So what has happened to the 2 nations since the great crash of 2008 and who has come out better. Financial crises take a long-time to recover from and we can't be sure we are there yet, plus of course the US has not had to deal with the Euro collapse, which has probably benefited the US, but more of this later.

First up, let's compare GDP:

|

| Stats: Cityunslicker.com |

We can see from the above that firstly the US crash was worse and also that GDP growth in in the US has been stronger. In total, the US economy is now .12% bigger than 2008 but that the UK economy is still 3.5% smaller.

So on the strength of this the US debt fuelled recovery has done better than the US attempts at austerity.

But how about the Debt to GDP ratio?

The US debt ratio has gone for 66% of GDP to 101% - an increase of 35% of GDP - in real terms this is from just under $11 trillion to nearer $17 trillion

For the UK, debt has gone from 38% of GDP to 70% of GDP - an increase of 32% an a real increase of £300 billion or so. So much for austerity in the UK then, it has been pretty fictional and the same amount of debt has been added as in the US, give or take 3% - but the US has delivered an economy 3.6% bigger.

This is equivalent to about half a trillion dollars, so relative for the UK would be about £200 billion bigger than it is today if we had kept pace with the US, given 50% of GDP goes in tax that would equate to a huge part of the annual deficit of £120 billion odd.

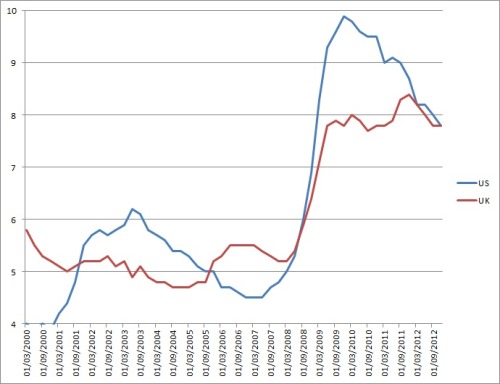

How about Unemployment?

In many respects, there is not much to see here. US employment rose to a higher level than in the UK, but has then come down faster as growth has kicked in - but only to reach the same level as the UK's rate now anyway - with both economies on 7.7%.

Verdict

This is a difficult one, firstly, there has not been much fiscal austerity in the UK and the US is about to embark upon some - so Summers' proposition about our fiscal approach is simply wrong. He does not know what he is talking about. Having said that, the US has outperformed the UK in GDP and seems on a better path than the UK for growth - all for the same relative costs in national debt. So the US has done better.

The reasons for this could be varied, but I would posit better de-leveraging of debts caused a bigger fall in the beginning but has enabled a firmer recovery.

However, the US now has a debt/GDP ratio of 101%. Once the economy normalises and interest rates rise, there will be a massive cost to the US economy in terms of public debt servicing. In the current ultra-low environment, which the US benefits from and the Eurozone crisis helps them with due to flight to safety reasoning, this matters not. In the long term, the UK debt levels should top out at under 80% of GDP -we have a lower debt burden.

Also, should another crisis hit, the US is now just one step away from Greece and Japan, whereas the UK's better fiscal health means we are maybe 2 steps away.