Ed Balls has bought out that good old political trick of higher taxes on the wealthy. As we all know, taxes on someone else are always a vote winning idea.

Ed Balls has bought out that good old political trick of higher taxes on the wealthy. As we all know, taxes on someone else are always a vote winning idea. As the saying goes, if you rob Peter to pay Paul, you can normally rely on Paul's vote come an election.

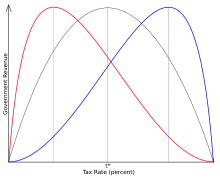

What is harder to dispute is that 50% is above the Laffer curve. the report from the Treasury thus far is pretty inconclusive. Due to people shifting their incomes, in collusion with their companies, in 201/12, there is little real data to work on. We don't really know if lowering the tax threshold raised more money or not. Equally, due to the timing int he middle of a dreadful recession where tax receipts collapsed, we don't really know if it raised any either. Truthfully too, no one knows where the Laffer curve is or if it even exists; if it did real events will always interfere to skew the results anyhow.

The best that can be said is that in the round of £600 billion odd of public spending, the difference is a rounding error. But of course, politically, this is a good old piece of divisive us-against-them vote-winning.

For Labour, it smacks of desperation as they are opposed to every cut so need some sort of veneer to say they would raise revenue. For the Tories, they are left on the side of big business and 'the rich' - a homely pace but not one packed with voters (although election funding is at least sorted!).

Worse news for those of us who want to vote UKIP. Their policy of a flat tax has also had real problems in the real world. Most of the EU Countries who have applied it also have an equivalent of National Insurance too. Except that the NI is often 30%+, so the nice flat tax of 10% ends up equating to 40% odd anyway.

You just can't escape the need to tax in Countries where social spending is so high and increasing all the time as the population grows and ages.

Personally, I think this is great politics from Labour - useless economic policy, but then they have that mark anyway, it hardens their anti-rich vote which outside of SE England is the key to power for them.

40 comments:

Wearily, one must point out that in life there are many issues where there is not a "right" decision, only an option with the least damage or cost. That is if you can really work out which one it is. We have got ourselves into a fix where any decisions on tax and spend are bad news for many people. In any case the only ones these who pay high taxes are those who cannot avoid or evade them.

The cost of the NHS doubled from 2003 to 2013, and the number of people employed went from 1million to 1.4million.

Fundamentally this is the problem. Private sector companies have an interest in becoming more efficient and employing fewer people. Public sector companies have the opposite interest.

Nobody in the NHS thinks "How can we make hip-replacement more cost effective, quicker and efficient with lower labour costs?". In my experience they have made the whole process of getting even simple procedures more protracted and inefficient. The drug companies are holding everybody to ransom. But nobody wants to take this on. Consequently the public sector is expanding at a hell of a lick but without actually delivering better services. Does anybody really believe the NHS is delivering so much more now than ten years ago?

30% of graduates are migrating to the SE. London in particular.

Perhaps they will all become Conservative voters. And I agree that high taxation results in diminishing returns and is usually exacted through populist jealousy more than anything else.

They - graduates - are already subject to high tax in the form of tuition fees.

Why is a taxation on brain power deemed by the Tories to be less damaging for the economy than a tax on earning power ?

Scrap pointless courses and pointless universities please - but why tax clever people for being clever ? Is there a curve for that anywhere ? It seems most inconsistent with Tory tax policy to me.

As I wrote at the time, Osborne should have left the 50% tax rate in place UNTIL the economic news was booming. And If that took as long as it actually has, like to now, then he should have promised a tax cut for AFTER the election.

Politically, which is what this is all about, the TORIES would have had the 'financial sense' high ground all along. Pointing out that Labour never raised the tax to 50% except on their deathbed.

they would have avoided the charge of only in it for their mates and bankers, etc. Keeping the 'all in it together' slogan strong too.

Not many agreed with me at the time...

v. interesting program on r4 late last night.

Pollster basically said that (apologies for badly misremembering) as soon as the '10 election was over :

libdem ~20% - 9 -> 11

lab ~30% + 7 -> 37

(the rest went to the greens)

cons ~37 - 7 -> 30

ukip ~3 + 7 -> 11

and nothing much has changed since.

... so it seems labor are looking to pick up the LibDem vote.

I am not a libdem person, but I am not sure this will go down that well with them.

Instincively, a tax rate _over_ 50% feels like it would be on the wrong side of the Laffer curve.

I am not sure where = 50% lies

Whose idea was it to decouple the income tax and NI thresholds?

The Lib Dems made a big thing about the personal allowance being raised to £10k, but the NIC4 threshold has barely moved and the difference is catching up.

On a low income (say 14k) for 2014/15 you'd pay £544 NIC4 while on the old decoupled rates it'd only be £360. That's in essence a backdoor raise from 9% to 13.6%.

Why is the media obsessed with a 5% increase on top earners but ignore a 4.6% raise on the lowest earners?

"old decoupled rates" should be "old coupled rates".

Worth remembering the coalition has already created a >50% marginal income tax. The Child Benefit recovery tax in the £50k-60k band.

A 55k-ish earner with 3 kids is on a 66.5% marginal tax rate today: 40% tax + 2% NI + 24.5% CBrecovery = 66.5%. Where was the laffer curve when Osborne dreamt that up?

Should you be blessed with 8 kids (gulp) @55k-ish, you have higher than 100% marginal tax rate!!

... forgot to point out that there are probably far more people with kids in the £50k-£60k income range than people in the £150+k range. So this isn't a weird corner case - it has more significant people impact than the Labour proposal.

Even with just 1 kid the marginal tax rate is 52.5%. (40% tax + 2% NI + 10.5% CBrecovery = 52.5%)

Don't forget that the vast majority of the incidence of employers NI is on the employee - ie in the absence of employers NI wages would be higher than they are today. So in fact tax rates are already well north of 50%, its just that approx 12% of your salary gets taken away by the State before it even gets nominally attributed to you.

@Ryan your point about the drug companies and the NHS is similar to one I made to much misunderstanding a while back.

Much welfare spending is accounted under recipient welfare, where as infact it is more importantly in terms of politics, lobbying and spending actually corporate welfare.

50% is a big round number. It says out loud they've not done their homework to see if 48%, 52% or even 72% will raise the amount of tax needed to pay off the deficit.

Instead this a philosophical move saying that over half - adding NI - of your income belongs to the state.

So glad I live abroad these days.

Laffer curve is an important economic / behavioural concept but, as CU said, not at all reliably quantified, and in all probability a constantly moving target with at best retrospective application

if irredeemably uncalibrated it remains a platonic construct: 'laws' of economics should never be confused with laws of physics, notwithstanding the garbage issuing forth from 'econometrics'

it's gesture politics all the way

(believe it or not, newstyle WV = voteas always ...)

If I was running Greece right now I'd be looking at the tuition fees and the taxation and rubbing my chin and putting a plane together like this:

British weather is shit, tuition fees are shit. Taxation is high. We are going to create a British enclave on one of the Greek islands where all you bright young Brits can come and live. You can forget about your tuition fees and we'll only charge you tax at 20%. Come here and write some apps for the iPhone, or make music or whatever in the sunshine and tell the UK to go screw.

This is what we need - a bit of real competition between styles of government. Then we'll see just how long socialism lasts.

@Nick Drew: I'm not so sure that the Laffer curve is as unqunatifiable as many on the left would make out.

If you are free to drop your working hours by 20% to avoid a high marginal tax rate - you are quite likely to do so. Similarly, if your income after tax is no better than being on bennies, you are likely to go on bennies. So I think the Laffer Curve is an overly simplistic measure - but a more sophisticated measure would start to call into question whther high marginal tax rates make sense at any given income point. We saw that union leaders were paying mor einto their pension funds to avoid the higher tax bracket - which of course means that instead of paying 40% tax on say £10,000 over that bracket, they paid no tax on that £10,000 because they had adopted a tax avoidance strategy well within their grasp. As soon as you put a hard and fast boundary where extra tax is paid, people will put extra effort into slipping just under it.

So, we should replace the Laffer Curve with the Ryan Effect: The tendency for fixed tax boundaries to push taxable incomes under those tax boundaries.

@Ryan & your advice to the Greeks: the Irish have long since planned this in the event UK socialists carried out their longstanding wet dream of making life impossible for Public Schools

Eton-on-the-Liffey would be a reality quicker than you can say Eleven Thousand Pounds per 'Half'

The clear, and in my view inevitable, solution to all this is a land valuation tax; This is what you are all staggering around and probably afraid of your shadows will come.

Watch businesses abandon London for Newcastle or Carlisle to reduce their tax burdens. We would be able to create tax havens _within_ our own borders.

All this arseing around about rates is just flatulent grandstanding by a bunch of self-aggrandizing morons in London. Its incredible how little they get done, but of course, if you are hell-bent on maintaining the status quo, thats all you can expect.

The main obstacle to Land Valuation Taxes are precisely the type of fat old insouciant c*nts who populate parliament and their notions of entitlement. Ring any bells?

We need wholesale reform here, not piecemeal tinkering and bull*hit artists.

Lots of great comments until Land tax - which is a silly communist idea that would destroy the south east of the country and remove property rights so that all the foreigners bail. bejesus it is badly through through.

the points on NI are well made. mr CU is lucky to be a very well paid person, enough that these changes have a small impact on me. The real impact is the 100k removal of personal allowance and child benefit - this costs me thousands. 5% extra is marginal. Plus NI means I pay well over 60% in income to the state at every pay packet. That is why Ryan and you all have excellent points - 50% is a meaningless headline when the real withdrawals are made via employer and employee NI and other benefits.

A pox on all their parties for demagoguery and economi illiteracy.

So why don't those on welfare get up and work for a few more quid a week.

Answer, the laffer curve, but at the other end.

It's real

I just don't get whose votes he's after - surely he's just preaching to the choir which seems premature or desperate.

I'm all for gesture politics. Who is going to gesture at me? Oh, nobody. I'll just sit in the middle of the range and pay for this whole bloody charade, ignored by all parties and pressure groups.

Screw them all, this system no longer has my support nor consent.

rwendland - the NIC employees' marginal rate is 12% not the 2% you stated. So your sum: 40% tax + 2% NI + 24.5% = 66.5% should be 40% tax + 12% NI + 24.5% = 76.5% assuming the child benefit rate really is 24.5%.

Employers' rate is 13.8%. So if you are a recent graduate the marginal rate on the cost to your employer (yourself if you are a Ltd company under IR35) for pay above £32,010-00, but well below £50k, is: 40% tax + 12% EmployeeNI + 13.8% EmployerNI + 9% = 74.8%.

And Osbourne thinks that will entice more small company setups?

Land Tax: - a tax on wealth you already own having purchased it with income that has already been taxed - twice.

Communism by the back door.

Of course, in an age where ever more people are opting for the "Grand Designs" approach to self-sufficiency and thereby escaping the grasp of government almost completely, you can understand the atrtaction to the state......

Further to my grump last night, I have been thinking more about this (thinking is always dangerous).

I think it's clear in a handwaving way that as tax rates go up they are bound to affect investment/spending/etc. decisions. After all, that is why Parliament levies "sin" taxes etc.

But while higher and lower marginal rates on different things must inform decisions, might it not be the overall burden of taxation which affects overall levels of investment/spending/etc.?

All the above discussion of huge marginal rates of "income tax" prompted me to look at what proportion of my total earnings gets stolen by the state.

Adding up my income tax and NI, estimating how much I spend in VAT, council tax and adding a little bit extra on for booze tax I reckon my taxes are about 35% of my gross income. This does not include whatever my employers pay in NI on my behalf, because I don't know how it is worked out.

While this 35% is a complete waste of money because public money gets spent on the wrong things and I seriously object to being treated as a cash cow, it is a considerably less scary number than some of those being bandied about.

Watch out BE withdrawing your consent, you'll become a radical of some persuation next :-)

Land value tax!!! Wtf

You put a stake through communism and it reappears first as environmentalism and then as this nonsense. Ryan and CU have it right. Aside from the tax iniquities and destruction of property rights, it would make us all serfs of an all-powerful state. And we already pay the highest property taxes in the world.

I daresay that pillock Wadsworth will turn up any minute and accuse us all of being "homeownerists", whatever that is.

No pox on me for my own illteracy however.

Mr BE, your ax rate needs to of up by about 13.8% - so nearer fifty percent for you old chap. Also did you include say petrol, insurance tax, betting tax, how would you know what import duties are raised on the products you buythat is added to their price when you buy.

Plus you should average out over a few years the stamp duty of buying a house. In a couple moves with stamp duty levuies a few years ago my effective tax rate for that year was around 80%. I am sure I did a post on it, must be in the archives somewhere.

Great. Thanks for ruining my fantasy.

I don't have a car, nor bet, and import taxes are built into my VAT number I reckon.

I can't afford to move out of my shitty crumbling damp ex-council flat even though I earn a supposedly good salary, so no stamp duty for me.

I also have a lodger so get some tax-free income from that and I put huge sums into my pension pot so that lessens the overall tax burden (although it doesn't improve my spending power!).

How depressing.

The other day when I was struggling to get a GP appointment I worked out that my "contribution" to the NHS is double what the top level BUPA policy would cost me. I pointed this out to the practice manager and suddenly an appointment was found for me.

As for the rest of public spending, I think the least the recipients of my largesse could do would be to send me a thank you card every month.

Actually I have some time for the notion of land taxation, although I wouldn't suggest that it should replace all other taxes as *some* do.

I think that land is incredibly inefficiently used in this country which is surprising given how little land we allow ourselves to use.

There really is a problem with grannies "bed blocking" the bigger houses while larger families are stuffed sardinelike into pokey little flats and Barratt boxes.

There's also the problem that London really is a bubble by which I mean that there is a virtuous circle of talent moving to London so London becomes yet more attractive to talent. I am not against this but the whole country cannot be a suburb of London. A bit of extra price competition between London and the North wouldn't do any harm surely.

I wouldn't introduce a land tax though. I might sort out Council Tax so that councils raise most of their own money, and sort out the bands so that expensive houses pay more tax.

And there would have to be some clever transitional system so that people didn't get shafted.

Actually in 2015

GDP = 1581, Spending = 668, deficit = 97 (source ukpublicspending.co.uk - not sure how accurate)

So the Govt spends about 42% of GDP and in that 42% borrows about 6% for you, so the average person (as companies are owned by people) currently experiences about 36% taxation.

Not sure about a land tax, but I would go for CGT on housing owned by people and imputed annual CGT on housing not owned by people.

I think commercial property is already taxed on disposal?

oops s/2015/2013/

Budgie - "40% tax + 12% EmployeeNI + 13.8% EmployerNI + 9% = 74.8%."

Where's that 9% coming from ? Withdrawal of Child Benefit ?

Above 42K you only pay 2% employee NI - alas I don't think that the beautiful zone where you're still paying basic tax but your NI rate is 2% exists any more.

So you're still talking a marginal rate of 40% plus 15.8%. Which is a damn sight more than someone paying themselves via dividends will pay even at 50% !

36% of GDP is an interesting figure but it doesn't help us work out how much tax people are paying because about 50% of the population make no net contribution to the public purse. This means that the tax burden falls on only half the population. (Yes, I realise that the other half *think* they pay taxes, but they really don't).

CGT on residential property? So if there's an increase in house prices (no individual can affect this one way or another) you could not sell your house and move to a similarly priced one. What would that do to labour mobility? Or would it put pressure on politicians not to create housing booms in the first place?

Hoping for

"put pressure on politicians not to create housing booms in the first place?"

Realistically,

if you make moving house more expensive, chances are you end up with more people renting (like france).

CU: " Land tax - which is a silly communist idea that would destroy the south east of the country and remove property rights so that all the foreigners bail. bejesus it is badly through through"

What is this nonsense? Raising £1 in LVT quite observably does less harm than raising £1 in income tax (let alone VAT or NIC). Why is taking £1 of somebody's earned income OK but not charging him £1 for benefits received?

Why is somebody's earned income not their "property".

And quite provably it would not "destroy" high rent areas - if anything it would improve them, because those hard working 30% of graduates who come here don't mind paying it (they are currently paying it as privately collected LVT i.e. rent) and it would shoo away the unproductive people in the South East.

And foreigners would not bail. Why would they? There are plenty of rich foreigners in Switzerland where they have the 'lump sum' tax system which is effectively very high rate LVT (the good news is that if you pay this, they let you off the income tax).

You keep saying this knee jerk Tory stuff but it is simply not true.

And I suspect that Sebastian Weetabix is a Faux Lib rather than a Homey, i.e. not worth arguing with. Go on YouTube and search "Milton Friedman property taxes" and try your silly arguments with him.

Anon, I guess that Budgie's 9% is student loan repayments.

Ryan: "Land Tax: - a tax on wealth you already own having purchased it with income that has already been taxed - twice."

Just because those other taxes shouldn't have been charged in the first place and ideally would be got rid of, the best tax is simply charging for benefits received.

And you don't buy a house out of taxed income, you buy it with the money you save on rent.

And the older Homeys who trot out this nonsense, and it's them who bought their houses for tuppence ha'penny years ago, so the tax they had to pay to generate that income was about one shilling.

FIGHT!

NB. You have to rescale all these tax calculations, because the 40% income tax is based on the number on the P60 which doesn't include the employers NI (nice trick that - an income tax which the majority of the population aren't even aware of).

If you're including employers NI in the calculation, then you need to rescale all the tax %s to match.

Mark, lets put it in terms that are easier to understand.

Consider a farmer. Is it the farmer's LABOUR that is putting food on your table, or is it the FARMHOUSE?

Now do you understand?

You can only tax LABOUR. You can only tax LABOUR because only LABOUR produces output. You can apply tax in all manner of inventive ways but in the end they can only be paid by labour.

Not your fault Mark. The Marxist left is always trying to re-frame the argument so that we no longer know up from down. Strange really because it was Marx that pointed out that all wealth comes from human labour in the first place. It was one of the few things he got right.

Ryan, as I might have said above, go on YouTube and search for "Milton Friedman property taxes" or read the relevant bit from Adam Smith.

Taxing earnings and profits is far more socialist and damaging than taxing land values. There's no natural reason to want to tax LABOUR unless you are a socialist who doesn't believe in the Laffer Curve.

And of course you can tax land - people are prepared to pay rent or mortgage payments to occupy it, and that stream of wealth going from LABOUR to LAND can be siphoned off as a tax. Lots of countries - including the UK do it or have done it to a greater or lesser degree.

So your statement that you can only tax LABOUR is slightly absurd and flies in the face of observed facts.

Post a Comment