When can we be rid of this virus? No, not Covid, the Federal Reserve.

Yes, I know, you think I am about to enter a conspiracy world of who owns the Fed and how it is all some cabal of Jeremy Corbyn's deepest and closest friends.

Well, sorry to disappoint, but instead there is a huge story here. When Tesla fell on Monday 20%, erasing in truth only a month or so's gains, Bitcoin fell in sync. Suddenly, Jerome Powell, chair of the Federal Reserve, decided to remind the markets that the Fed would not remove the trillions of excess liquidity from the economy anytime soon. The liquidity is a feature, not a bug of the current system.

The same is the case with our own Bank of England, but we have not had a huge run up in share prices and other assets like the US. Here, Government debt has easily absorbed all the extra debt created by the Central Bank.

In the US, we are seeing crazy wild markets. Bitcoin and other digital currencies are hitting all time highs, SPAC's (Special Purpose Acquisitions Companies) are literally raised like South Sea bubble entities - "for reasons for which no one is to know the purpose." Sadly, I see the FT and lawyers etc rushing to promote shell companies in the UK and to try to get SPAC's registered here.

SPAC's are a sign though, as are the crazed valuations of a few successful stocks. There is not much to invest in and there is far, far too much money chasing it. Private Equity sits on its largest amount of 'dry powder' - money raised but not deployed, ever. This is getting put into SPAC's to 'deploy' it but really it is just moving around savings and charging fees to the investors.

With the markets the way they are, the underlying economy is in a wild phase itself with Covid smashing some sectors and boosting others. Forcing technology change in a year that would have taken a decade before.

Central banks have created this monster and Governments love it - after all for them it is the magic money tree come true. Massive extra spending and no inflation. If inflation comes about then it is easy to cancel the fantasy QE bonds so goes the Central Bank theory and reduce money supply.

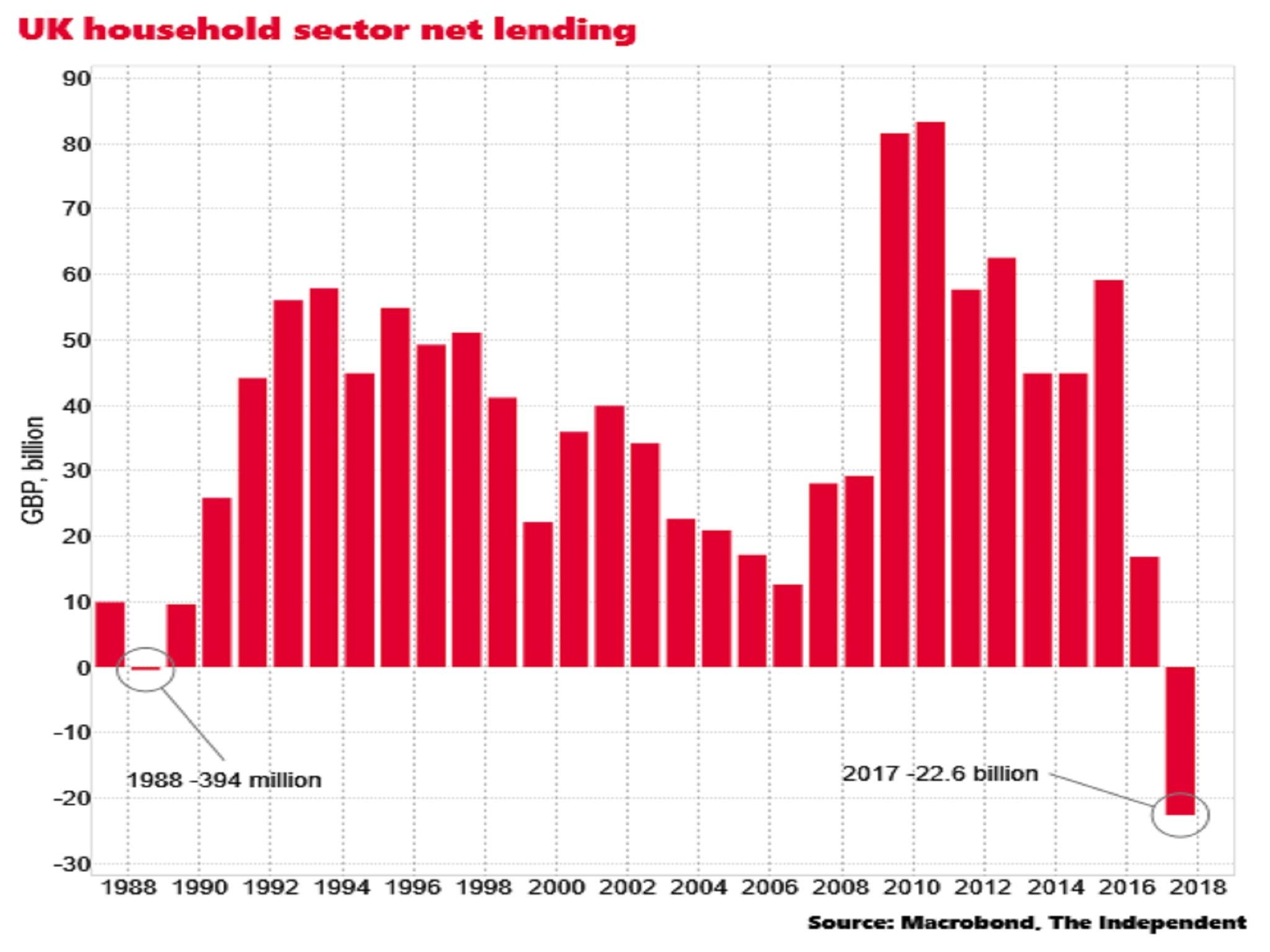

See below for what we are really doing though - a huge currency debasement strategy with apparently limited inflation impact.

I am thinking hard on how this ends. In 2006, a huge run up in credit and debt ended in Great Recession, which was entirely predictable for 2 years beforehand. Here we see the Central Banks juicing the market and Covid providing both the spark but also the cover. My base case is the blow off phase lies ahead of us still - perhaps after another run up of asset prices. In reality the end phase must be some serious inflation or, if the Central Banks execute on slimming their balance sheets, huge deflation and bust. Either way, it is not a happy ending.