all of us (slide 68): "relying on markets being flexible is hard".