There's an interesting dynamic rumbling in the energy sector and associated financial elements, the dialectic of which is as follows:- We can't use fossil fuels in future, oh dear me no. Perish the thought. Put my pension into something else. Let me believe that the ambulance runs on pixie-dust and electricity comes entirely from wind. Don't allow any more production of North Sea oil & gas. Make Shell's life hell if it even thinks about such a thing. I might even start to feel very strongly about all this.

- Actual disinvestment starts apace: actual pension funds switch out of fossil fuels by the billion. For the BPs and Shells, the Centricas and even the EDFs (see below), the cost of capital starts to rise. They actually sell some of, maybe all of, their hydrocarbon-related assets.

- But in the world outside of all those tightly-shut eyes & heads-in-sand, the ambulance still runs on diesel and electricity is still generated using fossil fuels.

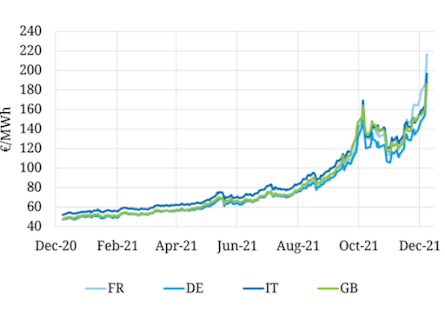

- In fact, the market for fossil fuels right now is pretty tight (see previous post) AND, what with all this wind in the power fleet & other kinds of uncertainty, prices are exceptionally volatile. They are likely to stay that way, even if in absolute terms they subside from today's level.

- Some people are making a Great Deal of Money from this - right now. And the scope for a great deal more to be made in the coming years is huge: particularly via assets (and managements) that are responsive enough to make hay from all that volatility - e.g. efficient & flexible gas-fired power units. Even just the continued supply of simple gas to western consumers (whether the green-woke like it or not) has a lot of mileage still in it (at least two decades, I'm guessing).

- But the 'traditional players' seem to feel themselves unable to make the usual response to an economic reductio ad absurdum, in terms of investment (long term) and arbitrage (short term) to take advantage of the mispriced assets etc.

For present purposes, let's put aside the amusing cognitive dissonance that ought to be (though probably isn't) increasingly wreaking havoc with all those who like to mouth "we don't need fossil fuels" but still like to be warm etc etc. It's the economic & commercial dissonance I'm interested in.We can easily spot little Volodya Putin and other traditional upstream players making pots of money out of the situation. They probably hope to make yet more. China, though essentially an energy importer right now, will probably benefit in relative terms (that is, relative to the West) by being untroubled by 'green' scruples. All this is easy stuff.

But what of other business models? Can 'western' firms somehow thrive in this crazy market?

Exxon: it's been clear to me for a long time that Exxon, that ailing, blinkered and sluggish beast, is basically hoping it can quietly get on with not changing much at all, and not go down the costly, guilt-stricken route of Shell et al. But is there anywhere to hide for a US stock-exchange listed firm of Exxon's prominence? Can any others of its kind, smaller and perhaps less exposed to the limelight, pull off that trick?

The big commodities players: there are plenty of these big players - you all know who I mean, but slander is slander - who, if they have any scruples whatsoever, well I've never noticed. (Ditto their shareholders: well they couldn't, could they?) Some of these cos are indeed buying up fossil fuel assets: the energy version of money launderers and sanctions-busters. Are the unscrupulous to be the big western beneficiaries?

A.N.Other Corp: this is where it gets really interesting. Case study: EIG Partners - ("Over the past decade, EIG has thoughtfully developed a quiet yet purposeful commitment to integration of ESG factors throughout our business") - whose website homepage would encourage you to believe they are essentially investors in wind farms and solar. But lo! Earlier this year they quietly bought West Burton B, one of the UK's biggest, most modern and efficient gas-fired power plants, from EDF which is busily trying to reposition itself as 100% green. And what magnificent timing: EIG has already made an absolute ton of money at WBB from the extreme market conditions of the second half of 2021.

Here's another example: Vitol, who've also bought UK gas assets recently - this time from none other than Drax (who have problems of their own) - and are likewise minting it this winter. Here's how they brand this venture ('VPI'): "We are part of the UK’s pathway to Net Zero, complementing the increase in renewable energy to power homes and businesses. Our portfolio includes hydrogen and carbon capture projects to help lower emissions and develop a future for decarbonised, dispatchable and flexible generation in the UK." Oh and, errrr, gas-fired power plants.

So: is it all simply about greenwashing? Maybe you just need the right "communications" firm in tow. Good old capitalism at work: assets change hands from those who don't know what to do with them, to those who do. At distressed prices, if the former are panicky enough ...

Well, maybe. I think Shell was hoping they could pull this one off, too. Do we think it's all about shuffling the western-owned assets into less prominent, more media-savvy hands? Or is it destined to be yet another massive transfer of wealth from the naive & decadent West to the hard-nosed East?

ND