Friday, 31 December 2010

2010 Trading Review and Happy New Year

My aim was to try and match last year's 150% up, but I did not quite manage it this year coming in only 115% up on the year. Still, its not bad to have back to back triple digit gainsyear on year.

The star performers were, as predicted in January, oil stocks and commodities. Xcite energy was easily the best performer, but others such as Gulf Keystone and Dana Petroleum had very useful gains too. Most disappointing was Minerva, I have now sold out and at an average of only 90p some way off the highs of 130. how they have not let their large empty building opposite Cannon Street is beyond me.

Many shares that have performed poorly over the year, such as Ascent Resources and Xtract Energy have come good towards the close of the year as the FTSE gains pushed more money into higher risk shares.

The only real loser I backed this year was Desire Petroleum, a lack of research meant that I picked this over Rockhopper back in May and promptly lost 50% before selling out. One other bad hit was Haike Chemcials, but even that turned round at the end of the year for a break-even position for me to exit. Another poor perfomer, with 20% loss was Forte Energy, a uranium paly which I still may get back into long-term, but this was not the year of yellow cake.

Next year is going to be a fun year, I am planning a much slimmer portfolio and have already reduced down from 12 shares to just six. Gone are Heritage Oil (at 450p it is well priced), Polo Resources (similar 20% gain was my aim and so sold out). The big position are now EMED, XEL, GKP and IAE, with smaller positions in XTR and AST.

Predictions for macro-market events to come tomorrow or Sunday.

Happy New Year

Wednesday, 29 December 2010

Even more predictions

Taking a leaf from the book of spin, here is a picture to distract you from the words.

Taking a leaf from the book of spin, here is a picture to distract you from the words.Really, you only need look at it.. the content isn't very substantial...

1. .Cameron has a 45-60 Majority. England doing very well in the World Cup .. emergency public sector cuts budget followed by another tax raising budget later in the year. ..the UK ending the year with 1.5% growth.

Seem to have packed 4 predictions into 1.

- First 2 are epic fails.. growth was 1.7% GDP the year end so that's a partial/ Still -FAIL

2. Troop casualties rise during the June surge.. plans are well advanced for troop withdrawals from Afghanistan..British commitment to be severely scaled back for 2011.

Correct. Casualties were reduced {so they are about the same as previous years} because of the scaling back and withdrawl from Helmand.

3. The integrated Broadband-TV set top box, which should just about make an appearance, will make a difference to households.

- Except it didn't. That hot piece of kit is still 1 - 2 years away. Damn bad tip off!

4. Dave Miliband will succeed Macbreth. But only just and he will have to give a high profile role to Ed. A Kennedy style cabinet forms, the difference being they never actually hold office.

- Fail ..

Bobby beat Jack to the Shadow Whitehouse but Jack quit in a huff. That left Ed Balls as Attorney General.. who'd a thought

5. UK will retain its AAA But the cuts will have to be more severe than the politicians think. The current 10-15% will not be enough. NHS and education ring fencing, plus the government's forward military announcements are not going to leave much for the rest. Possibly even department merging or another attempt to make councils regional instead of county wide.

- spot on! Knew those 'vote rigging' erm i mean 'Aircraft carrier' contracts would be unbreakable. Whole thing stunk from day 1.

Now...Soooo....what do you think of the picture?

More Predictions Revisited

Modesty almost forbids, but then somehow it falters: *ahem*, 5 out of 5 for me. (Smug ? Moi ?)

Modesty almost forbids, but then somehow it falters: *ahem*, 5 out of 5 for me. (Smug ? Moi ?)1. No legally binding global environmental pact. Tick: Cancun was another disappointment for the world-governmentalists. The dangers of this 'legally binding' nonsense are not yet fully behind us, however.

2. Tension between oil-indexed gas prices (rising) and spot price of gas (soft) to go critical, with beneficial consequences. Tick: propelled by the twin forces of recession and shale gas, 2010 was the year Gazprom (against all its shrill rhetoric) was forced to make fundamental concessions in the pricing and contract structure of its long-term gas sales to European buyers. There are more changes to come, I confidently predict, and the benefits of all this will be material (measured in billions, ultimately).

3. Gold to continue its upward trend. Tick: up 23% in both GB£ and US$, and a stonking +35% in the sickly EUR. Even up 12% in the Aussie $. PS I am not a gold bug. But the trend was indeed my friend, (as was the down-tick between May and July).

4. Ed Miliband. Prompted by a comment from one of our excellent Anon's, I'd actually called this one much earlier in 2009, and am rather prouder of that than ...

5. UK to retain AAA. Tick: but it was a no-brainer and I only included it because Dale had predicted we'd lose it. To those who kindly say: but it might have been different - what if Labour had got back, what if the Boy Osborne hadn't been so decisive, etc etc, I reply: any government of whatever stripe would have done what the coalition did. Proof: just how easily the LibDems signed up for the emergency budget. Death in the last ditch before surrendering AAA. Although for completeness we should note that, err, the Chinese downrated us.

If that wasn't enough - 12 months late, along came rentamob to make good on my prediction for 2009 of fighting in the streets.

Oo-err: how do we follow that ? Better sober up for some 2011 prognostications ...

ND

Tuesday, 28 December 2010

How were the 2010 Predicitions?

1. FTSE to be up 10% , well just a small sell off would see me right here as I have it just shy of 6000 - pretty sure this will be on the money. Not only that, but the vast majority of commentators thought we would have a losing year.

2. EMED Mining to treble - Hands up a big miss on the share predictions it is about 0% up on the year. Only option is to double or quits on this one. The share, covered earlier here this month, should be set for a great 2011 (oh, dear repeating predictions hoping they come true, is very New Labour).

3. Oil Price to be stable; this is up quite a bit more than expected, at $90 thank to a Santa Rally. So can't claim this one!

4. UK Politics, only one prediction here; Nigel Farage to lose Buckingham, easy one.

5. Spending Cuts to cause social problems - This has come to pass too, strikes on the Transport network over minor job losses and student riots were definitely widespread disorder.

3/5 - typical!

Monday, 27 December 2010

Uk House Prices look grim in 2011

OK, so the UK banks are not that interested in lending to consumers at anything other than egregious rates anymore, but still, that is some market support. Instead the market continues to weaken. In 2011 there is no way the UK is not going to at least double its interest rates (saying UK interest rates to move up 0.5% is pretty conservative though, isn't it?).

The market continues to be a phoney market. People can afford their mortgages, they don;t want to sell at reduced prices, so prices stay high and demand is held down too by the lack of mortgage availability.

So in 2011 this position will being to unwind and prices are only going to head lower, possibly as much as 10%; and this will not take into account inflation of say 5% so that real prices will be down something like 15%. This is a good thing overall for our property enthusiastic economy, less so specifically, for those hoping to trade down to buy a pension. I won't be buying any resi property shares like Taylor Wimpey next year either.

Saturday, 25 December 2010

Happy Xmas Everyone

Hope you all have a great day (as for 6 of the last 8 Xmas's I have a bug!).

Friday, 24 December 2010

Better Omen

Well here's one just down the road from Schloss Drew that is alive and kicking. Taken today, these pics are of an egregious oak in a long avenue of more traditionally-minded peers that have shed their leaves for the winter as a normal oak would. But not our hero, who is still in full green leaf.

Well here's one just down the road from Schloss Drew that is alive and kicking. Taken today, these pics are of an egregious oak in a long avenue of more traditionally-minded peers that have shed their leaves for the winter as a normal oak would. But not our hero, who is still in full green leaf. Must mean something ... something like: while other blogs are falling by the wayside left, right and centre, at least some are evergreen ..?

Must mean something ... something like: while other blogs are falling by the wayside left, right and centre, at least some are evergreen ..?Something positive, anyhow. Happy Xmas to all !

ND

FTSE hits 6000 for Xmas

Thursday, 23 December 2010

THAT'S How You Clear a Runway

Option 1. From Ivan the Russian Soldier, who knows a thing or two about snow - and about blindingly obvious solutions. In this case, a jet engine on a tank chassis. Симпљс !

Option 1. From Ivan the Russian Soldier, who knows a thing or two about snow - and about blindingly obvious solutions. In this case, a jet engine on a tank chassis. Симпљс ! Option 2. From Bruce the Australian Aviator, who knows how to make a crème brulée from 100 feet above ground. In this case using the famous (and strictly forbidden) 'dump-n-burn' technique, giving a quick touch on the afterburners of an F-111 having *ahem* evacuated a fuel tank first ... no worries, mate !

Option 2. From Bruce the Australian Aviator, who knows how to make a crème brulée from 100 feet above ground. In this case using the famous (and strictly forbidden) 'dump-n-burn' technique, giving a quick touch on the afterburners of an F-111 having *ahem* evacuated a fuel tank first ... no worries, mate !Get with the programme, Heathrow !

ND

Wednesday, 22 December 2010

Bad Stuff, Good Stuff

Back from Germany for Christmas, & to confront the usual backlog of incoming rubbish in need of attention.

Back from Germany for Christmas, & to confront the usual backlog of incoming rubbish in need of attention.Top of the pile . . . Utility Week, 'your unique guide to the UK and European utility industries', which has done us the service of interviewing one Sarwjit Sambhi, head of power generation at Centrica. So - what does Mr Sambhi have to say ?

He just wants the government to get on with market reform. He wants a market framework that gives generators a fixed level of revenue. Otherwise, he warns, "nothing will be built ... we need guaranteed minimum revenue".

Ordinarily one would have just a very few crisp words for such a miserable pleader, before sending him on his way. Regrettably, however, Chris 'Crapper' Huhne and indeed the whole government seem to swallow this nonsense whole for breakfast each day. So now I must wade through the ocean of dirigiste drivel that is last week's "transformation of the power market" from DECC, a.k.a. the "reform" that Mr Sambhi has been demanding so greedily. Analysis to follow in the coming days.

But . . . there is good news - Alice Cook is back !!!

That, and the fact that CU and BQ have been posting brilliantly during my lamentable period of blog-slacking: there's hope for us all yet.

ND

Even more leftovers.

Movie references..hehe.. as they say in Family Guy.

At the time the news was running probably planted stories of Dave almost seeming to bully Brown, like a P.E. teacher with a fat kid. Dave pulled punches for a few weeks. This was before Gordon's own bullygate kicked off.

Red Ed shows he is Vince-able

Uncle Vince has of course mad a fool of himself and wasted his entire Political Capital, this is a good thing for the Coalition Government as it reduces his ability to be awkward.

However, for Labour they have looked a gift Horse in the mouth. Instead of trying to lure Mr. Cable to their side, they have viciously and personally attacked him. Where now for Vince? He won't quickly forget the bitter personal Labour attacks, so he will be stuck in bed with the Tories.

A much more obvious Labour strategy would have been to say we agree with Vince the Coalition is wrong about Murdoch and his comments about evil Tories are right. Get him onside. After all one day the Labour party might be calculating they will need him in a Coalition Government of their own.

All the more reason to find today's attacks bizarre, the Labour leadership is really lacking in political nous. Even if they succeed in getting a scalp of Vince Cable they have lost. He will be angry with them from the back benches and the Tories will appoint the more right wing David Laws in his place.

Tuesday, 21 December 2010

More leftovers

Has been back peddling ever since.

Monday, 20 December 2010

2010 leftovers

However a recent upgrade has allowed some to be uploaded. A sort of pre-beta. So rather than bin them, {which may have been a better idea}, or finish them.. {can't..Can't load into WMV - only out, and anyway ,moment is gone..} will/may post some of the more completed ones up.

Happy or sad XEL Xmas?

Now the tests are underway, but can they complete them, analyse them and publish them before the market close on Christmas Eve?

I never thought share trading would end up like following a plot from some B grade soap opera.

Saturday, 18 December 2010

Who is the Media Christmas Turkey of 2010?

2. Iain Dale - services to Radio broadcasting

3. Will Lewis - services to drinking

4. James Murdoch - having Daddy by his own company out

5. Adam Crozier - taking ITV to the same place he took the FA and the Post Office

6. Ambrose Evans Pritchard - Desperate for global meltdown, yet it proves resistant

7. Nick Robinson - Calling the wrong Milliband the victor

8. Adam Bolton - Losing it with Al Campbell and not hitting him

9. Boris Johnson - for being Mayor, lothario and Telegraph contributor

10. Rachel Johnson - supporting her brother and ruining her own magazine too boot

Any others missing?

Friday, 17 December 2010

Who is the biggest political Christmas Turkey?

I offer up some choices:

1. Gordon Brown, for the microphone gobbling incident in the election

2. Nick Clegg, for the Student fees promise

3. David Milliband, 'he's behind you'

4. Brian Lenihan, for saving Ireland even more effectively than Brown saved Britain

5. Ed Balls, beaten by his wife for leadership bid and still committed to national economic suicide policy

6. Ed Milliband, for fratricide and services to Marxism

7. Phil Woolas, "I thought hating Lib Dems was what everybody did"

8. Iain Dale, for thinking that being a local radio talk show host is better than the top political blogger

9. David Cameron, for thinking that ignoring the EU political crisis is the way forward

10. Some suggestions?

Winner to be selected by BQ,ND and CU committee. Winner to receive one years' free subscription to C@W.

Thursday, 16 December 2010

Comedy is getting old

Having fallen out of love with the BBC, I was involved in a blog post war on another site over privatisation. The person most in favour of the BBC claimed that the ten most popular UK comedies were BBC productions. This was probably a reference to the top 50 British sitcoms.

This is probably true. If you take television over the last 60 years then the BBC has a monopoly for 20 of them, a duopoly for another 10 and very limited competition for another 20 before Sky and Virgin and C4 + C5 got their act together. But if the poll is ALL TIME WORLD greatest comedy/sitcoms how does the BBC do?

Not so well I'd guess. 8 out of the 10 BBC shows are over 25 years old. {but then the poll was 2004..anyone got a newer one?} Not that that matters much, but it does mean that some of the 'newer' comedies from other sources are likely to give the BBC a run for our money. For me, here's a possible best ever.

2. Seinfeld

3. Outnumbered

4. Blackadder5. Phoenix Nights

6. Friends

7. Porridge

8. Red Dwarf

9.Charlie Brooker's various wipes

10. IT crowd

11. Yes Prime Minister

12. Alan partridge

13. Frasier

14. Family Guy

15. Big Bang theory

16. The Thick of It

17. Father Ted

18. Larry Sanders show

19. Cheers

20.Lead Balloon

No room for Soap, Open All hours, Reggie Perrin, Some Mothers do 'ave 'em, New Statesman..which haven't aged as well as others. And no room for Extras, Dad's Army, Curb your enthusiasm, Peep Show, Daley Show,Armstrong and Miller well...well .. because there's just no room..dammit!

So lets see. List your top BBC & NON BBC comedies into the comments and see if can come up with a top 20 best ever. I have a sneaking suspicion my BBC favouring opponent may have been right.

33k Public sector jobs go in three months

|

| This represents ' diversity' according to Local Councils |

At 33k per quarter it is going to take 7.5 years to get rid of a million. I am hopeful the coalition can push the numbers reduction for more like 50k per quarter.

Even this is only a 15% reduction in public service workers, I can't see how this affect the precious frontline services too much - some will go because the Unions will insist on it and the managers will cut others before themselves. But an organisation can plan for 15% cuts over a 5 year period.

If only Government were that simple.

Wednesday, 15 December 2010

Emed at last, but Spain is a un-capitalistic country

In many ways it is a sad story that EMED have had to wait so long as a big chunk of the process has been trying to overcome major corruption of interests in Spain. Landowners have held blocking sections that they have wanted to sell only for ransom demands and a local committee supposed to look after the community has been on their side for over 2 years; delaying the mine re-opening and the thousands of jobs that will go with it.

It shows just how difficult it can be to do business in Spain - good luck to BA merging with Iberia. I see their union is up for some more strikes over Christmas so they are certainly getting into the mood of Spanish practices.

Tuesday, 14 December 2010

The Government's inflationary Plan A

However, two graphs below demonstrate what the real Plan A is.

The above shows the dire state of UK finances over the last couple of years and the non impact thus far of the new administrations cost cutting measures. Below UK inflation:

Sunday, 12 December 2010

Looks like Spain has dodged the bullet for 2010

So Spain will live until 2011. John Major said this morning he thought Spain would survive, his belief in the power of politicians over the markets is touching, but reality will hit next year. I seem to remember his Government being the one in which Mr. Market perhaps proved otherwise!

Friday, 10 December 2010

Trading Update: XEL or bust

| Symbol | Last price | Mkt cap | Price | 2010 YTD |

| MNR | 75.75 | 122.1 | 61.58 | -10% |

| EMED | 10.55 | 45.18 | 9.89 | -10% |

| XTR | 2.22 | 19.01 | 2.647 | -10% |

| AST | 7.9 | 41.06 | 6.41 | 0% |

| IAE | 133.3 | 0 | 85.08 | 40% |

| GKP | 179.5 | 1213.81 | 120.36 | 100% |

| XEL | 283.75 | 442.92 | 57.95 | 380% |

| HOIL | 420.4 | 1210.19 | 308.2 | 33% |

| AEY | 54.5 | 0 | 66.16 | -15% |

| POL | 5.19 | 124.02 | 4 | 28% |

| RGM | 6.7 | 35.79 | 9.23 | -15% |

Thursday, 9 December 2010

Question Time

David Dimbleby is joined in London by

Liam Fox MP {maverick coalition defence minister and man with no truck with the Big Society}

Norman Lamb MP{lib dem - is he an abstainer?}

Sadiq Khan MP {Labour MP, freedom for tooting, a bit too shouty for Question Time, but very bright}

Aaron Porter [leader of the students , labour MP in waiting and deficit denier}

Janet Daley -{ journo, telegraph blogger, will stomp on Aaron if he isn't prepared}

The rules!

it couldn't be simpler. The BBC Question time audience asks the panel between 4 and 8 questions each week. You choose what you think they may be, and enter them into the comments. Points are awarded for correct answers, methodology, insight and sometimes on a completely random basis.

This weeks winner gets to pick Santa presents for

Nick Clegg, David Cameron or Ed Miliband.

BQ - 1. Student top up fees- vote passes?

- 2 Is this the end of the lib dems?

-3 Wikileaks again

-4 Hancock's cock getting him into trouble

-5 Strikes .. should underground be banned from strikes

BEATLES SONG TUNE WINNER

"You've Got To Hide Your Love Away" - William Hague

VERY GOOD.

Wednesday, 8 December 2010

Political Beatles

Lenin & McStavka

Lenin & McStavkaReal politics died 30 years ago.

Meantime, well known rock aficionados, Gordon 'Arctic Monkey' Brown and David 'Morrissey' Cameron, invite you to partake of a Beatles political songtitle compo.

"Money can't [quite] buy you an election" - G.Brown

"Help" - Ed Miliband

"I think we'd better hold your hand" - Osborne to Vince Cable

"Yellow Latrine" Nick Clegg

"Strawberry playing fields for never" - D. Cameron

Your best efforts into the comments.

Tuesday, 7 December 2010

Sir George Matthewson sees no Monkey

A fact which helps his third point, that no one was found to be corrupt and the board was not guilty of a failure of Governance. The truth is RBS fought tooth and nail with Barclays for ABN AMRO and paid a premium that was beyond belief. Certainly, beyond what Barclays (who for all their problems at least have never put their hand out to taxpayers) would even consider paying. The board stood by and watched Sir Fred Goodwin and his ego get hold of this. It is a massive failure of Governance.

As the FSA waved it through it does not surprise me at all that subsequently they give this the green light, in secret of course. When will there be a real independent investigation of these crooks and those at the FSA who connived with them. It is not just RBS, HBOS and Northern Wreck executives and their regulators all have a case to answer, one which frankly it is not in the interest of the FSA to expose.

At the moment the collective FSA and City gentry are engaged in Monkey Business:

Monday, 6 December 2010

Desire dashes HMRC dreams

The dreams of HMRC of another North Sea style bailout fund for the UK are therefore dashed. At least we can save some money by downgrading defences of the Falklands now that the Argies won't want to invade again.

Sunday, 5 December 2010

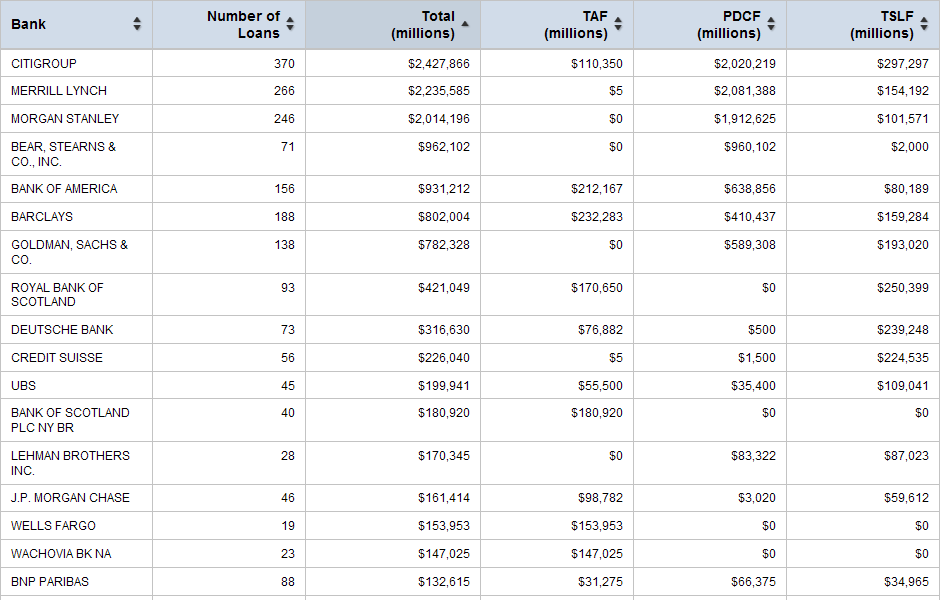

Numbers to make your head hurt

Click for the full effect.

Saturday, 4 December 2010

Anti-Busines Loons quote Moron for spurious justification

Also, the protesters really miss the point, if people are avoiding tax then that is legal - so they should be protesting for changes to the Government tax codes- almost 70% of which is a Labour creation or they should be protesting against the HMRC who they are paying through their taxes (note my generosity here) to fail to collect taxes.

The anti-business mood is getting stronger though, crazed students protesting about the real costs of university funding and loons thinking protesting at Topshop is going to help them when they are holding their hands out for more money.

It does demonstrate how the Left is struggling ideologically after its horrible failures of being in Government left the Country destitute.

Friday, 3 December 2010

The turn of the saint

Confederate General Braxton Bragg was a remarkably intelligent and well-informed man, professionally and otherwise. He was also thoroughly upright. .. A man of the highest moral character and the most correct habits, yet he was in frequent trouble. His irascibility had led him to be transferred away from many posts.

Confederate General Braxton Bragg was a remarkably intelligent and well-informed man, professionally and otherwise. He was also thoroughly upright. .. A man of the highest moral character and the most correct habits, yet he was in frequent trouble. His irascibility had led him to be transferred away from many posts.There is an anecdote very characteristic of Bragg.

He was stationed at a frontier fort with several infantry companies commanded by a field officer. He was himself commanding one of the companies and at the same time he was acting as post quartermaster. His commanding officer was called away to other duties, and as next most senior, Bragg assumed command of the fort. As the acting company commander he made a requisition upon the quartermaster–himself–for some supplies he wanted.

As quartermaster he declined to approve his own requisition, and endorsed on the back of it his reasons for so doing. He returned this unfilled requisition to the company commander, who was also himself.. - With his company commander's hat on he responded to this rejected request, urging that his requisition called for nothing but what he was entitled to, and that it was the duty of the quartermaster {himself} to fill it. As quartermaster he received his own note yet still insisted that he was right not to allow the supplies.. In this condition of affairs, and presumably before blows were exchanged, Bragg referred the whole matter to the absent commanding officer of the post. The latter, when he saw the nature of the matter, exclaimed:

“My God, Mr. Bragg, you have quarrelled with every officer in the army, and now you are quarrelling with yourself!”

What the young Lieutenant Bragg, soon to be a Major General in command of an army, was trying to do was show how his orders as a line commander conflicted with his orders as a commissary. If he wanted to mount a long range patrol as commanding officer he was bound to ask for additional wagons and horses and tents and extra troops and rations and so on. As a quartermaster of a fort his job was to ensure there were enough supplies in store, and not to authorise extra items except in the most extreme situation. But all Bragg succeeded in doing was to make himself a laughing stock.

Anyway, enough of the history of obscure 19th century military figures. I see Vince Cable has now decided he will vote in favour of legislation that he was thinking of voting against, even though it was not just government policy, but actually his very own proposals. He has decided, for now, that it might be a good idea to at least seem to be in favour of legislation that he is supposed to be steering through parliament...

Complaint to the BBC Trust

The FA, the 2018 bid committee, the Royal Family and the Government invested heavily in trying to win the 2018 World Cup for the UK.

The BBC deigned to show a panorama programme about corruption within Fifia just a day before the decision day for hosting the World Cup.

Earlier this year the Sunday Times had investigated Fifa and Fifa had made clear it did not welcome the investigation and that it had effected the England Bid.

Despite this knowledge the BBC arrogantly cited its own right to free speech to broadcast the Panorama programme this week. Today Sepp Blatter made it clear in the voting process that certain media events had effected the English bid. England then got 2 votes and went out in the first round.

The BBC could have broadcast the same programme tonight or next week, the reason it did not is clearly because it was chasing ratings. This chase may well have cost England the chance of hosting the 2018 World Cup.

As such, the BBC should immediately refund the costs of the bid, the Government and all parties who have made such efforts that the BBC saw fit to sabotage in such an obvious manner.

Given the BBC is funded by Licence, the cost should not be borne by extra funding, but by finding the money from current budgets.

Do you think I will get a response that is not utterly self-serving? I look forward to their pathetic self-justifications.

Thursday, 2 December 2010

Ratings chasing BBC

Just to follow on from the argument raging over the BBC's decision to air the panorama FIFA corruption program before the bid, comes another, much smaller controversy.

Just to follow on from the argument raging over the BBC's decision to air the panorama FIFA corruption program before the bid, comes another, much smaller controversy.Next week Panorama is investigating "video games". They are doing a Daily Mail style lament that some kids spend 20 hours playing games and never go outside and so on.

No doubt the best selling World of Warcraft, an online multi-player fantasy game, will be under the spotlight.

USA sales alone showed a profit of $250 million from game sales 2001-9. But that is as nothing to Blizzard's WOW 12 million paying subscribers. It earns about $10/month for each one. There are people online who sell their 'fantasy accounts' to others for tens of thousands of pounds.

Their brand new release World Of Warcraft: Cataclysm launches. on the same day that the Panorama program airs. 6th December.

Is this yet more ratings chasing by the BBC? Will the program find a lonely, unsociable kid from amongst the 12 million who play? Will they condemn 'video games' as the media regularly does with games like GTA IV or Burnout Dominator, or like they used to do with other 'young persons' entertainment such as raves, punk, 'glue sniffing', heavy metal, or Bill Hayley.

I've never played the online game so i don't know its appeal but the BBC..

Its downloadable Doctor Who titles { I think there are 10 or so} were commissioned for a second series in September.

'Addicted to Games?' will air on the hypocritical BBC One on Monday (December 6). Don't feel you have to watch it.

Question time quiz.

David Dimbleby is joined in Coventry by

Danny Alexander,{Treasury and muppet revivalist} Nadine Dorries{Tory who holds ..erm, unconventional views..Batty as a moorhen.}

Ken Livingstone{former mayor of London, lefty left winger,but is at least as independently minded as Boris}

Sir Christopher Meyer{ambassador to USA and a big clue to one of the questions}

Jon Sergent. {Never as interesting as the BBC think he is. Such a Labour tribalist he's usually very boring.}

Guess the questions and win a prize! Answers in the comments.

This weeks winner gets a ticket to the next UK hosting of the world cup in 3018.

I predict..

Q1. Wikileaks

Q2. Student kettling and freedom to protest

Q3. BBC ruins FIFA bid.

Q4. U-turn on scrapping sport.

Q5. Why is Vince cable voting against himself?

So if not Fred the Shred....?

|

| Courtesy of The Telegraph |

Of course, given the FSA was the regulatory body, this also handily helps them out of a hole as if RBS was guilty then they would be too by association.

The real focus should be on who is at fault though; because it is not the Greedy bankers on whom everything is currently blamed. Instead the approach to interest rates, the ending of boom and bust and the public sector spending are prime candidates, along with some very poor application of accounting standards. What this tells me is that the market was badly mis-regulated, more than the actors in the market were being criminal.

So at this rate, I would hope that Gordon Brown gets investigated by the FSA as he has a much bigger case to answer.

Wednesday, 1 December 2010

Limits on height of staff at work welcomed

|

| Typical disgraceful office seen from the UK Public Sector |

There are good reasons for this, tall bosses are seen as domineering and can often be found taking the mick from smaller members of staff. Also tall staff can cause disharmony as smaller staff resent their status in life.

Of course, tall staff don't like this idea, as they are tall and often physically stronger they say they more than carry their share of the burden of work and should not be limited in numbers. If anything, this is adding to discrimination where there should be less.

I find it hard to take sides here, clearly Government interference is most welcome on such subjects as nit-picking from the centre always leads to better productivity and performance outcomes; yet somehow I feel that discrimination is unwelcome..what do you think?