Andrew Lilico- writing yesterday - is very critical of the Bank of England. Along with many Austrian economists he sees the failure of the Government to stop inflation as a betrayal of our Country. Of course, this is true on one level, the current government and any future ones are reduced to impoverishing the population as they can't bring themselves to shrink the Government nor ween the population off unaffordable social benefits.

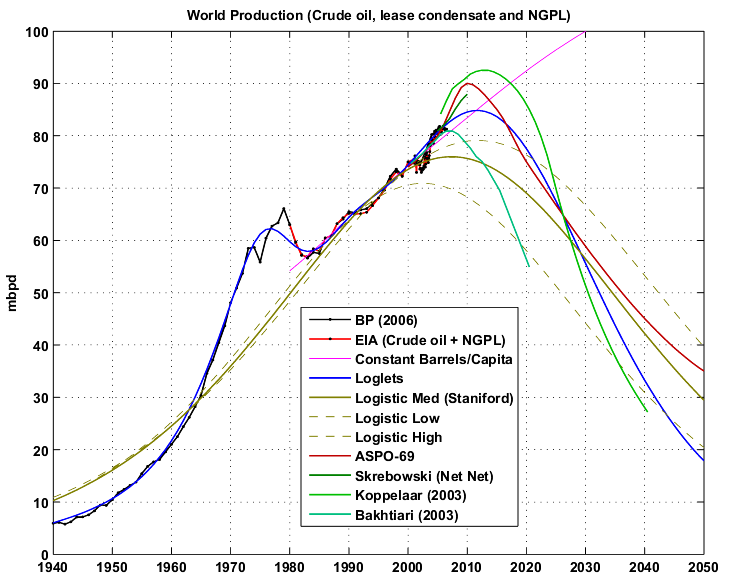

The main accusation though is that the Bank of England is not helping by ignoring inflation which we import - this in turn offsets any gains we may make in exports. However, long-term, perhaps we need to make some adjustments. Look at the graphs below, global population is expanding rapidly and resources are being consumed ever faster - faster than we can produce them at current prices. Of course, in food terms Malthus and his ilk have been proved wrong too many times. But you can't grow Oil, Rare Earth Minerals or Uranium. Technology will help mankind to survive, but in the next 20-30 years the Earth will experience the peak human population boom. This will mean prices for everything increase as more people compete for limited production. Again, capitalist market economics will ensure we will find enough ways to extract resources, but the real price will have to rise to get them to market - so implying significant real terms inflation.

It is not the end of the world, but it does mean that inflation is with us for a long time to come (ignoring any small deflationary dips caused by recessions along the way) - if this is the case, what should our macro-economic policy be? There is certainly a danger with fiat currencies of the wealth of nations being decimated in short order by poor policy decisions. Arguing for a pure anti-inflationary stance as the starting point of domestic policy can't be the right place to start from for the long-term.

6 comments:

The way to be able to afford to buy more of the internationally-traded bits and pieces like food, oil and iPads is to earn more. Would a different monetary policy over the last couple of years would have made Britain richer than it is today?

I read 'When money dies' by Adam Fergusson and recommend it to all.

There is a section devoted to the Austrians.

Basically between 1919 and 1923 they lost their empire, their currency, there was mass unemployment, the whole of the middle class was impoverished, mass shortages of food, social unrest, and the government was effectively handed over to foreigners (the league of nations) and at one point the chancellor was seeking a merger with Italy, Germany or France.

Even though this was some 90 years ago, I can understand the Austrians collective horror of monetary instability.

BE - as ever, who knows with hindsight. Certainly the current Govt is going wrong with tax hikes and no spending cuts. the real issue is the massive bank bailout - that is what sytmies normal economic activity and will continue to do so over the course of this parliament.

Andrew - One for my holiday reading list i think, ta.

Hmm, I don't think the thought experiment is as hard as you suggest. If the BoE had only dropped rates to - say - 3% would the economy have grown more or less since the crash? I would guess rather less. Likewise the government is doing the absolute minimum in order to preserve low interest rates. We are still in a deflation/deleveraging phase so if the government slashed spending and cut taxes there is a good chance the private sector simply would not replace all that lost demand.

I can't get worked up about 5% inflation, I really can't. I am just about old enough to remember double-digit inflation and how miserable people were in the early 1990s. This recession has been nowhere near as bad.

The TBFPII(Timbo's Beer Fags & Petrol Inflation Index) - newly calculated :)

According to this index inflation for the last 40 years is running at an average compound 9% (just below for the "P" element)

Elements:

1971 -----> 2011

Fags 4s/11d -> £7.10

Beer 1s/10d -> £3.30

Petrol 1s/3d(ltr)-> £1.35

("New Money" and Imperial conversions left as an exercise for the reader)

I've calculated a couple of others. Such as Housing:

My first house was a 2 Up 2 down Terrace House. Cost in 1972 - £6000.00

Apply 9% Compound for 40 years and you get Ta Da! £188,456.00 Which is probably just below what you would pay for said house in Sunny Central Surrey today.

Breakfast (in a greasy spoon café) 1971 = 1s/6d compound at 9% = £2.35 Try finding breakfast (including tea) for that!

I know someone is going to say that some things (material manufactured things) have reduced dramatically relative to the 1970s But we don't have to buy those things where as we do need breakfast, petrol, houses and most definitely beer.

Conclusion:

The government figures ranging from -x to +x for annual inflation are bollox! If you want to know what things are going to cost in retirement - compound today's price by 9%

We all know that inflation is used to make the government's (and our own) debts disappear quicker. More inflation = more tax income. But how is this supposed to happen when the wages to be taxed are actually decreasing? To pay the debt using inflated taxation we need wage increases to be around 9% PA not -3%!

Conclusion 2: We are 12% adrift of the debt payback by inflation scheme (I don't see UK manufacturing and export paying for it)!

Don't worry, we are on the verge of WW 3, that should reduce the human population by a couple of billion. Wars always happen when commodity prices head up, you are familiar with the war cycle aren't you? Marc Faber had a good section on it in his book, 'Tomorrow"s Gold'. Not the most cheery read, but as Gandalf said, 'nobody would choose to live in these times, but these are the times that we live in".

Post a Comment