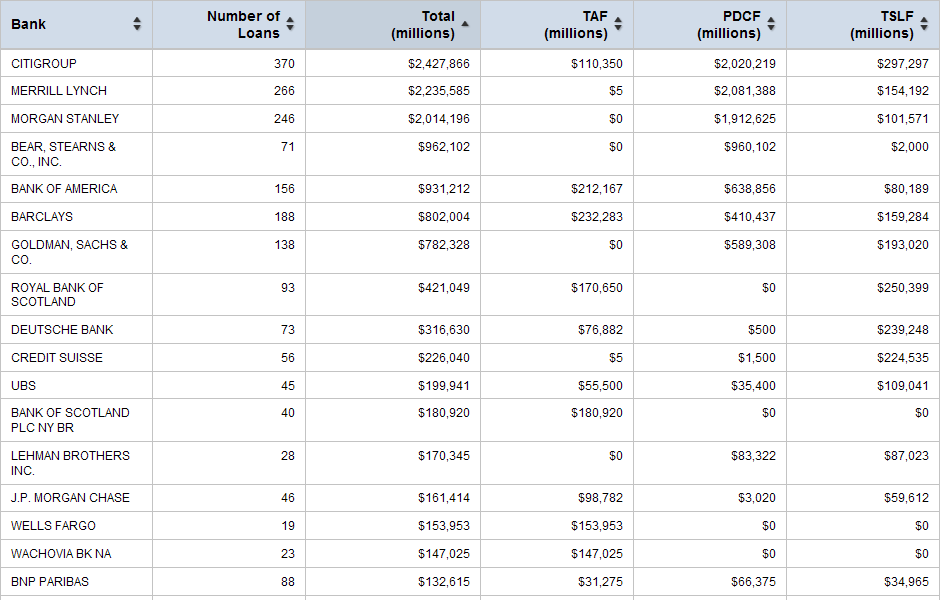

Much data passes me by in the day to day hurley burley, but having seen this tonight I am gobsmacked, yes those columns do read millions. Yes the FED really did issue an amount of money to 100 banks not unadjacent to global GDP in the space of a couple of months. So really, yes, they all went bust.

Click for the full effect.

10 comments:

Ah yes, but those are not the totals outstanding at any one time, those are the totals of successive loans that were advanced and repaid, advanced and repaid.

Quite right Mark, but the time period is months, maybe over a year - so still mind blowing numbers - $800 million to Barclays! Nearly as much as the UK deficit.

no CU it's 800 BILLION to Barclays, like you said in the post

It would be more interesting to have a look at the maximum loan rather than the total churn.

The totals are pretty mind blowing. I'm starting to wonder though if I was wrong about the bank bond rollovers which are due next year, the year after and so on. next year 250 billion has to be rolled over, so presumably the FED could loan this, or the BoE. Surely though it would have an inflationary effect a year or so later, wouldn't it?

Thanks to anyone who can provide an insight

ND - £800 billion, yrup. So the loans must have been enormous - many, many billions. The story in the market re Barclays was that a £7 billion Arabian bailout saved them - this just proves this to be a fantastical lie.

Anon - re the rollover - well, yes you are right. That is what is going to happen. The problem is that sooner of later the rest of the world will wise up to the FEd increasing money supply by these incredibale amounts and then the dollar is going to tank, along with the Pound.

Look at the spreadsheets and you will see that TARP was all Fanny/Freddie stamped paper - implicit US gvt guarantee remember.

ACO - there are the total loan numbers so you can make an estimate as to size. For Barc and RBS it seems average size is just iver $4 billion. That is a lot of Tier 1 Capital.

I confess to not understanding.

I am not sure where the money came from or where it went.

I cannot tell if this is important or a tractor statistic.

The largest of the bunch are the PCDFs.

Banks had certainly lost quite a bit, and are required to maintain a certain amount of reserves. You can't just lend out everything that is deposited (called fractional reserve iirc, and some argue against even forcing banks to maintain a fraction). I think the reserve also implemented some more stringent requirements on the fraction required to be held, and also I'm sure some borrowed additional due to the fed's "stress test" analysis of the different banks...

Anyway, if a bank find that it has less than the required amount, they typically borrow from another bank at a very cheap rate for fairly short terms.

Anyway, when all hell broke lose, banks stopped lending to each other. So, the fed stepped in.

Now, what I don't know is exactly how short term these loans are. I'm fairly certain that they're all less than 28 days -- probably much shorter.

Anyway, these numbers are inflated. Imagine if I borrowed and paid back a million dollars from you every week for a year. It would appear I've borrowed 52 million dollars, although I've never held 52 million dollars at any given time.

It's still scary:

"During the first three days the facility was open, an average of $13.3 billion was borrowed daily with $28.8 billion in loans outstanding. Lending activity peaked in the first week of October 2008, averaging around $150 billion daily."

So yes, that much money was indeed borrowed, but not necessarily all at once, and by and large it's all paid back with interest. I would probably go so far as to say that it has *all* been paid back, since these banks are still around (afaik) and it's all short term debt (although I don't fully understand all the different programs.)

Post a Comment