But a revised set of our own is due out later today. Here is the link to the data from last month on producer prices. These are the prices of goods as they are made, so this data provides the best leading indicator of where prices are going to go over the next quarter or so. Below is the graph from the ONS:

Note the large upward spikes starting last August. Generally inflation can take a year to 18 months to feed through the whole system. The second graph implies rising energy costs are the main cause, which may well be true, when you look at the graph below produced by EDF:

Note how the price is 87% higher for electricity than a year ago. EDF has raised customer prices by around 25% during in this time, so perhaps we have not seen the last of these price rises.

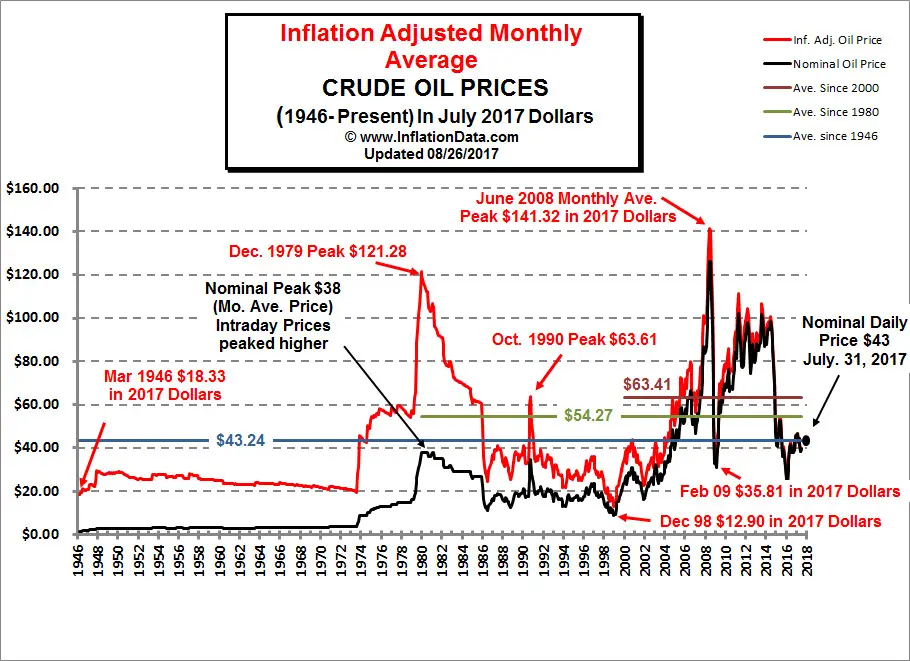

Finally, the other key energy component is oil, there is a great chart here from the excellent inflationdata.com:

Note the spike at the end and that oil prices have increased another 10% since the graph was last updated a month ago.

Finally, things are also looking bad for our friends across the pond, see this insightful piece in the Wall Street Journal that looks at precious metals prices too. there is a super graph too on what inflation really means to your income too.

Conclusion: We have mentioned stagflation before and now this is inevitable. What we are increasingly seeing in the numbers though is a much higher level of inflation than is currently being forecasted. Alistair Darling thinks 3% is unacceptable - we may get to double that before 2010. Don't count on interest rates falling much further this year and next year they will have to rise significantly - which will prolong the downturn/recession.

20 comments:

It seems that CU may be right, most of the signs point towards a recession.

However, in a time of stagflation what is the best thing to do with your money? Index linked bonds? Housing? I’ve read quite a lot about what is going to happen to the economy, but people rarely talk about how to take advantage of each situation.

M4 money supply grew by 1.6% in January too. That is consistent with continued increases in inflation despite BoE talk that it intends to get a grip on inflation. M4 rising at over 15% per annum will eventually see inflation catching up with the same rate unless it is absorbed by something that doesn't show up on the CPI/RPI.

I agree with Dr Ed - what is best to do with savings in a stagflationary environment?

Dr Ed/Ed,

The best hedges are things that store value in real terms - like, commodities, precious metals (GOLD), oil etc.

these will increase in value above the inflation rate so holding real value. Stocks and shares suffer so they are more of a punt.

(As I am not a financial advisor none of the above should be construed as advice)

Largely, I'd agree with CU, except I wouldn't buy in at any old price, since I understand there is speculative money chasing these items on margin, too. Perhaps there will be a window of opportunity when the credit crunch causes a further market drop and forces some of the gamblers to sell to settle borrowings.

Also worth noting that the gold market is small enough to be temporarily affected by central bank stock sales - until the cupboard is nearly bare.

Meanwhile, anything wrong with index-linked savings certs? Dull, but dependable?

You could consider buying farmland. Farmland in some areas is doubling in price every year at the present time. As Mark Twain said "invest in land, they aren't making it anymore!". With farm produce prices rising the demand for farmland is rising too. At £4000 per acre it is possible to buy small plots. The land can be rented out to those that actually want to do the grubby business of actually farming it.

Buying land has one huge advantage at the present time. If things get really bad you can use it to produce your OWN food. That might seem a bit extreme, but in Steinbeck's "Of Mice and Men" set during the Great Depression the main characters dreamed of owning their own land so they could be self-sufficient.

Dr Ed, index linked bonds or NS&I current account is the way forward. Oh, and sell-to-rent. Then bury head in sand for a few years.

Surely in an inflationary environment borrowing to buy is the way forward because the debt will be eroded? Or does stagflation mean that house prices will stand still?

Other Ed,

Stagflation is a combination of stagnation and inflation. Everyone is poorer, so I would have imagined that house prices may fall. Although as I’m answering my own question from the first post, feel free to ignore my waffling.

Sadly I have no house to sell, else I would have sold it a while ago, but I do have about £10k of savings I was thinking of trying to protect until I want to buy (I’m in a very good situation renting wise, so I feel no pressure to move).

I was thinking about investing in some kind of natural materials fund, as I read that MS’ rose something like 250% over the past 5 years, and I can’t see demand slacking off for the foreseeable future.

It would also be possible to invest in farming land as my other half’s parents live Cumbria, and I know of land near them which is up for sale now. Although I know noting about this industry and as this blog so humorously pointed out in the Mitchels & Butlers post, playing with things you don’t understand can get you burnt.

So my options as I see it are:

1. Invest in some managed fund (base materials or maybe farming land)

2. Go with index linked savings if I think I’m going to need the money in the next 3 years.

Any views?

just make sure the index link is RPI and not CPI or else the savings are worth nothing.

Just for a flyer, some bank stocks now pay better dividends on their shares than interest rates on their savings accounts!

Land is always a good buy - just not very liquid if you ever need to get the money out...

Another possibility is to open a Swiss bank account and put the money in Switzerland in Swiss francs. You need a fair amount of cash to do this, but £10,000 is probably enough. The Swiss M4 money supply is growing at a measly 2% p.a. so it is a pretty hard currency compared to the £. It is also 40% backed by gold reserves.

Switzerland is also handy if you need to do a runner if things turn nasty here. My wife is Asian and I wouldn't be at all surprised to see a backlash against the immigrant community in the UK if the global economy really comes apart at the seams like it did in 1929. My wife knows all about fleeing from countries that have turned on their own. I'd like to believe it couldn't happen here, but if it could happen in Germany it can happen anywhere. It just needs things to get bad enough for people to turn on their neighbours. It is all a question of just how bad could things get this time around. Personally I am more and more of the opinion that we have spent most of the years since WWII building up our own funeral pyre.

Right now NS&I are offering an index linked 3 or 5 year bond which is RPI+1.25 tax free. Were the economy to worsen, so that index linking your savings became important, would this change/get withdrawn?

Aside from the fact that this seems a fairly decent way to save tax-free even if inflation stays the same over the next 3 years, would there be any benefit in buying now as opposed to in 12 months when the RPI is at 6% (or whatever)?

RS: I was thinking about that same thing the other day. Is the rising number of people with extreme religious views (like in the USA) a sign of the beginning of something worrying, or just that the world is getting smaller…

RPI is now about 4.5% so +1.25% would be 5.75% tax free which is a very decent rate. I guess that with such a bond they give you the overall rate for the whole period not just whatever the rate of inflation is on the day you buy the bond?

It seems like a good deal if so.

it is a good deal; I can't face signing up to returns like that though....

The NS&I index linked is a brilliant deal, but you can only invest measly amounts like £15k, so a fat lot of good for sell-to-renters.

dr ed: Well this isn't the place for such a discussion, but I must say I am surprised by the rise of the religious right in the US. What worries me most is that the flavours of Christianity that have become most popular either focus on the Apocalypse or Old Testament intolerance. Jesus and his talk of love, kindness and tolerance doesn't seem to feature highly. I'm not sure what the motivation is though, but a backlash against 50 years of liberal left policy coming unhinged is quite likely I suppose. They really didn't like Bill Clinton getting BJs in the Oval Office. That seems to have been the last straw for many.

In the UK the situation is even worse. If all the planned Islamic terrorist attacks in the UK had been succesful then we would be looking at hundreds of dead and a major backlash. The danger to my Christian but Asian wife would be that in such a backlash just being a bit brown might be seen as justification enough for getting a Molotov cocktail through your living room window.

As I say I'd like to think we are too civilised for such things here, but in Northern Ireland in the 60s the "Troubles" started when (largely unemployed and poor) Protestants took a dislike to people following a slighty different flavour of Christianity and started burning them out of their homes.

Unfortunately economic failure is often the catalyst for such societal breakdown, which is why I want to be in the position to run if necessary. It's all a question of just how bad things could get on the economic front.

"The NS&I index linked is a brilliant deal, but you can only invest measly amounts like £15k" Ho no. Two issues, so that's £3ok. Same for wife makes £60k. Then buy £30k in trust for your wife and she does the same for you. £120k. Then there's the littlies - 3 is it Mark? - so that's, what, £90k more. We're over £200k before even a new issue is, er, issued.

I think it's a mistake to see religion as the problem. It's just the seed-crystal; really the trouble comes from a reaction to perceived threats to security and identity. The internationalism of some elements of the Brit-hating Left is a fire-starter. Liberalism is more likely to survive if we establish firm control over our borders, and the rule of law within them.

@Sackerson:

Yes, I agree that the rise in religious fundamentalism in the US is a REACTION to the excesses of the liberal left, rather than a phenomena in itself.

I think if you look through British history it has tended to be the same - rather liberal administrations that tended to let things slip followed by rising crime, prostitution (and hence widepsread outbreaks of STDs), drunkeness followed by a snap back to rather authoritarian administrations. These authoritarian administrations have often been backed up by religion, (and have therefore been rather intolerant of other religions). Often the imposition of their views has resulted in severe persecution and sometimes civil war.

Of course one person one vote democracy tends to stand in the way of a truly authoritarian government, so it is likely to be the first casualty should a large political grouping with authoritarian tendencies take power, as we have seen in many cases the world over. Sadly the current government have put in place exactly the tools required for such a dismantling of democracy, just at the time when we may be entering the worst economic crisis in living memory. It has also done a pretty good job of inciting the Muslim minority. Why? Could Blair/Browns religious convictions hold a key? Or were they just plain stupid? At the moment I tend to go for the latter.

情色電影, aio交友愛情館, 言情小說, 愛情小說, 色情A片, 情色論壇, 色情影片, 視訊聊天室, 免費視訊聊天, 免費視訊, 視訊美女, 視訊交友, ut聊天室, 視訊聊天, 免費視訊聊天室, a片下載, av片, A漫, av dvd, av成人網, 聊天室, 成人論壇, 本土自拍, 自拍, A片, 愛情公寓, 情色, 舊情人, 情色貼圖, 情色文學, 情色交友, 色情聊天室, 色情小說, 一葉情貼圖片區, 情色小說, 色情, 色情遊戲, 情色視訊, 情色電影, aio交友愛情館, 色情a片, 一夜情, 辣妹視訊, 視訊聊天室, 免費視訊聊天, 免費視訊, 視訊, 視訊美女, 美女視訊, 視訊交友, 視訊聊天, 免費視訊聊天室, 情人視訊網, 影音視訊聊天室, 視訊交友90739, 成人影片, 成人交友,

免費A片, 本土自拍, AV女優, 美女視訊, 情色交友, 免費AV, 色情網站, 辣妹視訊, 美女交友, 色情影片, 成人影片, 成人網站, A片,H漫, 18成人, 成人圖片, 成人漫畫, 情色網, 日本A片, 免費A片下載, 性愛, 成人交友, 嘟嘟成人網, 成人電影, 成人, 成人貼圖, 成人小說, 成人文章, 成人圖片區, 免費成人影片, 成人遊戲, 微風成人, 愛情公寓, 情色, 情色貼圖, 情色文學, 做愛, 色情聊天室, 色情小說, 一葉情貼圖片區, 情色小說, 色情, 寄情築園小遊戲, 色情遊戲, 情色視訊,

Post a Comment