My goodness.

The denizens of the Bank of England have only gone and done it, raising interest rate by 0.15% today. A harbinger of the doom to come.

Inflation sits at a mere 5% or thereabouts and surprisingly wages for the year have manager, err, 0% rise. Too much covid and change in the economy to sustain wage rises even though some sectors have done well.

Still this is almost the first rate rise I can remember! People under 30 won't even really know what the Bank of England does or what the significance of interest rats is - we have been in a zero-interest economy for so many years, nearly a decade and a half now.

Of course, with Quantitative Easing and inflation, real interests rates are at -5%. Holding cash is very bad for your wealth, much better to spend it or buy assets as quick as you can.

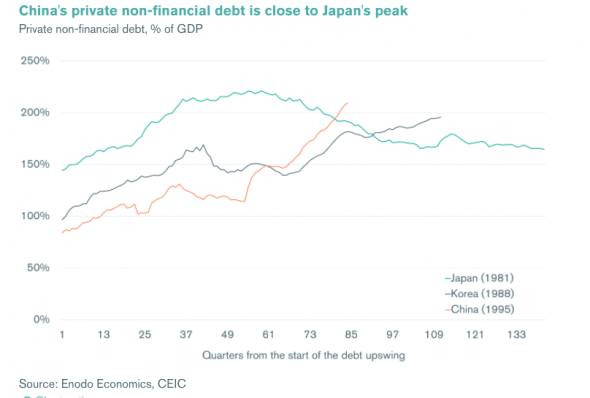

It is still a long way from going back to a 'normal' economy and I still feel in the end the only way back will be with some very high inflation to erode the debt pile of the West vs East dynamic in the world - and that will be so painful that the politicians might try and put it off for generations yet.