So what has happened to the 2 nations since the great crash of 2008 and who has come out better. Financial crises take a long-time to recover from and we can't be sure we are there yet, plus of course the US has not had to deal with the Euro collapse, which has probably benefited the US, but more of this later.

First up, let's compare GDP:

|

| Stats: Cityunslicker.com |

We can see from the above that firstly the US crash was worse and also that GDP growth in in the US has been stronger. In total, the US economy is now .12% bigger than 2008 but that the UK economy is still 3.5% smaller.

So on the strength of this the US debt fuelled recovery has done better than the US attempts at austerity.

But how about the Debt to GDP ratio?

The US debt ratio has gone for 66% of GDP to 101% - an increase of 35% of GDP - in real terms this is from just under $11 trillion to nearer $17 trillion

For the UK, debt has gone from 38% of GDP to 70% of GDP - an increase of 32% an a real increase of £300 billion or so. So much for austerity in the UK then, it has been pretty fictional and the same amount of debt has been added as in the US, give or take 3% - but the US has delivered an economy 3.6% bigger.

This is equivalent to about half a trillion dollars, so relative for the UK would be about £200 billion bigger than it is today if we had kept pace with the US, given 50% of GDP goes in tax that would equate to a huge part of the annual deficit of £120 billion odd.

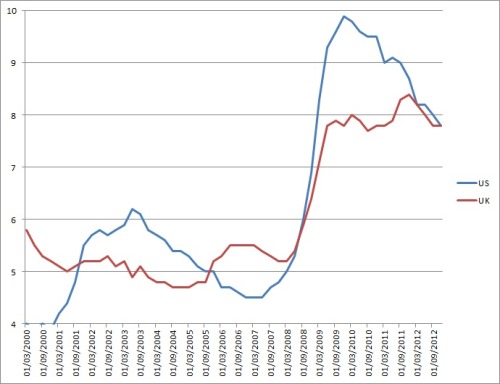

How about Unemployment?

In many respects, there is not much to see here. US employment rose to a higher level than in the UK, but has then come down faster as growth has kicked in - but only to reach the same level as the UK's rate now anyway - with both economies on 7.7%.

Verdict

This is a difficult one, firstly, there has not been much fiscal austerity in the UK and the US is about to embark upon some - so Summers' proposition about our fiscal approach is simply wrong. He does not know what he is talking about. Having said that, the US has outperformed the UK in GDP and seems on a better path than the UK for growth - all for the same relative costs in national debt. So the US has done better.

The reasons for this could be varied, but I would posit better de-leveraging of debts caused a bigger fall in the beginning but has enabled a firmer recovery.

However, the US now has a debt/GDP ratio of 101%. Once the economy normalises and interest rates rise, there will be a massive cost to the US economy in terms of public debt servicing. In the current ultra-low environment, which the US benefits from and the Eurozone crisis helps them with due to flight to safety reasoning, this matters not. In the long term, the UK debt levels should top out at under 80% of GDP -we have a lower debt burden.

Also, should another crisis hit, the US is now just one step away from Greece and Japan, whereas the UK's better fiscal health means we are maybe 2 steps away.

20 comments:

I think you need to rebase the values.

If you express UK GDP growth in terms of USD, the graphs may look a little different - and this is how an international investor will look at the uk.

If you want fun, express them both in terms of EUR.

Summers' point was illogical. He said that the UK was a great example of how austerity doesn't work. We haven't had any yet. He also said that guaranteeing home loans was madness but he was behind the whole US sub-prime madness.

Debt to GDP is a bit of a misleading figure. GDP can be, and was massively by the last administration, manipulated.

Only when one cannot or choses not to borrow more is the real size of the underlying economy revealed.

When both economies have eliminated their public sctor deficits we'll know the real position - which I suspect won't be good for the UK.

I blame Gordon Brown.

And Tony Blair, I blame him too.

Andrew I am not getting into that!

Also I ignored monetary policy, which on a comparison is roughly the same, maybe with the Uk still slightly ahead on money printing.

BE - Exactly, he clearly does not know what he is talking about.

Jer - I don;t think eliminating deficits is really in any of our politicians plans..they may say it, but it isn't. One day perhaps teh markets will make it so but I doubt it as we can print...

Lot of spamming today.

Do you think the USA citizen's ability to hand back the keys and make mortgage debt a lender's, rather than a borrower's problem, has an effect ?

Gilts have a much longer average life than Treasuries: this may prove helpful.

I would just say that neither picture is very pretty!

Will probably look much better if you do the comparison in 12 months time with Cyprus :(

Looking at notional GDP expressed in the host currency is a waste of time, otherwise Zimbabwe would be topping the growth tables.

You should at least look in terms of a basket of currencies (perhaps trade weighted) and definately USD purchasing power.

The man who owned a $200,000 house in a crappy part of England in 2007 now owns a $60,000 house. If he'd traded for gold in 2007 he'd have $600,000.

SL - have you noticed that currencies rise and fall. I don;t think the US/UK ratio has changed much really in 30 years....it was $1.10 to the pound in 1984...its $1.50 odd today.

It's silly to compare Sterling to Zimbabwe, our trade weighted devaluations normally get s reveresed with 4 years on average.

c'est très important de trouver des solutions sans égales mais le problème résoudre dans la manière à suivre pour en avoir en fin de compte un résulta qui peut par la suite faire et par la suite enchanter tout le monde.

this is very interesting and very good """ Larry Summers, a former senior US economic advisor made some pretty stinging comments yesterday about UK economic policy. He said it was a mish mash of austerity and loose monetary policy which has clearly failed, comparing it disapprovingly with the US policies.

So what has happened to the 2 nations since the great crash of 2008 and who has come out better. Financial crises take a long-time to recover from and we can't be sure we are there yet, plus of course the US has not had to deal with the Euro collapse, which has probably benefited the US, but more of this later.

""

I just wanted to let you know that what you do really affects peoples lives and that people - like me - truly appreciate it.

www.elizabethcollege.org |

Great article Lot's of information to Read...Great Man Keep Posting and update to People..Thanks

http://www.sherbornbusiness.com |

Thank you for posting such a great article! I found your website perfect for my needs. It contains wonderful and helpful posts. Keep up the good work!

www.greatbusinessforum.com |

Post a Comment