In short, no.

I feel compelled to write this again as the media is full of dark thoughts about the banks and the world as a whole.

I personally blame the constant storms in the real weather as having a zen like influence on the traders of the world markets.

In the UK for example, Barclays, Lloyds and RBS have more or less closed their investment banking groups.

The remainder have Tier One equity of 10%+. They have been lending little real money except on mortgages and credit cards; of this, little has been securitised, let alone put into CDO's.

The current issue really is that with all the secy stuff gone, the Banks are making no money and the regulators continue to find new crimes for which they get fined. I have little sympathy with the Banks or their shareholders on this.

But we are a long way off 2008. What wold be more troubling at this time would be a huge run on Government bonds, as that is where the real debt expansion has been. However, the threat of QE means that even the top hedge funds of the world are unlikely to try and fight that war in the West.

Instead we have a profit problem - itself predictable in world of a zombie economy and commodity induced deflation.

On the plus side, it means banks look cheap at the moment and he medium term benefits of oil prices are yet to work themselves out (i.e. a boost to the consumer economy) - so the economic future is brighter than it appears right now potentially.

CU

Showing posts with label Banks. Show all posts

Showing posts with label Banks. Show all posts

Tuesday, 9 February 2016

Wednesday, 27 January 2016

RBS: Government owned until 2020

RBS has another year of losses to add to its list. Eight straight years, it is hard to think of another business outside the Guardian newspaper that can sustain such a dire record.

And not just a small loss either, a £2.5 billion loss. Yes it can be argued that the main cause here is yet more fines and covering for litigation and fallout from the financial crisis, plus the need to plus a huge hole in its pension deficit. On this basis the core bank is making money, is still the largest SME lender and gearing back up in the mortgage market with Natwest soon to top best buy mortgage tables once more.

However, a loss is a loss. The share price is around half of where it needs to be to break even in a Government sale. 50% loss of £48 billion. At least, with a tier one ratio of 16% we can be assured that the bank could survive another recession.

Pity its shareholders though, every year is the promise of Jam tomorrow in terms of dividends and profits. Every year it does not happen, we are far closer to the next recession than the last too; will RBS make it out of Government control before 2020, I would not bet on it.

And not just a small loss either, a £2.5 billion loss. Yes it can be argued that the main cause here is yet more fines and covering for litigation and fallout from the financial crisis, plus the need to plus a huge hole in its pension deficit. On this basis the core bank is making money, is still the largest SME lender and gearing back up in the mortgage market with Natwest soon to top best buy mortgage tables once more.

However, a loss is a loss. The share price is around half of where it needs to be to break even in a Government sale. 50% loss of £48 billion. At least, with a tier one ratio of 16% we can be assured that the bank could survive another recession.

Pity its shareholders though, every year is the promise of Jam tomorrow in terms of dividends and profits. Every year it does not happen, we are far closer to the next recession than the last too; will RBS make it out of Government control before 2020, I would not bet on it.

Monday, 11 May 2015

Taxes do have effects - Bank Levy a case in point

Now that we are free of a the potential of Socialist interference in markets, we can look once again at what the new Government is doing and whether that will really help much.

One interesting article in the Financial Times (much a better read when there is no election coverage in its dripping pink pages. Seems the Keyensians has been routed too there), which describes how many of the Investment Banks are taking a dim view of the Governments continuing bank levy.

In a world of low interest rates and free QE money for the Banks, it can be hard to make a buck. So the Bank levy, which has been increased each year just to raise as much as the year before, can have a big effect.

Lots of the trades banks are now doing make very little real money. The Repo desks are a haven for this. Billions of dollars of transactions for fractions of a percent profit. (All Socially useless once might say, but that one is currently drinking himself into a stupor in North London).

Yet these trades are hi by the Bank levy and also the Bank are less than impressed about real regulation which has caused them to be fined repeatedly for market abuse. The latter no one can doubt, the Banks hate getting caught rigging markets but of course this is exactly what needs to happen to make a market work.

The fact the Banks want to go to Hon Kong or elsewhere where they can openly abuse their clients is their look out. Moves in the that direction are welcome as the reasons for it are unjust.

The Bank Levy though is different, it relies on Banks no shrinking their balance sheets to raise revenue when of course its imposition incentiveses banks shrink their balance sheets. Moving UK operations to other places in Europe or the US where there are no Bank Levy's is a bad thing.

The City in the UK, despite the past few years, is in a delicate state. The large investment banks are mainly gone, destroyed by the financial crisis. RBS is shut, Barclays heading the same way. UBS and Credit Suisse are a shadow of what they were. In their place is Sovereign Wealth Funds, moving in with their money. But they are not the same and not really HQ'd here and one day we will discover they can use Sovereign immunity to help erase their poor commercial decisions.

The West needs a robust capital industry more so now than ever, with QE money sloshing around and huge fiscal challenges to be overcome in the next two decades. Some thought around tax incentives would be welcome in the June emergency budget.

One interesting article in the Financial Times (much a better read when there is no election coverage in its dripping pink pages. Seems the Keyensians has been routed too there), which describes how many of the Investment Banks are taking a dim view of the Governments continuing bank levy.

In a world of low interest rates and free QE money for the Banks, it can be hard to make a buck. So the Bank levy, which has been increased each year just to raise as much as the year before, can have a big effect.

Lots of the trades banks are now doing make very little real money. The Repo desks are a haven for this. Billions of dollars of transactions for fractions of a percent profit. (All Socially useless once might say, but that one is currently drinking himself into a stupor in North London).

Yet these trades are hi by the Bank levy and also the Bank are less than impressed about real regulation which has caused them to be fined repeatedly for market abuse. The latter no one can doubt, the Banks hate getting caught rigging markets but of course this is exactly what needs to happen to make a market work.

The fact the Banks want to go to Hon Kong or elsewhere where they can openly abuse their clients is their look out. Moves in the that direction are welcome as the reasons for it are unjust.

The Bank Levy though is different, it relies on Banks no shrinking their balance sheets to raise revenue when of course its imposition incentiveses banks shrink their balance sheets. Moving UK operations to other places in Europe or the US where there are no Bank Levy's is a bad thing.

The City in the UK, despite the past few years, is in a delicate state. The large investment banks are mainly gone, destroyed by the financial crisis. RBS is shut, Barclays heading the same way. UBS and Credit Suisse are a shadow of what they were. In their place is Sovereign Wealth Funds, moving in with their money. But they are not the same and not really HQ'd here and one day we will discover they can use Sovereign immunity to help erase their poor commercial decisions.

The West needs a robust capital industry more so now than ever, with QE money sloshing around and huge fiscal challenges to be overcome in the next two decades. Some thought around tax incentives would be welcome in the June emergency budget.

Friday, 1 August 2014

Baking results - when is a one-off provision not a one-off?

Interesting to see the most of the UK bank's half year results this week;

Pick of the bunch is RBS, whose underlying profits came in much higher than expected. The Bank has over a long period done a good job of selling down its Real Estate debts. However, in the long-term the more of less closing of its investment bank make it a much less appealing business. It's grip on UK SME business and personal business is strong and will remain so, enabling it to retain a core income. This maybe under-threat as its new CEO is very keen on retail banking and credit cards - but still, no one in the Treasury can argue it is a risky bank anymore. Shame the resulting value of the bank is about 50% of what was paid to bail it out. Somehow I doubt future Chancellor's are going to want to put that write down into the books - making it tricky to see the end of state aid.

Barclays has many similarities to RBS, for a longtime the bank was far superior in coping with the crisis, but the last two years have seen the end of that. It's new CEO also is looking at closing down the investment bank and pushing up retail banking - if all the Banks have the same strategy this may prove good for customers, but not for shareholders. It's results are underwhelming, but provisions are low suggesting little systemic risk.

Lloyds is the average of the bunch. Like the other banks it is keen to show off underlying profits, less keen to highlight the one-offs' that drag its profit down. The PPI mis-selling provisions keeps going up, there are huge fines for various pieces of LIBOR fixing and market abuse. All in all over £1 billion.

All the banks play the standard accounting trick of including these items as one-off. But there they are, year after year, going up and up and up. PPI Provisions have increased for over 2 years, they are hardly one-off's.

No wonder the shareprices lag the markets and are at 50% of where they were in 2007/8. One day perhaps all the bad news will be in the public domain, but the various CEO's have been saying the end of the road is in sight for seven years - I think there will still be two or three to run and then we will be into the next recession in any event!

Monday, 4 March 2013

How's that UK Financial investment portfolio looking?

Not great is it. On the day that HSBC announces near-record returns and even scandal-hit Barclays managed to stay in the black this year. Santander will be fine too.

Lloyds Banking Group and RBS managed to make huge losses - in fact RBS managed the biggest loss since 2008. Now partly the way banks account for profit and loss on the value of their own debt is having too big an impact on results. Last year they all benefited to the tune of a couple of billion and this year they have given it all back.

So the banks are right to say this plays a big role in obscuring their underlying performance. This year what really killed Lloyds and RBS were the big fines for PPI and Derivatives mis-selling combined with the still ongoing process of unwinding all their poor loans from the boom.

HSBC and Barclays have more or less finished this process, so regulatory fines aside and a bit of re-org costs at Barclays and they are on track.

Some of the key underlying businesses at Lloyds and RBS too are showing good signs of recovery - the issue is that they still have plenty of toxic assets (far less than before, but still tens of billions and what it left is the more toxic stuff) to go. Plus bit re-org costs and the Government has forced them to end most of their 'casino' banking markets and trading businesses. Also they have pulled back internationally, where the economies are growing, to focus on the UK, where the economy is flat.

So, pity the taxpayers, it will be a long wait to get even a nominal return on investment. The best option still remains a giveaway to taxpayers of the shares, it will reduce the overhang and be a fillip to hard-pressed people across they land as they cash in a few hundred quid - who knows that might even herald the end of banker-bashing.

Waiting for the shares to hit a return point just won't work - the market will be aware of the over-hang and so any time the shares get near that price they will get a nose-bleed. Creative thinking definitely needs to be applied here.

Lloyds Banking Group and RBS managed to make huge losses - in fact RBS managed the biggest loss since 2008. Now partly the way banks account for profit and loss on the value of their own debt is having too big an impact on results. Last year they all benefited to the tune of a couple of billion and this year they have given it all back.

So the banks are right to say this plays a big role in obscuring their underlying performance. This year what really killed Lloyds and RBS were the big fines for PPI and Derivatives mis-selling combined with the still ongoing process of unwinding all their poor loans from the boom.

HSBC and Barclays have more or less finished this process, so regulatory fines aside and a bit of re-org costs at Barclays and they are on track.

Some of the key underlying businesses at Lloyds and RBS too are showing good signs of recovery - the issue is that they still have plenty of toxic assets (far less than before, but still tens of billions and what it left is the more toxic stuff) to go. Plus bit re-org costs and the Government has forced them to end most of their 'casino' banking markets and trading businesses. Also they have pulled back internationally, where the economies are growing, to focus on the UK, where the economy is flat.

So, pity the taxpayers, it will be a long wait to get even a nominal return on investment. The best option still remains a giveaway to taxpayers of the shares, it will reduce the overhang and be a fillip to hard-pressed people across they land as they cash in a few hundred quid - who knows that might even herald the end of banker-bashing.

Waiting for the shares to hit a return point just won't work - the market will be aware of the over-hang and so any time the shares get near that price they will get a nose-bleed. Creative thinking definitely needs to be applied here.

Monday, 9 July 2012

Vince and Ed both grab the wrong end of the stick

Vince Cable, the anti-business secretary, has once more sounded the canard that the double-dip is the fault of the banks not lending.

No, Mr Cable, this is not true. The reason the banks are not lending is becuase there is very little demand for new money. Big ticket projects are being funded by placings and a very strong bond market - even high yield bonds are still getting away. SME lending is dead becuase small SME's who have a clue are not looking at the economic situation and deciding that now the time is to bet the company on a huge bank loan.

Of course, let's not forget, the Banks have some serious problems that are not helping the recovery at all. Sitting on piles of bad property loans which they can't sell becuase it will bankrupt them is having a bad effect on the many sectors, such as the construction industry. Yields are just being used to pay zombie debt rather than providing capital for new business and opportunities. This is a problem that requires bank recapitalisation, not more lending.

Meanwhile, Ed Milliband is thrashing around trying to say something to keep himself in the papers. The current one is how all the retail banks should be broken up. But this is not the real problem is it? The real problem is the securitisation market and the access that gave banks to wholesale funding. Making banks smaller does not help this. Indeed, the Mutuals proved a complete failure and the sector has shrunk massively.

The real piece of work that was needed was to increase capital requirements for Banks to stop them over-leveraging and to split the Investment Banks away from the retail banks so that they could blow themselves up without resort to the taxpayer. To a large extent this is now being done - not that improvements could not be made. As usual, crazed politicians are just throwing around populist ideas. Milliband is making an arse of himself yet again - which is good going with toxic Ed Balls as his shadow Chancellor I did not think it could get much worse.

No, Mr Cable, this is not true. The reason the banks are not lending is becuase there is very little demand for new money. Big ticket projects are being funded by placings and a very strong bond market - even high yield bonds are still getting away. SME lending is dead becuase small SME's who have a clue are not looking at the economic situation and deciding that now the time is to bet the company on a huge bank loan.

Of course, let's not forget, the Banks have some serious problems that are not helping the recovery at all. Sitting on piles of bad property loans which they can't sell becuase it will bankrupt them is having a bad effect on the many sectors, such as the construction industry. Yields are just being used to pay zombie debt rather than providing capital for new business and opportunities. This is a problem that requires bank recapitalisation, not more lending.

Meanwhile, Ed Milliband is thrashing around trying to say something to keep himself in the papers. The current one is how all the retail banks should be broken up. But this is not the real problem is it? The real problem is the securitisation market and the access that gave banks to wholesale funding. Making banks smaller does not help this. Indeed, the Mutuals proved a complete failure and the sector has shrunk massively.

The real piece of work that was needed was to increase capital requirements for Banks to stop them over-leveraging and to split the Investment Banks away from the retail banks so that they could blow themselves up without resort to the taxpayer. To a large extent this is now being done - not that improvements could not be made. As usual, crazed politicians are just throwing around populist ideas. Milliband is making an arse of himself yet again - which is good going with toxic Ed Balls as his shadow Chancellor I did not think it could get much worse.

Tuesday, 25 October 2011

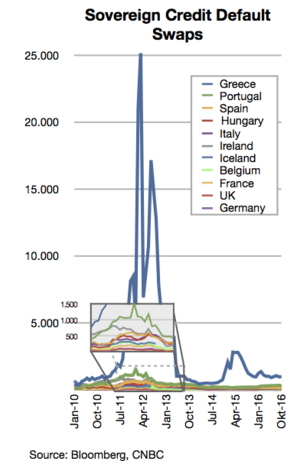

CDS don't matter

The front page of the FT today is focused on the continuing story of the Euro crisis and the proposed haircut on Greek debt. Why there is no discussion about the other PIIGS at the same time is beyond me, but hey ho we can do that next year perhaps.

Anyhow, the Bankers are trying to defend their positions as much as possible. Clearly they don;t want to take more state money than they have to as this will end in restricting their own pay substantially. The current line being pushed is fear of the CDS market and what impacts that may have.

Rather conveniently, no one knows the answer to this - so it is the ultimate bogey man. As the respected Chris Whalen observes ""To be generous, you could call it an unregulated, uncapitalized insurance market. But really, you would call it a gaming contract."

Although I doubt my 2 year old son could be persuaded to be scared of a Credit Default Swap monster - it does though seem to work on politicians.

the reason that it does not matter is that CDS are predominantly issued by banks and things that pretend to be banks. the fact that some of these are going to have big problems is of little consequence to the real world and indeed, some banks going under is a good thing. As with Northern Rock, idiotic business models need to be allowed to fail.

Worse still, with a 100 billion euro fund to support the banks with their bad CDS positions and overload of Greek sovereign debt, there is a decent fund to help the needy anyway - all at taxpayer expense. This is even more of a non-issue.

We only have a day or two to wait for the final verdit, it will be interesting to see if financial alchemy based lobbying wins a reprieve for the banks or not.

Monday, 2 August 2010

UK Banks filled to bursting

At the end of last week I made a small purchase of some banking shares, the first time in over a year for me to buy into British banks. Until now there was just no security in owning them. This week is going to be a watershed though. HSBC announced a big hike in profits today, with less exposure to the US Household business the future is set fair for them. Also Lloyds, RBS and Barclays are all expected to report good profits for the first half of 2010.

The reaction in the market has been quite spectacular with the FTSE up 2.5% at the moment - there is of course always a lot of volatility in the summer months when volumes are low and a few big trades can really move prices.

Nick Drew wrote earlier about the Banks getting off lightly with Basel III and this is being built into share prices too. There is now just one thing hanging over the banks, the closure of Government cheap money support and a move back to funding from the markets for their balance sheets. This is a big deal as the wholesale markets remain comatose since the Financial Crisis began. Perhaps the Bank of England will extend the credit (after all, this makes the taxpayer money as the it is lent above LIBOR).

More importantly, the Government can begin to think about a disposal of its shareholdings as the banks move to profitability. Moving too soon is not possible, but perhaps by the year end things will look different. A healthy set of clearing banks is utterly central to any UK wide economic recovery.

The new will be even better if they get broken up in the process...but that is one thing I am not gambling on as my faith in Vince Cable to achieve anything at all is zero.

In terms of trading, there is still a good window this week for buying into the rising trend.

The reaction in the market has been quite spectacular with the FTSE up 2.5% at the moment - there is of course always a lot of volatility in the summer months when volumes are low and a few big trades can really move prices.

Nick Drew wrote earlier about the Banks getting off lightly with Basel III and this is being built into share prices too. There is now just one thing hanging over the banks, the closure of Government cheap money support and a move back to funding from the markets for their balance sheets. This is a big deal as the wholesale markets remain comatose since the Financial Crisis began. Perhaps the Bank of England will extend the credit (after all, this makes the taxpayer money as the it is lent above LIBOR).

More importantly, the Government can begin to think about a disposal of its shareholdings as the banks move to profitability. Moving too soon is not possible, but perhaps by the year end things will look different. A healthy set of clearing banks is utterly central to any UK wide economic recovery.

The new will be even better if they get broken up in the process...but that is one thing I am not gambling on as my faith in Vince Cable to achieve anything at all is zero.

In terms of trading, there is still a good window this week for buying into the rising trend.

Subscribe to:

Posts (Atom)