How the decision was made for Yvette Cooper to stand as a Labour leadership candidate.

And how Ed Balls reacted.

Friday, 28 August 2015

Friday Fun - Naming Day

What name best suits for the new Labour Leader?

I really like the Jezbollah efforts that I have read, better than the bland Corbynista. Can we do better though?

After all we are about to gets years of hilarious copy on a plate with nuclear disarmament, Nato-Withdrawal and Open borders for the Open University.

The top runners for me are:

Jezbollah

Jezallah

Jerry the Red

any advance on these?

Thursday, 27 August 2015

Next target for the newspaper's oil wrath : retailers

In the recent times the Major petrol retailers get a lot of stick, somewhat justified but not entirely, for not reducing their prices when the price of crude oil falls. As I have gone into before, the refining of the product and margins in that industry are of course more important factors. Not that journalists care.

I have been impressed of late with Journo's uncovering the scams at airports and hospitals where customers are over-charged because of the captive market created in the local environment. These are good things and show the power of a free press, albeit in a small way.

To continue this theme, we can consider what crude oil gets made into - the answer is easier if we try to think of things not derived from crude oil. For example, in a supermarket:

- All the medicines are oil based more or less,

- All packaging that is not pure paper - so, er, all of it.

- Most flavourings and dyes

- All baby products, with each nappy being one cup of crude oil originally for example

- Then there is the heating and lighting

- Much apparel, including all trainers, are mainly oil based

- Plus the costs of transporting everything to the market.

- Even all the food is grown with oil based fertilisers.

So basically, supermarkets have had a 50% reduction in the input costs to their products in the past year months. It may take some time to feed through as many of the products are a long-time in production and transport. We should really expect to see big reductions in retail prices across the majority of goods. In fact, this alone could well be enough to push the country into deflation for the rest of this year.

However, I have a sneaking suspicion the desperate big Four supermarkets - all suffering from stiff competition, will use the falls to help them rebuild margins and profitability where possible.

Wednesday, 26 August 2015

FTSE struggling to hold 6000...

"A summer blip"

That was the confident tone I head on speaking to friends and associates working in the Banks on Monday this week. The adults were away and there was low volume, allowing hedgies and their algorithms to have their fun by hitting stop losses.

No need to worry, China has a history of the Government interfering in the economy to keep everything on track.

Yet I now note the US markets were not very re-assured by the Chinese panic interest rate reduction announced yesterday. Indeed, the market fell. The FTSE in the UK today is down another 1% and struggling to hold above 6000 points. Indeed, the long terms chart looks like it is ready to make a decisive break up or down - I don't get the feeling that an 'UP' is on the cards right now.

When the Central bank cannot provide re-assurance to the markets through emergency policy then something fundamental is really wrong in the economy. China is an interesting conundrum as it is unlikely to do anything as radical as fall into outright recession. The markets there too have been juiced with retail investors who are being robbed by the professionals as is ever the case and this may make the situation appear worse than it is.

However, I am mildly worried. September is upon us and after that October. It is 7 long years since 2008. These months have a terrible history of igniting the woe in the markets and the economy.

What will happen when the adults come back next week?

Monday, 24 August 2015

Getting old ?

The air crash at Shoreham caused the first civilian deaths at an airshow in 60 years.

And while the crash was certainly a major one, and some relatives of the dead asked for air shows to be stopped, the track record at these events is unbelievably good. Its far far more likely a person would be injured traveling too an airshow than at an airshow.

The government decided against the usual panic, media led calls for intimidate knee-jerk action. in the debates its always suggested an outright ban as the first response. When the London and Glasgow helicopter crashes occurred there were similar calls to ban all helicopters in cities.

Instead the government decided to stop flights by the vintage planes and have a review. They are going down the health and safety, risk assessment route. And quite right too.

As we read the other week on this blog, when discussing the Tornado, military aircraft in particular have a short shelf life. They aren't supposed to be flying 50 years after they were designed. Who would they fight? Who would dare fly them in combat ?

The United States had an unusual role for some of its veteran aircraft. They were turned into airbourne firefighting planes. Dropping gallons of water-slurry onto fires. Vintage aircraft were a common sight, indeed the only sight for many years as these planes, a mix of transport and military designs, some 50 years old, were used regularly by the US Forest Service.

In 2002 a c-130 transport plane, which was built in 1957, suffered structural failure while firefighting and broke up in midair.

In another incident that year a variant of a US Liberator bomber,converted for firefighting, also broke up during operations. This plane was from 1945.

Naturally both had had airworthiness certificates. And been approved to carry out their role.

Nevertheless in 2003 several planes were told to be withdrawn from service and in 2004 the entire tanker fleet was grounded.

For the USA this was a major blow. Wildfires are commonplace. Grounding an entire fleet of 40+ aircraft left just helicopters and light tankers and some more modern, converted, military transports.

But the authorities had decided that the accident rate, general maintenance, stresses of their role, left them no choice but to ground all the old planes. And the Forest service would have to just do what it could until new aircraft became available.

Initial reports from eyewitnesses at Shoreham seem to suggest it was not mechanical failure that caused the crash. So grounding every plane over 20 years old would be foolish. instead the regulator has instructed that..

Vintage jets will not be allowed to perform "high-energy aerobatics" over land at air shows. And all Hawker Hunters,the plane that crashed, have been temporarily grounded.

This does seems a very sensible precaution.

A B-26 invader from the Steven Spielberg movie ALWAYS. A film about dare devil aerial firefighters.

The film was released in 1989 {and a bit of a flop - even though its a great romantic film}.

The B-26 was a WW2 bomber. An early one too. Coming into service in 1941.

Back form hols...all a bit worrying... all very 2008 too?

Tuesday, 18 August 2015

Paddy Power pays out on Corbyn

|

| Noel Gallagher ? |

Bookmaker Paddy Power have paid out on Jeremy Corbyn being elected leader of the Labour party.

This is a surprise. the ballots have barely even gone out. There are still weeks to go.

Yet the betting company decided that there wasn't any point waiting as Corbyn was so far ahead; on every opinion poll and every popularity indicator, the unions backing, that it was a forgone conclusion he would romp home.They have their own data too. The actual sums being waged. Which are mostly going on Corbyn.

And of course, by paying out on Corbyn, they make his victory even more of a certainty.

So justifying their decision to pay out early.

Describing the MP for Islington North’s success in the campaign as the “biggest upset in political betting history”, Paddy Power is so certain that Corbyn will win that it is paying out £100,000, even though polling closes on 10 September.

So. it really does look like its happening. Syriza is coming to Britain. The false dawn of the Mili-Brand Youtube will be buried under the arrival of the real deal.

What the exact effect of this will be, we can never be sure. Likely it will mean disaster for labour. But that is not certain. It won't take much of a downturn to kick of the austerity marchers again. If teenage Israelis are kidnapped and killed again, who knows how that nation will react? Another 'invasion' of Hamas?

Tory sleeze hasn't had much of an outing since 2010. We are long overdue a major scandal.

The EU referendum will put severe strain on Cameron and his whips. Even harder for him with a lukewarm Labour leader instead of one who would not even consider allowing a referendum. Corbyn might fancy giving the Scots an alternative to the SNP's fanatically pro EU support.

If Jeremy Corbyn really is Labour leader it might not be quite the dream that Tory strategists believe.

Labour infighting is certain. but it will add unpredictability to current areas of certainty.

But we can know for sure is that if Corbyn is leader, its all over for the Greens. Why vote for a veggie nut cutlet, folk festival cafe form of socialism when you can have the real raw red meat, dripping with blood, hard left socialism of the streets?

Friday, 14 August 2015

China Continues to Puzzle and Amaze

President Xi, it is said, has placed political control above - well, above all else. Which makes the access granted to the world's media for reporting on the ghastly Tianjin explosions all the more remarkable. And that's notwithstanding this rider from the Beeb:

(Pretty odd from an organisation which - commendably, but obviously without much let or hindrance - managed to cover the event comprehensively.)

(Pretty odd from an organisation which - commendably, but obviously without much let or hindrance - managed to cover the event comprehensively.)

I go back to my puzzlement over the MH370 affair. In a country and system where 'face' is so important, why were the distraught Chinese relatives allowed to emote in public, in such a raw fashion? It would never happen in, say, Japan etc etc - we discussed it all back then.

There are aspects of China I just can't read. Having thought the '08 Olympics would let the cat irreversably out of the bag (wrong), I find myself wondering again: is Xi really in control? Is he so much in control, he doesn't mind (from a position of strength) western media blanket-covering his industrial disasters? Does he just think he is in control to that extent? ...

ND

Authorities in China have over the past 24 hours silenced social media users who have criticised the coverage of the Tianjin explosions. Posts condemning "disgraceful" local TV coverage of the two blasts on 12 August have been removed from Sina Weibo, China's Twitter-like micro-blogging platform, as have posts suggesting that local authorities restricted international media reporting on the incident.

(Pretty odd from an organisation which - commendably, but obviously without much let or hindrance - managed to cover the event comprehensively.)

(Pretty odd from an organisation which - commendably, but obviously without much let or hindrance - managed to cover the event comprehensively.) I go back to my puzzlement over the MH370 affair. In a country and system where 'face' is so important, why were the distraught Chinese relatives allowed to emote in public, in such a raw fashion? It would never happen in, say, Japan etc etc - we discussed it all back then.

There are aspects of China I just can't read. Having thought the '08 Olympics would let the cat irreversably out of the bag (wrong), I find myself wondering again: is Xi really in control? Is he so much in control, he doesn't mind (from a position of strength) western media blanket-covering his industrial disasters? Does he just think he is in control to that extent? ...

ND

Thursday, 13 August 2015

Can Blair ever match Thatcher....for being hated by the Left?

Tony Blair is trying, without much chance of success, to stop Jeremy Corbyn being elected as leader of the Labour party.

(I never did get round to registering to vote as it happens...)

In an article in the Gaurdian, he makes a plea for sanity to a whipped up tribe of lefties. His article is very 'meh', of note is that he even feels he has to start it with 'even if you hate me....'

But the comments, wow they are amazing. The level of vitriol is outstanding. Blair had a checkered time as PM but his worst legacy was to let Brown have the keys when he left.

The Left now hate him, indeed, it had me wondering. Can he achieve the impossible and be hated as much as 'Fatcher' with every evil in the world his fault. I would never have believed that anyone else could be lifted to that level. Perhaps like Iran, where the US is the Great Satan and others can only attain 'Little Satan' status.

An strange turn of events though. I am glad I am not a lefty, all that confected hate and angst must be very trying to live with.

Wednesday, 12 August 2015

China Knocks Greece Firmly Off the Front Pages

The whole Greece thing became an exceptionally dominant story for a while back there, didn't it? Maybe it should be again, what with headlines like:

ND

Greek stock market surges as outline bailout deal reached with creditors€86bn, eh? But somehow that looks small beer alongside

China stuns financial markets by devaluing yuan for second day runningThat's quite a blockbuster for the silly season. As the price of oil gently subsides back into the 40s and Vladimir Putin mints ever more of the hard metallic currency he reckons the world understands best, Obama's final 18 months in office may be more demanding than he once expected.

ND

Monday, 10 August 2015

Oil collapse - a gift to the West.

There are some rulesabout the oil market which are being tested to production. One if the economics of sunk costs. It is very expensive to get an oil filed discovered, permitted, drilled and flowing. Literally billions of dollars for the larger fields.

Once this money is spent, then it is gone. Once the oil is flowing it is well under $10 a barrel. So if you have spend the money opening a field, it flows forever. Only accountants look at the overall economics. Countries do not budget like this, they work on a current account only formulae, once money is spent it is gone, worry about income for next year, not last year.

So once a large Petro-state has switched on the oil taps they never ever get turned off. The most an OPEC cartel decision can do really is limit the future expenditure on increasing production and hope that current fields run out.

Of course, with Shale in the USA it matters more whether the companies make money, but not so much more, such is the complexity of debt interest and leverage that overlays the industry. Plus the cost of drilling shale have already been absorbed, you may as well pump it.

Thus, despite a moderation in demand and a huge over-supply of crude oil, the world's petro states keep pumping. They need the money, even Saudi Arabia is likeley to have a 20% budget deficit this year. The oil will flow more and more and the price will keep dropping.

Today the price of crude is back under $50, as noted here before this is bad for the Middle East, Russia, Venezuela and Nigeria (and Scotland...). It is good for USA, Europe, China and India.

With Oil below $50 the inflationary pressures in the West are very benign, allowing the recovery from the Financial Crisis to continue. Russia will have a harder time justifying invading Ukraine and there will be less money to be funnelled to ISIS from its, err, 'enemies.'

Harder today to see is the dynamic really changing, demand in China is increasing more slowly and the West keeps investing crazily in renewables just when conventional prices are weakening. Plus the revolution that is LNG is still yet to come to much of the world and LNG prices make oil look like the liquid diamonds.

A new era of low oil prices thanks to ever increasing technologival innovation and desperation on the part of petro states - justhow the West wanted it.

Friday, 7 August 2015

Weekend Review: Ravilious Exhibition

Dunno how many of you are London-based (we make no capital-centric assumptions here, oh no!) but if you are, or are able to get to the wonderful Dulwich Picture Gallery before 31st, then I strongly recommend "the first major exhibition to survey watercolours by celebrated British artist Eric Ravilious".

Ravilious was bimbling along as a fine graphic artist of modest repute when at the start of WW2 he was appointed a War Artist. Of no obvious martial inclination, he nevertheless accepted this challenge with gusto - in his own oblique way - and hurled himself into headquarters, dockyards, and fully operational destroyers, submarines, convoys, aircraft ... ultimately to his untimely death on active service off Iceland in 1942.

His style sometimes breaks out into classic inter-war 'travel poster' mode, but is mainly characterised by an extremely tight, craftsmanlike watercolour discipline, with very pronounced and strongly-executed approaches to rendering large blocks of surface, be they acres of glittering ocean, miles of threatening skies, or simple square yards of soft furnishings. I have to believe the Hockney of the last two decades has been strongly influenced by Ravilious.

I've picked wartime stuff here but it's of tremendously varied and sometimes quirky subject matter - go google images for lots more (and some of the best, I can't find online). Boldly confident, crisply executed, though almost always of the lightest touch, and almost all of it excellent.

ND

Ravilious was bimbling along as a fine graphic artist of modest repute when at the start of WW2 he was appointed a War Artist. Of no obvious martial inclination, he nevertheless accepted this challenge with gusto - in his own oblique way - and hurled himself into headquarters, dockyards, and fully operational destroyers, submarines, convoys, aircraft ... ultimately to his untimely death on active service off Iceland in 1942.

|

| 'RNAS Sick Bay, Dundee' (detail) |

|

| 'No.1 Map Corridor' (detail) |

ND

Tornado and Other Amazing Old Aircraft

| Pic: MoD |

Yes, the Canberra, first flight 1949, last served operationally with the RAF in 2006. That's fifty seven years.

Track back 57 years before 1949, and we are more than a decade before the Wright Brothers did their epic thing. From their efforts in 1903 it took a mere 43 years for the speed of sound to be broken in level flight. By the end of the 1950s both Concorde and the forerunner of the SR-71 were on the drawing board. No pre 1930s aircraft had any serious life beyond the early 1940s (unless you count the Tiger Moth - 1931 - which had '20s antecedents): the main pre-war candidate would be the DC-3, the origins of which were in the DC-1, also 1931.

In short, development in aviation seems to have gone exponential for half a century, then plateaued out dramatically.

Perhaps more to the point, (a) aerodynamics got as far as it needed to in 50-60 years, and (b) it turns out not to be terribly useful to fly at Mach 2. By contrast, avionics has been where the big advances have come from since the '50s, along with metallurgy; and probably still has a way to go.

So forty-year-old-plus platforms can remain fairly viable, with periodic avionics upgrades. Airframe metallurgy is the limiting factor. The B52 is likely to be the all-time champion. Wiki says it will soldier on into its 90s: I have heard it said they'll probably make their century. Never raced or rallied, as they say - just thundering on over the horizon, straight and level, not too much stress on the old wing spars.

What, then of the Tornado? I quite like the machine, having worked with the RAFG fleet while still a soldier: the Jaguar was a bit flighty, the Harrier a bit flaky, the Canberra a bit staid. (I never experienced the Buccaneer; and to my eye it was the F-4 that was the really handsome ship.) Its latest recce capability is very fine indeed, and Typhoon cannot (yet) compete.

Tornado wasn't quite destined to match Canberra for longevity. Well, it certainly has been raced and rallied! - and honourably so (from the Air Force perspective, that is; we'll ask Chilcot for the broader view): seen a heap more action than anyone on an early conversion course in, say, 1980 would ever have imagined. Prior to the recent announcement, the plan had been to operate the fleet - currently rather less than 100 strong - in fast-diminishing numbers, cannibalising as spares run out, until they were down to one smallish squadron at the end of this decade or more likely before.

To run operationally through 2017 actually requires three squadrons, which probably means (does Osborne but realise it) that new spare parts will need to be made. BAe can perhaps respond - on a cost-plus basis, naturally - or perhaps we buy from the Saudis? Gp Capt S.Weetabix of this parish will doubtless have a view. Soldier on!

ND

Thursday, 6 August 2015

The Real Significance of LIBOR

A sound but incomplete point was made by Graeme, a commenter under our post on the exemplary sentencing of the LIBOR-rigger Tom Hayes earlier in the week

But that's surely not the real point. It's the undermining of LIBOR itself as a credible index, of the price-discovery process, and ultimately of the City and UK finance as a whole. We know just who the systematic losers are in that awful business. It's all of us: because the forces hostile to these vital interests of ours are many and varied, and just waiting for us to trip. I wrote here ages ago when this was first breaking:

ND

Some people are convinced that it worked to the detriment of some class of society…how can you possibly prove that? A joke sentence. I accept that it would be good to jail a banker or 2…but please let us not fabricate justice in this stupid way.True enough, it would be difficult, and more likely outright impossible, to establish direct net damages for the average person 'exposed' to LIBOR (as the media tell us we all are), arising from the riggers' games. That's because they were rigging to benefit their own specific book. Someone on the other side of that position would lose directly, of course - and others with the same specific exposure: but still others would by the same token be fortuitous beneficiaries. So - unlike (say) an oil producers' cartel rigging prices (upwards!) - the puzzle of net direct damages is intractable. It would, as Graeme rightly says, be ridiculous to assert that some category of our fellow citizens lost out systematically in terms of proximate losses.

But that's surely not the real point. It's the undermining of LIBOR itself as a credible index, of the price-discovery process, and ultimately of the City and UK finance as a whole. We know just who the systematic losers are in that awful business. It's all of us: because the forces hostile to these vital interests of ours are many and varied, and just waiting for us to trip. I wrote here ages ago when this was first breaking:

The integrity of the City's mysterious processes needs to be as secure as the hallmarks on our silver and gold - always accepted as totally trustworthy the world over, just as French hallmarks are taken with a pinch of salt ... the imperative of defending these freedoms and ways of doing business should rank alongside the physical defence of the realm."Too late!" do I hear you reply? Gotta start the fightback somewhere. When I were a lad ... coin-clipping and other forms of debasing the currency used to be high treason, with the usual grim penalties associated. They knew the seriousness of these things back then.

ND

Service Suspended

in memory of Australian Cricket:

Milliband losing..

Cable, Clegg, Balls..

Corbyn to be elected...

What a Summer!

Milliband losing..

Cable, Clegg, Balls..

Corbyn to be elected...

What a Summer!

Simple solutions to complex problems: Part II - Melting polar ice caps

There was some resistance when I attempted to persuade readers to embrace non-EU immigration and solve the current African migrant crisis. I realise that solving long term population shifts was probably a tad ambitious.

So this week, in the Quango Lectures, I shall attempt to try and solve something far simpler.

On this global warming site - www.underground {not affiliated to the tube drivers union} there is deep concern over the melting of the polar ice caps.

The Problem

- Melting ice in the arctic reduces the white reflective area that returns sunlight to space.

About 4.5 million kilometers is the area that is reported to have been lost between max and min ice shelf extent.

The Requirements

- There are some 100 million homes in Northern Europe and the Northern USA. The average house size in the US is 200 sqm. Canada 180sqm and UK 75 sqm. The UK has the smallest house sizes in EU so that gives us a good median EU/North American Home size of around 150sqm/home.

That gives us around 15000 sq km of roof area. Much more than we really need.

The Solution

- Introduce legislation to have all roof area in Northern Europe/North America painted white.

This permanent white will reflect the sunlight lost in the arctic and Greenland regions from melting ice and so prevent accelerated global warming caused by ice loss. It may even prevent the ice loss in the first place.

* The cost of initially painting or white covering all the roofs can be met by a temporary reduction in local domestic and business taxation. Council tax payment in the UK, for example, could be offset by by having the work completed. Or governments could use some of the money earmarked for Green energy subsidy instead. Either way the 100 million roofing works will generate significant VAT and sales tax receipts and a completion date of 2030 would ensure

Industry and employment will benefit from the initial works that need to be carried out. And the the design, manufacture and continuing research of reflective white, self-cleaning, slate and tiling for use in construction.

So this week, in the Quango Lectures, I shall attempt to try and solve something far simpler.

Global Warming.

On this global warming site - www.underground {not affiliated to the tube drivers union} there is deep concern over the melting of the polar ice caps.

Impacts of Disappearing Sea Ice

Arctic sea ice is an important component of the global climate

system. The polar ice caps help to regulate global temperature by

reflecting sunlight back into space. White snow and ice at the poles

reflects sunlight, but dark ocean absorbs it. Replacing bright sea ice

with dark ocean is a recipe for more and faster global warming.The Problem

- Melting ice in the arctic reduces the white reflective area that returns sunlight to space.

About 4.5 million kilometers is the area that is reported to have been lost between max and min ice shelf extent.

The Requirements

- There are some 100 million homes in Northern Europe and the Northern USA. The average house size in the US is 200 sqm. Canada 180sqm and UK 75 sqm. The UK has the smallest house sizes in EU so that gives us a good median EU/North American Home size of around 150sqm/home.

That gives us around 15000 sq km of roof area. Much more than we really need.

The Solution

- Introduce legislation to have all roof area in Northern Europe/North America painted white.

This permanent white will reflect the sunlight lost in the arctic and Greenland regions from melting ice and so prevent accelerated global warming caused by ice loss. It may even prevent the ice loss in the first place.

* The cost of initially painting or white covering all the roofs can be met by a temporary reduction in local domestic and business taxation. Council tax payment in the UK, for example, could be offset by by having the work completed. Or governments could use some of the money earmarked for Green energy subsidy instead. Either way the 100 million roofing works will generate significant VAT and sales tax receipts and a completion date of 2030 would ensure

Industry and employment will benefit from the initial works that need to be carried out. And the the design, manufacture and continuing research of reflective white, self-cleaning, slate and tiling for use in construction.

Wednesday, 5 August 2015

Will the Boundary Changes Happen?

As one who strongly believes in devoting attention to issues in proportion to their importance, when it comes to UK politics I have long followed the Boundary Changes issue with keen interest. Readers may recall I excoriated Osborne for failing to see the LibDems were guaranteed to renege during the last parliament, and I have tended to assume he won't screw up again. After two or more decades (sic) of professional, determined - and strategically inevitable - Labour prevarication, this is the Once In A Lifetime Opportunity to get it right. Right?

As one who strongly believes in devoting attention to issues in proportion to their importance, when it comes to UK politics I have long followed the Boundary Changes issue with keen interest. Readers may recall I excoriated Osborne for failing to see the LibDems were guaranteed to renege during the last parliament, and I have tended to assume he won't screw up again. After two or more decades (sic) of professional, determined - and strategically inevitable - Labour prevarication, this is the Once In A Lifetime Opportunity to get it right. Right?So when I mentioned my relative confidence on this matter in comments to a recent BQ post it was interesting to have King Kong's Banana replying:

a FEW BY ELECTIONS AND THEY WON'T GET IT THROUGH. GOLDSMITH PROBABLY BE THE FIRST, THEN SOME TROUGHER CAUGHT WITH THE BISHOP. AND ANOTHER WILL MAKE SOME DUMB ARSED RACIST COMMENT ABOUT CALAIS AND HAVE TO BE REMOVED. MAJORITY OF 3 NEXT YEAR. AND SO ANY TORY MP LIKELY TO LOSE OUT WONT VOTE FOR IT.Now that is interesting. As it happens I don't agree with Mr Banana per se, but it triggers another line of thought.

The reason I don't go with the above logic is that (a) the whips always offer to see any likely losers right - provided they behave, of course; and (b) there is no particular reason (bar the silly manifesto promise*) to stick with a reduced number of seats - it's only the boundaries that matter**.

However, the prospect of a single-digit majority after a couple of Events does make the whole thing rather tasty. Because every other party (barring the DUP?) has an interest in opposing boundary changes, thus giving the bastards an acute pressure-point.

Would they use a close vote on boundary changes to try to exact something on Europe? Or is a vote needed at all (see notes below)? What's the word in the '22, Mr Q?

ND

_____________________

* runs as follows: We will implement the boundary reforms that Parliament has already approved and make them apply automatically once the Boundary Commission reports in 2018 . 2018, eh? Three years of squeaky-bums all round.

** the reason the Tories carried through with the reduction in total numbers of seats in the last parliament, but not the boundary changes per se, was (I am told) that (a) the minority parties - all of them, LibDems included - would have prevented changes in Scotland, Wales & N.I but voted through the seat-reductions in England only, hah hah. So the changes were never put to the vote. But (b) the LibDems had signed up for the reduction in total number of seats and were prepared to stick with that. Tory strategists (pah!) felt that if the reductions went through (as they did) the Boundary Commissioners would be bound to make at least some rectification of the distribution of voters when implementing the new, reduced number of seats: a distinct second-best, and only of putative assistance in 2020.

Tuesday, 4 August 2015

RBS share sale; too little, too late

The Government decision to sell-off RBS shows how poorly Governments play the markets and how well they do politics.

RBS shares have been more or less the same for 3 years or more, see below:

They only came close in early 2010 right in the aftermath of the crash when the stock markets bounced prior to the Euro Crisis of 2010/11.

The awesome power of hindsight tells us that then was the time to get shot of RBS for the taxpayer. ADIA had approached the Government about buying at a modest discount the majority of the Bank. The politics was bad, with the Government wary of allowing the Bank to fall to the Gulf ownership.

Plus of course the Coalition was looking forward to the shares recovering like Lloyds and a profit being made (note on my calcs, the total profit to be made on Lloyds privatisation is less than the loss incurred today on 5% sale of RBS). As usual, Vince Cable put the kibosh on any sale and was totally wrong.

Once that window was missed, then anytime from Jan 2013 would have been fine to sell the Bank, the market worth has fluctuated around a mean of the price it is now. But it did not suit the Government to sell the Bank 'at a loss' before the election.

Now it is safe to do so....for a lower price and for the cost of the debt interest incurred on Gilts issued to buy the bank in the first place.

RBS is a fraction of what it was as Iain Martin explains well here, so the money is not coming back.

The sadder part is that this has been the case for years and years and the time would have been better spent selling the Bank off and keeping the losses lower. Now we will be another 2 years or more paying interest in Gilts to keep the Bank on state books.

The idea that RBS will suddenly be worth £5.50p per share or more is for the birds.

RBS shares have been more or less the same for 3 years or more, see below:

They only came close in early 2010 right in the aftermath of the crash when the stock markets bounced prior to the Euro Crisis of 2010/11.

The awesome power of hindsight tells us that then was the time to get shot of RBS for the taxpayer. ADIA had approached the Government about buying at a modest discount the majority of the Bank. The politics was bad, with the Government wary of allowing the Bank to fall to the Gulf ownership.

Plus of course the Coalition was looking forward to the shares recovering like Lloyds and a profit being made (note on my calcs, the total profit to be made on Lloyds privatisation is less than the loss incurred today on 5% sale of RBS). As usual, Vince Cable put the kibosh on any sale and was totally wrong.

Once that window was missed, then anytime from Jan 2013 would have been fine to sell the Bank, the market worth has fluctuated around a mean of the price it is now. But it did not suit the Government to sell the Bank 'at a loss' before the election.

Now it is safe to do so....for a lower price and for the cost of the debt interest incurred on Gilts issued to buy the bank in the first place.

RBS is a fraction of what it was as Iain Martin explains well here, so the money is not coming back.

The sadder part is that this has been the case for years and years and the time would have been better spent selling the Bank off and keeping the losses lower. Now we will be another 2 years or more paying interest in Gilts to keep the Bank on state books.

The idea that RBS will suddenly be worth £5.50p per share or more is for the birds.

Monday, 3 August 2015

Stop Press: 14 Years for LIBOR Rigging

Now this is sensational: 14 years for LBOR-rigger Tom Hayes. Around these parts we have long advocated punitive measures against convicted banksters and this is the kind of sentence that nice middle class people can't confortably contemplate. If it can happen to Hayes in the City - and Jeff Skilling at Enron - surely there are wider applications.

The remaining issue is: when do the senior managers find themselves coming to this salutary and bracing pass? And what's the statute of limitations in such matters?

ND

The remaining issue is: when do the senior managers find themselves coming to this salutary and bracing pass? And what's the statute of limitations in such matters?

ND

More interesting data for those wondering why Calais is such an issue, for now and the next 30 years...

A picture tells a thousand words so I am told, so here is my three thousand work essay on immigration:

The nub of it is to me, that the there is first map shows net GNI per capita today. As can be seen, sub Saharan Africa is a disaster, with no average wealth. With so little wealth, it is hard to accumulate any more as there is little to go around and little investment relative to the population.

No wonder the poor people there are fleeing to the UK, Afghanistan and Pakistan are not far behind.

Then we see that the projected growth of the world is all concentrated in African and South Asia. So not only are people poor but the affected Countries may well be doubling their populations in the next 15 years

Finally the sheer numbers from the UK. Sub Saharan Africa was until very recently a low population area considering its size - especially relative to Europe. But now we have reached the point of inexorable growth, with a billion young people due to grow up in the next 15 to 20 years.

They have nothing to live for where they are, so they will leave for a better future. The best place to go is to Europe, in terms of geography and economic chances.

So come they will. My own view is not wildly popular yet, but my feeling is this challenge is akin to that of the end of the Roman Empire and the dark ages. Massive population movements could overwhelm a more advanced civilisation through sheer weight of numbers. The Visigoths and other after all sort to be Roman, but could not be - it was rarely their intention to destroy what they found.

In today's world perhaps there is the technology to prevent this, but it would go against all of our current values to be so callous with a wave of humanity approaching unarmed.

Instructive too is the map below of the current wars - indeed how may of these are really driven by population issues such access to food, water and jobs. You could even make a case that the rise of religious fundamentalism is linked to the increasing poverty of the Countries affected due to massive population growth:

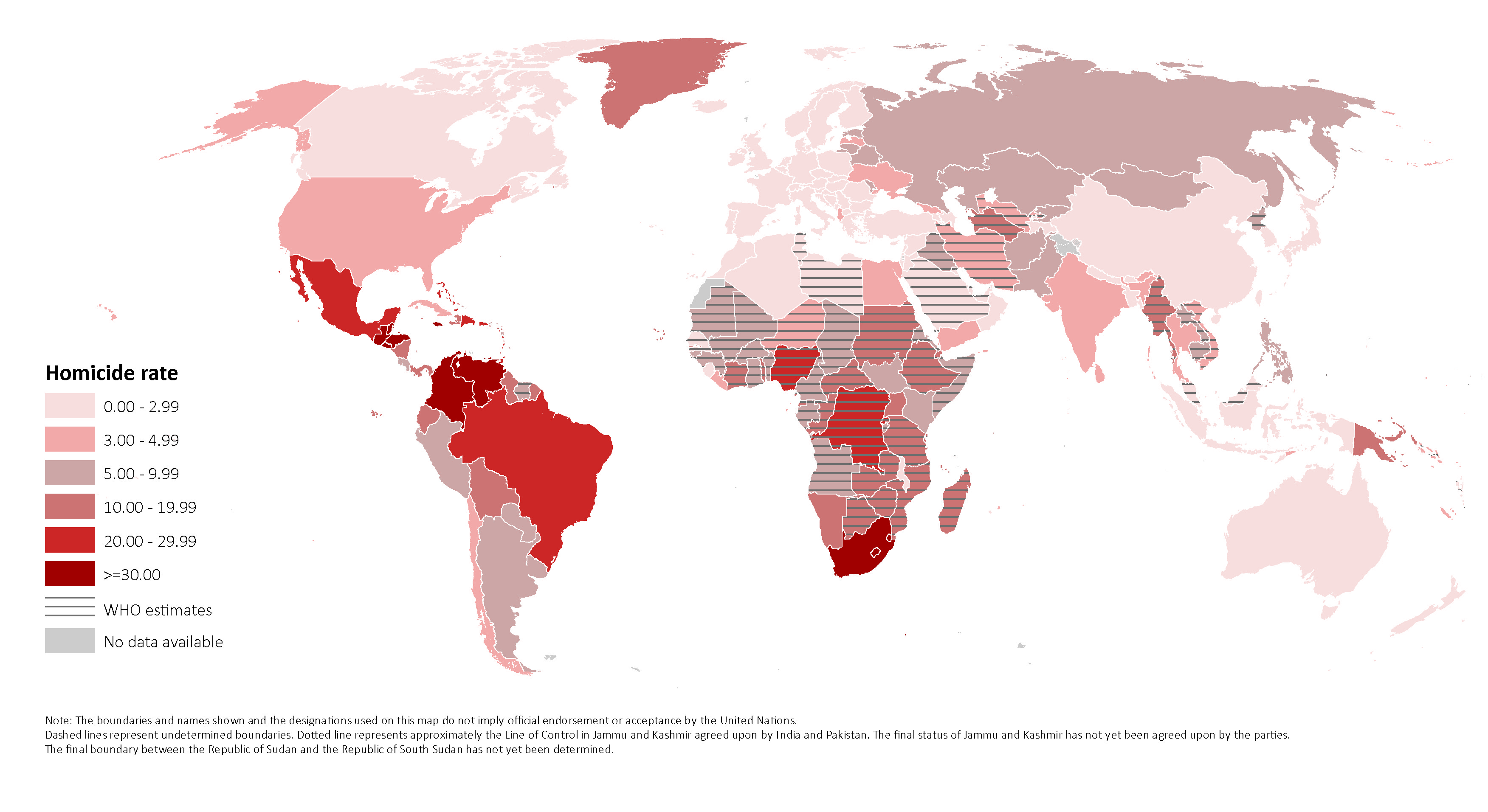

And finally, a last graph for the Bishop's and do-gooders who say we must help where we can. The people coming to us in the future have very different behaviours to us - the world map by homicides shows us how much value a human life has in different cultures:

Subscribe to:

Comments (Atom)