Readers will know that we at Capitalists@Work do not hold a high opinion of St Vince Cable. In fact, one of the highlights of the election was seeing him get torn to shreds by Andrew Neil.

Of all the Lib Dems in Government, St Vince is the worst. A die hard old socialist who has the added spice of massive over-confidence in himself. As business secretary David Cameron has wisely kept him away from the treasury and put him in a department which, lets face it, is going to some big hits when the spending review is done.

More worryingly, Mr. Cable has been put on a new committee to review the UK banks. Now

here are a few

links, take a look at what Mr. Cable thinks of banking. Of course, he worked at Shell in his career as an economist. Shell being one of the most profitable company in the world has little time for banks, it even has its own prop desk for trading FX and commodities.

Also of course Mr Cable was the socialist most demanding the banks be nationalised, including the total financial disaster that has been Northern Rock. Cable thinks of course this is a good thing, state ownership being better because precious profits go to him and his politician colleagues to hand out to grateful plebeians.

If you doubt this, see here where last year he calls for the guillotine for bankers who get paid bonuses.

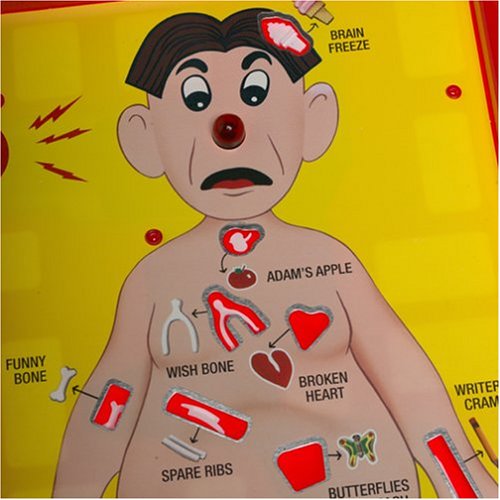

So Mr Cable will recommend some nasty medicine for the banks, a profits tax (silly), a separation of investment and retail banking (great idea in theory, hard to do in practice), a control on bonuses (illiberal) and

the closure of tax haven units.

The danger is that Mr. Cable decides he can have a private war on the banks, half of whom we need to nurse back to health to try and get our money back, the other half who have a major say in whether the UK remains credit worthy and contribute huge tax revenues already. Of course, the Tories, who two want reform, will get antagonised by this. Clever then to put ex-Banker David Laws, into the Treasury with George Osborne.

No idea what St Vince will do with his business portfolio, as an economist he is singularly unqualified to make real business decisions; great money to be found on him being the first minister sacked in the Government overall (Nick Clegg has no love of his rival either).

So - while Baroness Scotland got off with a slap on the wrist, Loloahi gets banged up ! How we need some of that Freedom, Fairness and Responsibility ...

So - while Baroness Scotland got off with a slap on the wrist, Loloahi gets banged up ! How we need some of that Freedom, Fairness and Responsibility ...