The front page of the FT today is focused on the continuing story of the Euro crisis and the proposed haircut on Greek debt. Why there is no discussion about the other PIIGS at the same time is beyond me, but hey ho we can do that next year perhaps.

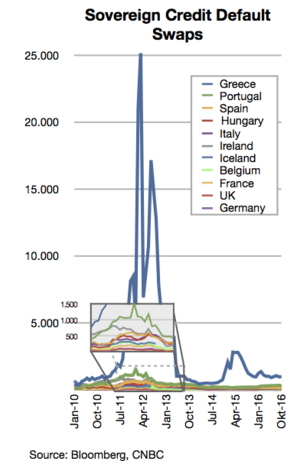

Anyhow, the Bankers are trying to defend their positions as much as possible. Clearly they don;t want to take more state money than they have to as this will end in restricting their own pay substantially. The current line being pushed is fear of the CDS market and what impacts that may have.

Rather conveniently, no one knows the answer to this - so it is the ultimate bogey man. As the respected Chris Whalen observes ""To be generous, you could call it an unregulated, uncapitalized insurance market. But really, you would call it a gaming contract."

Although I doubt my 2 year old son could be persuaded to be scared of a Credit Default Swap monster - it does though seem to work on politicians.

the reason that it does not matter is that CDS are predominantly issued by banks and things that pretend to be banks. the fact that some of these are going to have big problems is of little consequence to the real world and indeed, some banks going under is a good thing. As with Northern Rock, idiotic business models need to be allowed to fail.

Worse still, with a 100 billion euro fund to support the banks with their bad CDS positions and overload of Greek sovereign debt, there is a decent fund to help the needy anyway - all at taxpayer expense. This is even more of a non-issue.

We only have a day or two to wait for the final verdit, it will be interesting to see if financial alchemy based lobbying wins a reprieve for the banks or not.

10 comments:

But why would the CDS market be a problem? Positions are collaterialised on a daily basis. Whoever is going to lose money with Greek bonds at 50% of nominal has already lost it and paid out on it.

This lay person learnt about CDS from Gillian Lett's excellent book, "Fool's Gold". The account covers from their creation to them all going 'orribly wrong. Fascinating and enlightening.

"Why there is no discussion about the other PIIGS at the same time is beyond me". But not me: it's because the FT is not an impartial observer, but has long been a hustler for the whole Euro scam. That's why.

All you need to know about why certain people choose the F.T.

Should we add the video to this post?

http://www.youtube.com/watch?feature=player_detailpage&v=5HaqxxgPoEE#t=7s

Many CDS Tim are only triggered by a default event - so they only get paid on default which is what is going to happen to Greece. CDS defautl at 60% is not priced in until it happens. That is the way the accounting works - god knows where the music stops.

Although the summer correction in the markets has been caused by Banks needing to post morecollateral against their CDS positions and withdraw from other positions to do so (Downgrades a big factor here too)

Think of AIG, if the losses on CDS were daily collateralised with any market foresight, how come they ended up with a $180 billion loss over 18 months - it should have been priced in immidiately but there is market inefficienty and accounting tricks to get past, it depends on the types of contract, the timing and settlement issues etc. CDS being OTC is a big problem here as the ISDA standards are questionable themselves and designed to be overly complex to allow mutliple get outs.

I think that the central banks should have arranged to find a solution rather than rely on the politicians.

FFS Cameron, pull your f*****g finger out...

Just today, I had a long-awaited meeting with three accomplished and professional property people. It had taken me three weeks to get these people together.

It was a sparse lunch, yeah, a couple of tinctures, but the theme was still exasperation, and severe angst at the failure of this blasted government with their lacky banks, to bring it on.

We discussed seven schemes. Seven big building projects, ranging from, roughly - £6m to £15 million pounds.

Each one, when costed, appraised and verified, (RICS standards I might add) showed a minimal profit for us, but, 10% of fees going to other starving businesses, like architects, engineers, builders etc. There was a huge element of 'funding' expectation (i.e. what the banks will rake in for their ludicrous 'risk'), but this stupid administration are getting as bad as the last lot. You'd expect a nulabour crowd to be incompetent and clueless where commercial expertise is required, but the piddling about we're coping with right now is insufferable.

That 10% going to others, (forget the banks' take, they'll stuff you anyway) therefore amounts to about £7,000,000 pounds, which will be used up by waiting, desperate, consultants, builders, sub-contractors etc. The figures are all calculated correctly, and they meet normal financial requirements for funding. There would also be approximately 425 jobs created from our schemes.

From now on in, we are forced to 'negotiate' with councils for planning permission. We're not digging out green belt land, despoiling the parks etc, we're commercial people, making jobs in business areas etc. Councils prefer to prevaricate for months, while the meter clocks up thousands of pounds in interest (banks again), and of course, they might well charge for their 'advice'. It's an utter disgrace that these little twerps can hold so much business to ransom, sit on their hands, and try to apply an obscure policy which is beyond his/her understanding, or they go on paternity leave.

So Scrobs is feeling a bit let down by Cameron and his bunch of wandering people. At this rate, he'll be asking the Hon Prospective Member for UKIP a few serious questions, like, 'If you get in, how will you look after your own country first...?'

Scrobs - Wow !

The wrong men are on the back benches.

I'm thinking John Redwood in particular.

>We only have a day or two to wait for the final verdit

Still sticking with my 2 month old forecast for pandemonium this All Souls weekend.

Splice the mainbrace! batten down the hatches! Here we go...!

Lovely rant scrobs. The banks indeed are hoarding cash - but then all businesses do when they are gasping for their last breaths - our entire banking sector is flaming out on a global level currently.

Post a Comment